The past week has ended strong correction of the currency pairs like EUR/USD and GBP/USD. The growth of the dollar was linked lack of scheduled economic data, the market immediately saw this as a positive effect, since the program is the decline in asset purchases may move over to a later period. More fundamental to the growth were protracted negotiations to reopen the government, analysts believe that the solution will be found in the near future. On Monday, the specified currency opened higher and is now trading moderately.

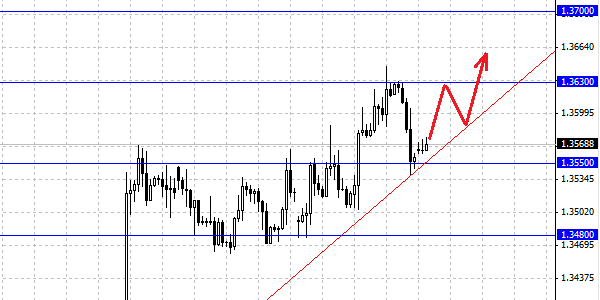

The EUR/USD fell to 1.3530 on Friday, the price has crept in at around 1.3550 . We believe that the fall of the euro was of corrective in nature, given the fact that on Friday, many players close their positions. Plus news background was for the currency pair on Friday also negative, which increased the downward pressure. If you look more deeply the course of trading, then on Friday a lot of players come out of long positions, which caused a sharp decline in share price, the remaining investors to go long this is alarming bell - may be the trend for the EUR/USD ends or is vague prospects. From a technical point of view, the single currency fell back to the level of support at 1.3550, resistance is at 1.3630 . The purpose for the pair EUR/USD remains maximum of the year, which is located at the level of 1.3700 .

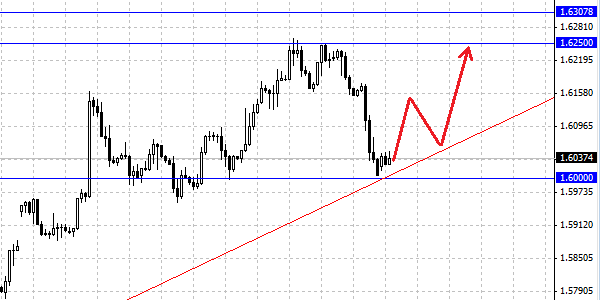

The pair GBP/USD also came under pressure and fell on Friday to a level of 1.6000. At present, the pound has grown up and is trading at 1.6030 . In principle, the situation with the pound in many ways similar to the movement for the euro/dollar and even for the most part similar to him. Some analysts began to express doubts about the recovery of the UK economy. To increase the interest rates may need more time, mainly to ensure the growth and confirm it. Another factor pressuring a pair GBP/USD is the meeting of members of the Bank of England, it will be held this week. Support and resistance levels remain the same - 1.6000 and 1.6250 . It's worth noting that if the dollar continues to strengthen, the achievement highs in pairs EUR/USD and GBP/USD would be unlikely.

Social button for Joomla