The trading week began with no surprises. Currency pairs are opened without sudden price changes. Currencies continue to trade near the highs. The problems in the U.S. ended but, nevertheless, the U.S. dollar remains under pressure. Last week, investors and traders are risk-averse, which provided support to risky currencies. The main question of this week whether such currencies as the euro and the pound to reach new highs, or stay on the current levels. Some analysts believe that market participants re-evaluate the situation in the market and the demand for risky assets will decline.

The EUR/USD after reaching 1.3700 psychological level fell back, at the moment the European currency is trading near the 1.3670 level. Now the euro is in the area of resistance, which inhibits further growth. Technical indicators point to a decline of the euro. But now the market is prone to more fundamental data. Market participants understand that the QE program will last for some time, and the decline in asset purchases should not be expected in the next six months, this fact inevitably puts pressure on the U.S. dollar. For the euro began to decline inadequate technical factors weaken the EUR/USD pair will only negative data from the Eurozone. Therefore, the only way out is to keep track of economic data.

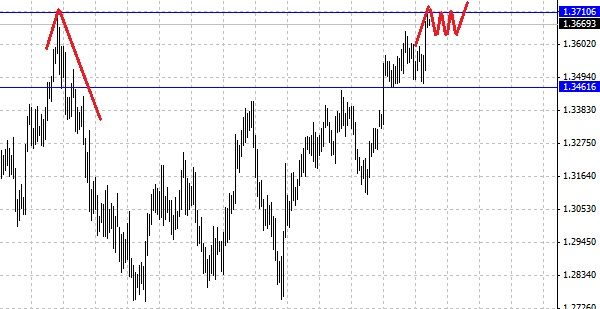

From the behavior of prices also can be seen a lot. The last time when the euro reached a value of 1.3700 against the U.S. dollar, the day began actively selling. Now there is no active sales, EUR/USD chart looks as if the market pulls back a little and adjusted in anticipation of continued growth. In other words, a sharp reversal, we do not see. The euro was not the only currency that has grown substantially in the last week, the market globally there is a weakening of the U.S. dollar. To consolidate it's position and more accurate signals European currency needs to demonstrate growth above the local maximum. This will serve as confirmation of the bullish sentiment in the market and the development of upward movement on risky currencies.

Tonight is also expected to yield data from the United States. Analysts expect a decline in home sales. If the forecast is correct, then the euro will be supported and will grow on the back of a weak dollar.

Social button for Joomla