The trading week started two minutes ago. Despite the fact that former USSR countries are celebrating the labor day this week, all the foreign markets are working during the labor day, that is why when planning the week one should take into account this fact. May 1-st will bring serious news factor from the USA – a meeting of FOMC with following comments will take place.

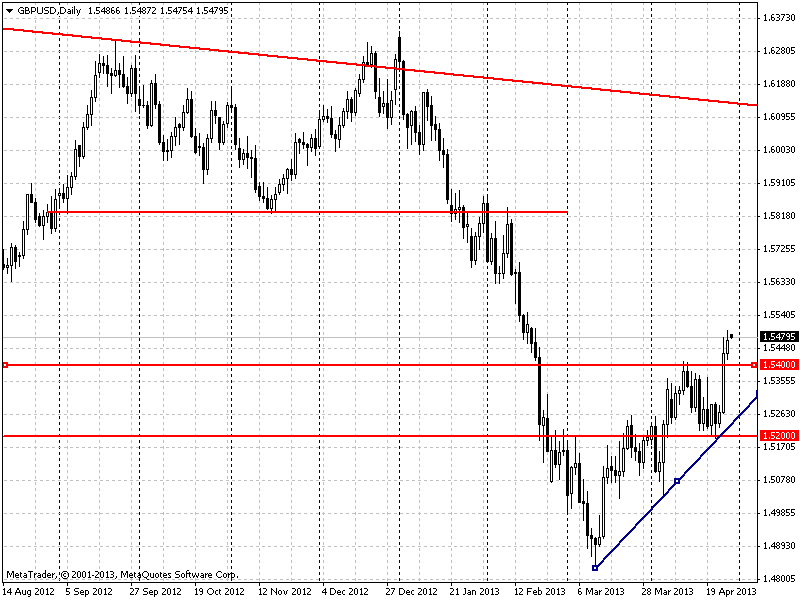

Meanwhile Soviet people are preparing for the holiday, Pound sterling is looking for strength and support to consolidate its luck, after passing the level of resistance of 1.5400 of USD. A great luck for traders who passed the breakdown of level of resistance will be entry into long positions on GBPUSD if the rebound occurs from the 1.5400 level if there is a correction to current growth. However there is a possibility that this correction will not occur.

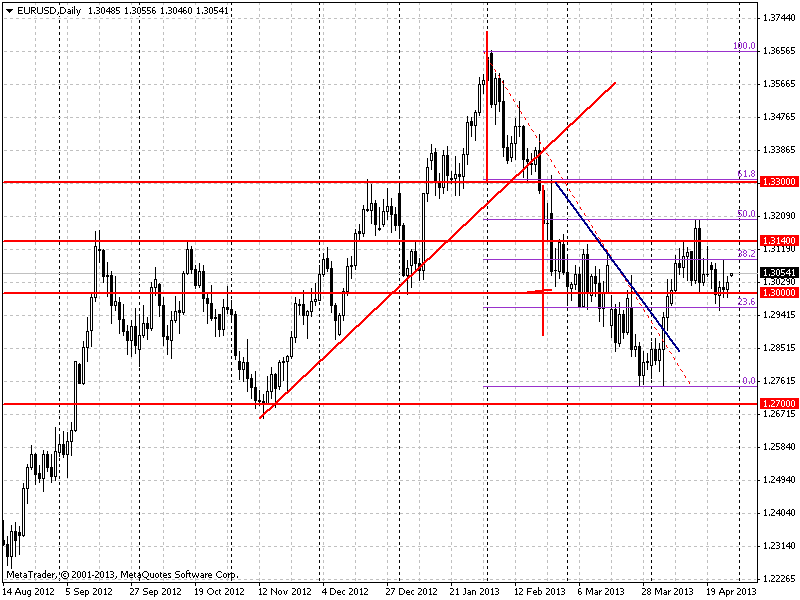

EURUSD is not so active and strong, but the pair is moving towards the top. However EURO course is gripped in the boundaries of two levels of 1.3000 and 1.3140 within which the pair is heading towards trading. If the quotations do not leave this level one should not enter the position on EURUSD.

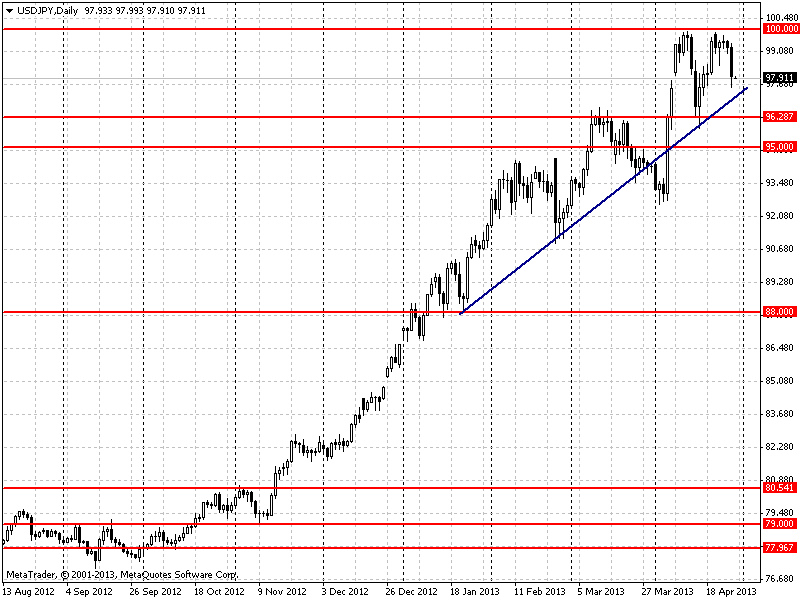

USDJPY pair as it was mentioned earlier lost its energy and can’t pass the resistance and a very powerful “psychological” level of 100 yen for 1 USD. Thus there is a deployment figure formed on the pair – a double top. But one should not enter the sales, since it might be a second round of correction before a serious level of resistance. And the strength of ascending movement is still there.

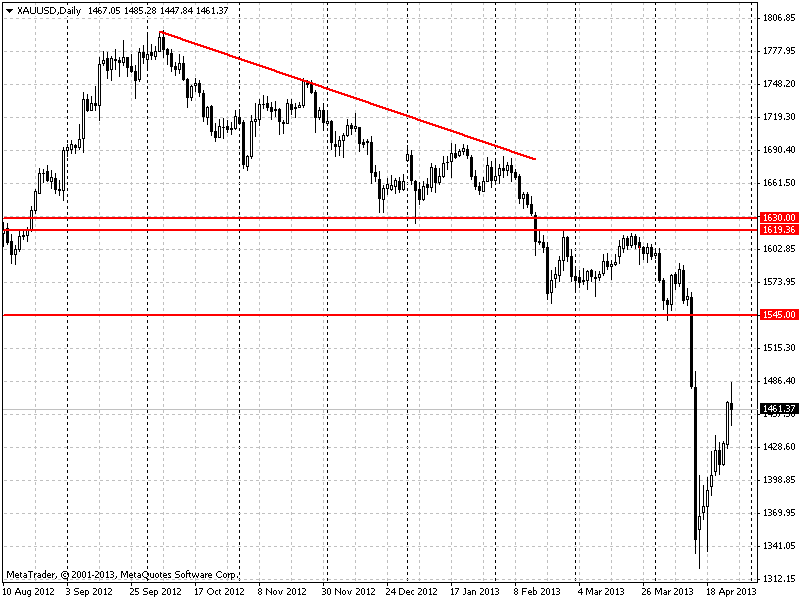

The gold has grown significantly in the past week against its strong fall, which was predictable. However one should not hope for high value of quotations of precious metal. There are grounds to think that the renewal will be slow and probably the peak for this week will not exceed the value of 1500 dollars for a troy ounce.

We wish you a successful and profitable week!

Social button for Joomla