Forex basics

Forex basics are the necessary knowledge and terms, without which you can’t start a trading career. Here you will learn what spread, options, types of accounts, pending orders and scalping strategies are. You’ll find answers to questions about how to choose a broker and trade on news with minimal risk, learn how to choose currency pairs. This section will reveal the secrets of training features and help you understand how to earn on Forex and succeed, while reducing risks and losses.

- Details

- Written by Admin

- Category: Forex basics

- Hits: 4322

Among the various spheres of human activity, the profession of a trader perhaps stands out stronger than the others. The reasons for this attention is not just many – there are a lot of them, ranging from scandals and lawsuits in the largest financial conglomerates to the pursuit of attractive image of a successful and financially independent person. In this publication we’ll take a brief look at who the Forex traders are and what their professional interest is.

First of all, let's start with the destruction of stereotypes that are spread among the population and prevent an objective assessment of a respected profession. The very first of them is the fear of losing everything, being got to trial, and so on. The matter is that in the general case the trader is a specialist who performs operations on purchase and sale of various assets in their own name or under the order of administration of the company in order to derive profits.

- Details

- Written by Admin

- Category: Forex basics

- Hits: 4214

The first question anyone who has decided to seriously engage in trading must answer is not even the kind of strategy or a currency pair to choose for trading, but rather how to choose Forex broker to work more comfortably and safely.

Thus, the main stumbling block novice speculators face is choice between dealing center (hereafter DC) or a licensed broker. One would say that there is no difference in this case, but it is not true. Firstly, the contract with the brokerage company has all the signatures, required details, and, as a consequence, legal force. The offers of any DC cannot be regarded as a legitimate document in most trials – in fact, everything will hang by a single thread and reputation of the company.

- Details

- Written by Jeremy Stanley

- Category: Forex basics

- Hits: 3801

One can meet a set of rules and attitudes on how to work with Forex on modern information sources of Internet trading possible to meet. Starting from the most difficult concepts and meaning of trading terminology, up to a simple question of the possibility of earnings.

- Details

- Written by Jeremy Stanley

- Category: Forex basics

- Hits: 3832

Forex levels are the most basic and fundamental aspect of price movements. Levels come to the fore and become the starting line of price movement and opening of order. And levels become the target of price trend. There are reasons for it. Forex levels appear in the technical analysis as well as the fundamental one, when after certain events, which are to come or already happen, the price is expected movements to move towards certain values.

- Details

- Written by Jeremy Stanley

- Category: Forex basics

- Hits: 7240

The graphic shapes identification is one of the common types of technical analysis. It includes the analysis patterns which are shaped as a result of price movements are of geometric nature. Implementation of Internet trading with the aid of graphic shapes has become rather widespread. And the Forex graphic shapes themselves have already become a part of the trading system for many traders.

- Details

- Written by Jeremy Stanley

- Category: Forex basics

- Hits: 3716

Many people believe that forex options are easier and less risky instruments for earning money through online trading. However, let's not make premature conclusions, but just look at what Forex options are. Let's first grasp what is an option itself, and how to earn using it in the financial market.

- Details

- Written by Jeremy Stanley

- Category: Forex basics

- Hits: 4087

- Hi!

- Hi.

- What do you do?

- I trade forex.

- How much you earn?

- I trade.

Probably the most common and frequent question that can be heard from the beginner or the person concerned - this is how much you earn on forex?

From a theoretical point of view, you can make money on forex is very much in a day can increase the initial capital of a few tens of times per month you can get more than 1000 % profit and more. Advertising on the Internet is just such promises about earnings. Fortunately or unfortunately, blame for the inaccuracy of advertising language is not rotated. Because the potential profit on forex limited only by the number of transactions and the maximum position size. Let us not deceive anyone and admit to each other that in the first place is the prospect of big money and unlimited profit margins attract people to trade in the foreign exchange market - Forex.

- Details

- Written by Jeremy Stanley

- Category: Forex basics

- Hits: 3533

Forex seminar – is one of the most comfortable opportunities for beginners and more experienced traders to get answers to their questions from professionals. Such training sessions can become a perfect preparation for basic trader courses and they will improve and widen your knowledge even after finishing them.

Currently there are several main types of such trainings:

- Free and paid Forex seminars. As a rule the first option supposes learning basic issues that will help the beginner to start working on the market. Paid classes are supposed for experienced players that want to deepen their theoretical knowledge and exchange experience with other successful players, as well as to discuss the most profitable strategies and peculiarities of their usage.

- Online Forex seminars and fill time classes. The first option allows learning from professionals even to those traders who live far from the capital and do not have direct connection with other players of the market. Such possibility allows them to exchange the experience, determine their trading mistakes and improve their theoretical preparation. The second option is supposed for those who live in the cities where different dealing centers function. As a rule the classes are organized based on them and the most successful players are taking part in the classes, and they can share the secrets of their success.

- Details

- Written by Jeremy Stanley

- Category: Forex basics

- Hits: 3596

The rules of trading on Forex market determine the main models of behavior of traders, pointing out the most dangerous moments that should be avoided during their work. This precautions will allow the players not only to save the assets while making the deals on currency market, but to get great profits, that will soon exceed significantly primary costs.

Successful traders and psychologists were capable of working out the most important moments that should be taken into account when starting to work on currency market. The rules of Forex trading do not create strict boundaries for the players, limiting their freedom of the negotiations. They are intended for determining the risks that can lead the trader to downfall and for their removal.

Forex rules determine several main steps of risk management:

- To consider seriously the risks that you run with certain deals;

- To lower at most the quantity of risks that the deal can bring;

- If there is a situation opposite to your interests on the market one should act really quickly in order to lower all possible risks and losses

- Details

- Written by Jeremy Stanley

- Category: Forex basics

- Hits: 4522

Few people do not dream of becoming millionaires, or to earn decent money which will be enough to satisfy the majority of your dreams. Unfortunately modern Russia can’t offer many job positions with such salaries, that is why people gradually start thinking about original ways of getting high profits. One of them is trading of currency market.

How to earn on Forex? How to get fixed high profits every month? These and many other questions are important for many beginners, because everybody knows that it is tough to achieve the result you want. Many people know how to earn on Forex market, but only a few can accomplish their goal.

If you are still wondering whether it is not unlikely to earn money on Forex to buy an expensive car or a flat, read the success stories of players from different countries. It is most likely you will encounter some secrets in them, secrets that these successful people share. Besides dealing centers consultants can inform you how to get money on Forex. They conduct courses and seminars. But the best way to commence earning money from the play on the currency market is to begin trading, because only through mistakes you can achieve your own strategy and success.

- Details

- Written by Jeremy Stanley

- Category: Forex basics

- Hits: 3991

Trading on currency exchange requires the trader to take into consideration many factors that can influence the trend changes. The use of different tools allows working out a successful work strategy that will not only expose to great risks the deposit of the player but will be able to increase its profits significantly.

Forex tactics include several main rules:

- Every player has to rehearse primarily on a demo-account where he will be capable of using all the tools he knows and to analyze the result;

- To trade only on the verge of price channels;

- install stop-orders, not allowing merging the deposit in case of emergency.

Forex tactics that can bring stable profits requires from the trader acute attention when analyzing the market. It is better to use Forex trading tactics together, using the most convenient ones for a player, because in that case he will be able to hope for the best result: less losses, more profits. Currently trading forex trading tactics are developed by traders in great numbers that is why new players should only study the results of their work and advice from more successful colleagues, and the profits will appear very soon.

- Details

- Written by Jeremy Stanley

- Category: Forex basics

- Hits: 3843

Every trader who was capable of saving up some money instead of spending them during the first days of trading can start judging about how successful his work is. And then he sees that somebody is trading better, somebody worse, so what is the case? Is there any secret of forex trading? Everybody is equal on Forex market, because this market is a huge international platform, and it is hard to conceal anything on it.

Forex secrets appear during work and every trader has some secrets. For example some traders prefer starting to work at the same time every day when the market is calm and they can predict the behavior. For others it is a development of certain scripts that they learned to use for their advantage. But more importantly all these secretes of trading on Forex are concealed in chosen trading strategies.

Today Forex secrets are sold even online, they are called profitable advisors and indicators that predict any movement of the market. Some of them work, others are simple dummies. They keep their real forex secretes very deep and it is hard to think of them. In order to stop searching for others’ secretes you will have to optimize you trading strategy and start saving up your nuances of deal- making.

- Details

- Written by Jeremy Stanley

- Category: Forex basics

- Hits: 3928

Forex capital management – is one of the most essential parts when working on financial market, and it is stated by many professionals. Because money management forex is the first thing that a beginner has to learn if he is not planning to lose his capital during the first days of trading.

When making any deals on Forex market it is prohibited to increase the volume of the lot for more than 10 times. Many traders that are just starting to trade understand the forex capital management intuitively. Because they appear on the market with little lots, thinking that if they are inexperienced they’d better risk small sums, and they are absolutely right!

The principle of working is very easy in order to follow money management it is necessary to use only small part of your deposit. It is important to understand that the bigger your lot is going to be the more money you need to have on your deposit. Because anything can happen and in order to have some profits at the end of the day you need to trade with something the rest of the time. If you spend your money and do not take into account the capital management on Forex market, the trader career can stop at that point.

- Details

- Written by Jeremy Stanley

- Category: Forex basics

- Hits: 3506

Many people want to get to know how trading on Forex functions, and it is true not only for the newcomers, who are making their first financial steps, but professionals as well, who decided to widen their investment basket. Because the trading on Forex market due to its liquidity attracts more and more people every day. In order to realize how trading on Forex market functions one should not be extremely smart, it is more important to understand basic principles of the growth of exchange market and share market. If you understand all of these things easily, then you will be able to see how to trade successfully on forex market within first months of the work.

How to trade on Forex market without elementary investment? It can be done if you open a demonstrative account where you will try your trading strategies. Because any deal made on Forex market, supposes a purchase and following sale of national currency. And the main goal that the trader is pursuing is that the purchase is cheaper and the sale is as high as it is possible. If you understand how to trade on Forex so that the difference between the deals is enough for you to live by, then you will make your first steps towards the wealth.

- Details

- Written by Jeremy Stanley

- Category: Forex basics

- Hits: 3377

How to become a successful trader? Probably every trader asks himself that question, especially those who are just beginners. But not every beginner can find an answer to that seemingly easy question, especially pass all the stages of development to become successful himself. But every step makes us more experienced and stronger.

So what are these steps and how they help in development of the professional, since everybody has his start and his possibilities. We will make out three main stages of formation from absolute beginners to experienced market speculator. Every stage must improve your theoretical ad practical skills.

A successful trader will not trade on a real account during his first days of work. He will open a demonstrative account and he will try to repeat everything his more experienced colleagues do. Probably something will not work out as planned but if you lose money, and you will lose some money you will not be into fever. Because it is so much easier to lose fake money than to lose real deposit.

When the workday is over successful Forex traders start counting their real profits. And you will need to put up with few cents left and think: “Where are the earnings that we were told about so much!”

- Details

- Written by Jeremy Stanley

- Category: Forex basics

- Hits: 3406

Night Forex has many fans who chose time span for work on purpose. Night trading on Forex is especially loved by fans of scalping (making short-term deals and getting profits on flat). The name derives from the fact that trading occurs on Asian market at the time when European territory of Russia and the capital and the biggest cities are sleeping.

Night Forex has one peculiarity – it is a very calm period for work. Such situation is provoked by the fact that European and American markets are closed and many traders are resting after a hard workday. But at the same time one should not relax, while working on the Asian market, because here one can observe significant price fluctuations especially if a trader works with currency pair which include yen. In the period from 3 A.M. to half past four important news come into being in Asia and they can influence the movement of prices.

By choosing night Forex many Russian traders work from 11 00 P.M. until 2 A.M. Moscow time, thus avoiding possible abrupt price change. They are engaged in peeping, by working on short-term deals and receiving 10-30 points for them.

- Details

- Written by Jeremy Stanley

- Category: Forex basics

- Hits: 3607

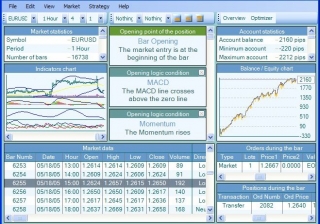

Mechanical Forex trading systems are special programs that help a trader to develop his own strategy and to make trading transactions. These programs work with information received from foreign exchange. They analyze them and then give you instructions, what deals are the most profitable at the moment.

Many successful traders use mechanical trading systems in their work, with that said they use a t times several different methods at once. They allow the players of the currency exchange to feel more secure in the constantly changing conditions of Forex market, because they will not have to look for information on their own or to come to conclusions after analyzing it. Thus, mechanical trading systems of Forex can facilitate their owners’ life. But they should not relax even in case they are given the information about several programs at once.

Mechanical trading systems have one major defect – a trader has to constantly follow the information that they are giving out and also to correct the parameters from time to time. Only by observing these recommendations the usage of these programs can bring the player of currency exchange market real profits and it will significantly lower the losses.

- Details

- Written by Jeremy Stanley

- Category: Forex basics

- Hits: 2987

Forex risks are one of the most important parts of the work on currency exchange, one should approach its study long before he starts making the transactions. Your strategy and profits will depend on how well you know the information.

A well premeditated action plan will allow a trader to cut his forex risks. Currently successful and unsuccessful trading operations made by experienced traders are at the ratio of 7:3 (the profits well exceed the losses).

Work plan on currency exchange is an obligatory condition of successful trading. In that case a trader has to make up a plan beforehand which allows him to make deals according to the strategy created, in case of positive or negative situation. In that case the impact of emotions on trading lowers significantly, which means that a possibility to get great profits is higher. Further we will tell you the main principles of work on currency exchange which will allow you cutting your trading risks.

- Details

- Written by Jeremy Stanley

- Category: Forex basics

- Hits: 3783

Forex work hours – is a period when banks are working and active trading transactions are made by traders from all over the world. Forex work hours continue for 24 hours a day during the whole working week (it starts at Sunday midnight and ends at midnight of Friday). One can’t trade only during the weekend and on official holidays, like Christmas or Easter.

Forex work hours are determined by Universal Time Coordinated (UTC). In Russia forex work hours change by two hours during winter (they are added), and by three hours – in summer. The forex work schedule is determined by Greenwich (GMT), but lately this time is considered outdated.

By knowing the Forex trading sessions schedule and by correcting your trading accordingly, any trader can achieve great success. It is not a secret that one of the most aggressive sessions is the American one, and during its work one can observe significant changes in the dollar price and changes in the direction of trading on the market as a whole.

- Details

- Written by Jeremy Stanley

- Category: Forex basics

- Hits: 3452

Forex transaction is the most important part of trader’s work. Forex transactions have another name – positions, which helps to determine the essence of this notion. Any trader can make transactions on foreign exchange from the moment of making a contract with the dealing center (broker) and will transfer on his account a certain amount of money that he is going to work with. After hos balance is replenished a trader can start trading.

The volume of forex transaction is called a lot. When choosing a broker one should pay attention to the minimal sum that he allows working with. Some companies collaborate with the traders that are capable of making the transaction for at least one lot, while others attract new people due to lowering the minimal volume of the transaction. Lately the number of dealing centers who are willing to work with beginners that are capable of making a transaction of 1/10 of the lot has been increasing.

After the forex transaction is complete the trader starts watching the situation, waiting for the most convenient moment to end it. Many beginners on currency exchange are always wondering how to close the deal in order to get the maximum profit. It is important to note that there is no universal answer to that question, because the work outcome will fully depend on studying the market situation, trader’s intuition and his psychological peculiarities.