- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3655

The trading week began with no surprises. Currency pairs are opened without sudden price changes. Currencies continue to trade near the highs. The problems in the U.S. ended but, nevertheless, the U.S. dollar remains under pressure. Last week, investors and traders are risk-averse, which provided support to risky currencies. The main question of this week whether such currencies as the euro and the pound to reach new highs, or stay on the current levels. Some analysts believe that market participants re-evaluate the situation in the market and the demand for risky assets will decline.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3716

Trading session on Thursday ended with the growth of major currencies against the U.S. dollar. Solving problems related to the budget could not support the dollar, but in a few months, or more precisely in January 2014 the Americans will again have to face this problem. Market participants reacted negatively because of reduced chance of curtailing the program to purchase assets in the year. Now, most investors expect the Fed will act only in the second half of 2014. This was the main reason for the decline of the U.S. currency. Dealt a blow to the U.S. China, informing markets that plans to cut America's credit rating by one notch to A-, explaining the inability of the U.S. fast to solve their problems.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3942

Bidding on Wednesday, stir strong volatility and volume news background. Today everyone is talking about only one, the problems associated with the suspension of the U.S. government and the question of raising the national debt ceiling ended. The result is quite expected, at the last minute Congress decided that increases the U.S. debt limit, the government can now return to work fully. Also identified specific date, the United States can make borrowing until February 7, and the government will run until 15 January 2014. In financial markets, this agreement caused a rise in global indices.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3717

Today, Monday, in many countries such as the U.S., Japan and Canada public holiday, so the exchange will be closed. This situation is diminished liquidity in the market, and therefore can be sharp currency movements and increased volatility. Of important events can be identified economic data on industrial production in the euro area, which will be published during the European session. In connection with the beginning of the week the major currencies, most likely, will show a significant recovery after falling last week.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3738

Bidding on Thursday ended with the growth of the U.S. currency. Currencies began to decline against the U.S. dollar in anticipation of the Fed minutes later after reports decline intensified since statements of the members of the committee supported the national currency. The main news was that the beginning to minimize the program to purchase assets may begin as early as this year. Market participants also expect news about the negotiations with regard to politicians «shutdown» government, this situation is still the main topic in the media.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3762

U.S. inaction on raising the national debt plates and renewal of the government keeps the market under pressure. Today the major currencies against the U.S. dollar, analysts believe that Asian investors are buying dollars because see the speedy resolution of the political problem, the ECB representative Joerg Asmussen also spoke in favor of the United States, noting that the decision will no doubt be found. Attention Tuesday was also drawn to the speeches of the President of America, Barack Obama, who spoke about the unthinkable failure to raise the national debt, and demanded an immediate decisive action to resume the work of the government.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3520

The past week has ended strong correction of the currency pairs like EUR/USD and GBP/USD. The growth of the dollar was linked lack of scheduled economic data, the market immediately saw this as a positive effect, since the program is the decline in asset purchases may move over to a later period. More fundamental to the growth were protracted negotiations to reopen the government, analysts believe that the solution will be found in the near future. On Monday, the specified currency opened higher and is now trading moderately.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3498

Trading session was held on Thursday against the release of economic data that largely determined the movements of currencies. The European currency has strengthened by positive news from the eurozone, as well as due to the weakening of the U.S. dollar. Today is the last day of the week and as usual it ends at the most interesting - the currency pairs are suitable for highs and upper limits, which are strong resistance. Behavior quotes around these values determine the future prospects of the market as a whole.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3837

At the end of trading on Wednesday, the U.S. dollar fell against most currencies. At the forefront of growth were the European currency and the British pound sterling. For the growth of the major currencies against the U.S. dollar has several reasons, one of them weak economic data from the U.S. labor market, the second - the president's speech, Mario Draghi supported the single currency. Restart the government in the United States also put pressure on the dollar and creates additional risks associated with the technical default.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3544

After a strong surge in volatility and significant growth of individual currencies in the market is a correction. As many market participants have closed their positions ahead of the conference the ECB and the U.S. labor market data. This news may give traders and investors new signals for action, in addition to disclose long-term prospects of the currency market. Do not be left unattended, and the British pound, the index of business activity in construction is an important factor in the economic recovery, analysts expect growth in this index.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3499

The new week started with surprises. Despite the overall decline of the dollar against major currencies during the Asian session, the European currency was opened up down. One of the central events of the week is the meeting of the U.S. Senate, which must decide on the financing of the budget. At this point, all currencies are in trading ranges, formed last week.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3475

The movement in exchange rates during trading on Thursday were multidirectional nature. For most currencies ended the day lower against the U.S. dollar. Market participants were pleased with the macro-economic data from the United States, which failed to show positive results and thereby lend support to the dollar. Today, Friday, traders and investors are also awaiting news section of the United States, an important event as it will be the European Central Bank President Mario Draghi.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3152

Currency trading on Tuesday for most currencies were in the red zone. The market continues to be adjusted, the U.S. dollar is slightly recovering. The main influence on the auctions had a business climate in Germany, it has not met the expectations of the market and was below analysts' forecasts, and thereby lend support to the U.S. dollar.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3309

Since the beginning of the week the euro under pressure, show an increase in other currencies against the U.S. dollar. Drivers for the euro today could be the ECB Mario Draghi speech and speech Dudley and Dennis Lockhart, which will affect the rate of the U.S. currency. The rest of the foreign exchange market is influenced by the FED's statement made last week.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3401

Despite the strong pressure that was the U.S. dollar on Thursday, the U.S. currency still managed to hold and recover some of the losses. In many ways, the appreciation of the dollar contributed to positive economic data on the U.S. economy.

The EUR/USD has shown mixed results, the growth of the European currency was stopped better than analysts expected data from the U.S.. The pair reached the 1.3570 mark, then decreased to the level of the opening. From a technical point of view we can say that the euro will consolidate after strong growth, so we have to be a small decrease in pair EUR/USD. Local levels of support and resistance levels are 1.3570 and 1.3500, respectively.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2920

That day came, so long expected by market participants. Today will be the FED meeting, which will provide new information about the quantitative easing policy and the further development of the U.S. economy. On Tuesday, the major currencies traded restraint, keeping almost neutral. In general, at the end of the day the dollar suffered minor losses, but almost all currency pairs remain in a narrow range since Monday. Other important news today, waiting for data on the British pound.

The EUR/USD showed a rise on upbeat data on business activity in the euro area and Germany. The European currency is trading against the U.S. dollar within a daily candle formed on Monday. All eyes are on today's FED meeting. What to expect from the meeting? - The opinion of Goldman Sachs.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3119

The dynamics of the dollar last week was mixed. Friday's trading was very volatile matter is that commotion about the new head of the U.S. Federal Reserve. News block only added fuel to the fire, if you look at the data published this week, unfortunately, we see poor numbers. But it is not all that bad, positive news pleases investors the UK economy. The main event of the week will be the FOMC meeting and everything connected with it - speech rates, statements and reports. Recall that market participants are interested in the fate of the quantitative easing program, so there is no doubt that the FOMC Steytment stir markets.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3035

The dynamics of trading on Thursday, will largely depend on the news background. Yesterday's economic data provided support to the British pound and the euro. Many believe that there was a rise in the euro against the abolition vote on military intervention in the conflict.

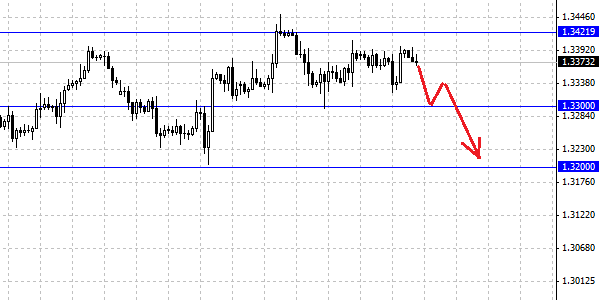

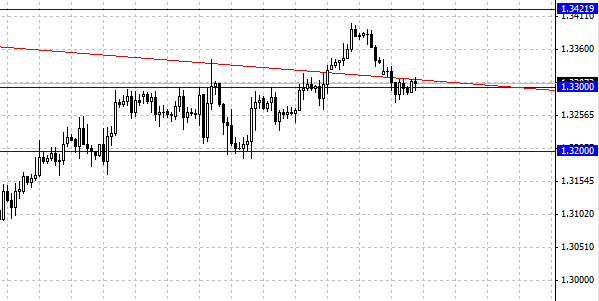

So, the European currency broke the level of 1.33 and is now trading in this area. An important event that may affect the dynamics of the pair EUR/USD will be the M. Draghi's speech today. Of America are expected labor market data.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2984

With the start of the new trading week is to analyze the recent movement in the market, and analyze near-term prospects. Although the focus of last week was the U.S. dollar, as a result, he was able to strengthen only against the euro and other currencies such as, for example, the British pound and the Australian dollar showed growth, the latter being very important.

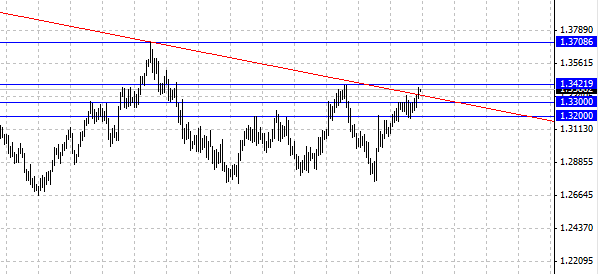

The EUR/USD has made an important break below 1.32 and is currently trading below the mark. Motion quotation EUR/USD is possible to note some correction after the breakout. Today, there are no important economic data that could affect the course of the auction, so the market is likely to be smooth motion. We believe that the European currency will continue to decline, the final goal is the level of 1.28, intermediate 1.30 . With the growth of pair EUR/USD Resistance 1.32, you can open a deal to sell with the above objectives.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3141

The markets remain dynamic, and set trends continue to evolve. American news block on Tuesday fixed the positive values that were better than analysts' expectations, which supported the U.S. dollar. At the same time, the report of the Bank of Australia and the interest rate, which remained unchanged, the Australian currency pushed up, released in the UK Construction PMI was better than expected, which also had a positive impact on the pound.

The EUR/USD holds tight after a 1.32 mark at the moment the European currency is at 1.3170 . Market participants are also waiting for the ECB meeting, which will take place on Thursday. While the pair EUR/USD is below 1.32, prevails further downside to the values of a pair of 1.30 - 1.28 .

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2832

At the end of last week, all the major currencies except the yen fell against the U.S. dollar. Reduction of the euro and the Australian dollar was the most ambitious, EUR/USD for the week decreased from the level of 1.3380 to reach 1.3220 (-1.22 %), AUD/USD closed at 0.8897 (-1.37 %). The British pound also closed in the red zone, but with fewer losses, GBP/USD fell from 1.5570 to 1.5491, thus losing 0.47 % for the week.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2832

Today, Wednesday, the foreign exchange market with the opening of trading the U.S. dollar shows growth. A significant decrease was observed for the pair GBP/USD and AUD/USD, the European currency is in no hurry to fall against the dollar, although moderately reduced.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2968

The trading week began with no surprises. With the opening of trading, as usually happens on Monday, there has been little activity. The European currency shows a slight decline, the British pound sterling and the Australian dollar traded unchanged.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2809

Price movements on Thursday showed the expected dynamics. The European currency reaching a value of 1.33 against the U.S. dollar retreated, the British Pound was down, while the Australian dollar is fighting for the level of 0.90 . On Thursday it was a lot of important economic data, which also had a significant influence on the course of trading.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2866

Over the past week the dynamics of exchange was mixed. Since the euro exchange rate ended the week little change -0.04 %, although during the week EUR/USD pair was quite volatile. The situation is similar to the Australian dollar, which ended the week down by 0.14 %. Showed a positive trend British pound (pair GBP/USD) which added almost 1 %.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2552

Thursday was marked by a sharp decline in the U.S. currency. Significant dollar sales have caused a surge of activity in other currencies. The EUR/USD jumps to 1.3350 and is trading near which at the moment. The reason for this increase is possibly a break of 1.33 . Prior to that, the dollar steadily in strength, and reached the level of 1.32, the purchase of this support level could also be a catalyst for a strong movement for the pair EUR/USD. After a number of positive statistics investors began to liquidate part of long dollar positions. His role in the weakening of the U.S. currency has played and the growth yield on 10-year U.S. Treasury bonds to two-year highs, which was perceived by market participants as an additional proof of intent FOMC to begin phasing out of stimulus measures is already at its September meeting.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2784

On Tuesday took place in the "dollar" bulls. Currencies continued to decline against the U.S. dollar. Since the euro fell against the dollar to 1.3230 level. Even the expected news on industrial production and positive economic sentiment could not stop the downward movement. Industrial production in the euro zone rose to a seasonally adjusted 0.7 percent in June on a monthly measurement, offsetting a decline of 0.2 percent the previous month, which was revised from 0.3 percent fall. Economists forecast that production will grow more rapidly by 1.1 percent. It also became known, the index of economic sentiment in Europe's largest economy rose to its highest level since March. A key indicator gave hope that a prolonged recession in the euro zone is coming to an end. Centre for European Economic Research ZEW reported an increase in the index to 42.0 in August, down from 36.3 in July, ahead of the growth forecast to 40.3 .

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3006

The trading week began with the strengthening of the dollar, which has recently felt quite weak. Market participants are buying the U.S. dollar, in connection with the major currencies are losing their value.

The EUR/USD during trading on Monday dropped below 1.33, but fixed below failed. The European currency is currently trading above 1.33 dollars - the level of support. The pressure on the EUR/USD pair has waiting for data on euro area GDP, today traders will wait for the sentiment index and industrial production data. The dollar may have economic data, the output of which is scheduled for this week. Earlier this year, discussing the possibility of reducing the stimulus from the FED propped up the dollar, but in the last week, the dollar was down due to lower expectations reduction of redemption of bonds by the FED in September. To further strengthen the dollar should be fixed below the level of 1.33, the immediate goal will be to support at 1.32 .

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3111

In the course of trading in the currency market on Thursday showed growth of major currencies against the U.S. currency. Dollar shows a negative trend, and every day is losing ground. Support currencies have economic data, as well as statements of central banks.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2742

Bidding on Wednesday ended with the fall of the dollar strong. Since EUR/USD pair showed a strong upward movement. To do this, there were many factors, primarily the support of the European currency was positive data in Germany. The Federal Ministry of Economics and Technology reported that as a result of June's industrial production in Germany increased substantially, thereby exceeded the forecasts of most economists. The second factor of growth of pair EUR/USD was the announcement that the agency Fitch Affirms Germany at 'AAA' with a stable outlook. Fitch said that the German government has exceeded the plan by some key financial goals. "Germany has all the ingredients to reduce the national debt - said in a statement. - The economy is growing, the state budget is relatively favorable, nominal interest rates at low levels." On such a positive pair managed to break through resistance at 1.33 and consolidate above. Now the pair is constrained by resistance, which passes through a maximum on July 31 - the level of 1.3350 . The Euro is trading near the downlink long-term trend. We believe that the EUR/USD pair has the potential to grow to a level of 1.35, but downside risks still remain.