Novice traders often hear about increase in volatility after the release of important news, but few people can explain clearly how to use this information in practice, so today let's talk about how to trade on news.

It should be noted that such a question often misleads the beginners, since this way of work is seen by the latter as a separate trading strategy that can bring a stable and guaranteed profit. In fact, trading on news pulses carries risks and also requires the trader's patience and extensive knowledge in the field of fundamental analysis.

On the other hand, there is an opinion in the community of traders according to which the search for news bursts is the fate of amateurs and "gamers", but in fact, this style of work is not so hopeless – on the contrary, in some companies and banks, the traders prefer to trade after the publication of important data.

By the way, we recommend to watch the documentary series "Wall Street Warriors". Several series of film refer to the topic of trading on news, and you can notice that professional traders prefer to make a decision only after the event occurred.

How to trade on news and avoid conflict with the dealing center

Another argument in favor of the aforementioned method of trading is the fact that some dealing centers (hereinafter DC) by all means try to deal with traders trading on news. The logic here is very simple – if restrictions are imposed on certain operations, it means that the dealer loses a lot of money on them.

However, many DC indicate limitations directly in the regulations, for example, the company may cancel the order, the profit on which exceeded a certain percentage of the account balance of the client; the condition of "possibility" to cancel all the transactions closed before the expiration of the minimum holding period (typically a period from 2 to 5 minutes) is also common.

In fairness, we should note that in most cases these companies compensate listed restrictions with other favorable conditions and bonuses, but in any case, if the regulations (or offer) contain similar clauses, you will have to forget about the question of "how to trade on news in such conditions" – you can even say thank you to the management for that, at least they honestly and right away notify whom they are not happy to see.

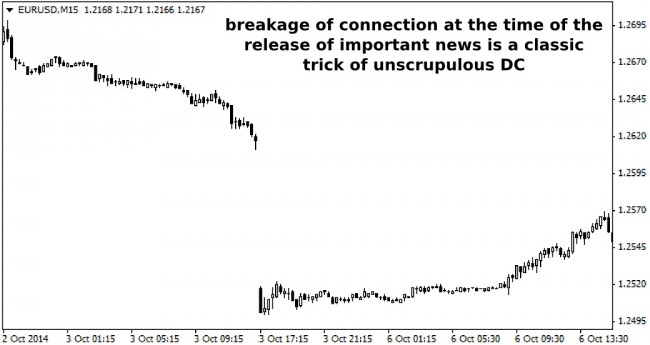

But other DC use more sophisticated methods, including disconnections and increase in the time of order execution (sometimes up to a minute, instead of the claimed few seconds). By the way, requotes that displease many traders cannot be attributed to intentional interference from DC, because you can specify the tolerance in points when opening orders in the MT terminal.

This means that ECN accounts and derivatives market (currency futures) are best suited for trading on news. Speaking of ECN, in this case you do not even have to change the DC, because today many companies offer different types of accounts to choose from.

How to trade on news with the least risk and maximum return

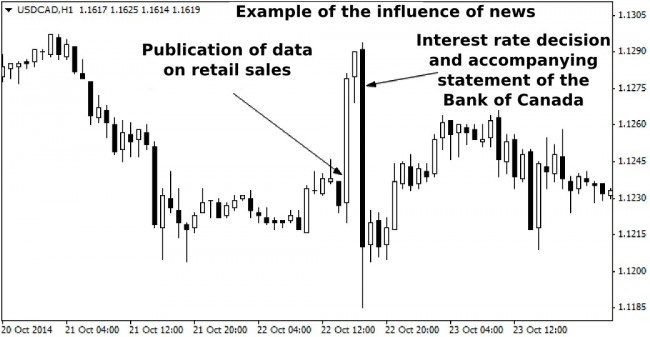

First of all, we should remember the main rule: not all news are suitable for trading, even most of the publications marked "important" in the economic calendar are not suitable for this. The matter is that the pulse may appear either after the publication of the fundamentals the dynamics of which has a direct impact on the policy of the central bank of a certain country, or after the statements from politicians and the meetings of the board of the regulator.

In particular, the first group of indicators the publication of which inevitably leads to an increase in the volatility of the national currency is as follows: final GDP estimates (for the quarter and year), CPI, unemployment rate and the number of applications for unemployment benefits, the amount of construction, production and trade (as well as their dynamics), the trade balance. Information about the number of jobs created outside agriculture is also important for the US dollar (the report is published on the first Friday of each month).

It is impossible to compile a list of events for the second group, since a lot depends on the current situation in a particular region, but in general, the catalysts of the pulses are statements by heads and deputies of the central bank, the economic forecasts of the government, the adjustment of key interest rates and the volume of quantitative easing (in other words, any measures of monetary policy), and in this case, the more unexpected the news, the higher the chance to catch a decent movement.

Therefore, before exploring the question of "how to trade on news", you should list the events that can have the greatest impact on the exchange rate. Please note that the compiled list will be different for each country, as even the trade balance indicators have different effects depending on its structure.

The rules of eponymous Forex trading strategy

The following procedure will seem much too primitive, since it ignores the dynamics of the indicator and is based only on the fact of the realization of the event, but at a distance, it shows a positive expectation. In order not to create problems for no reason, you will need to comply with the instructions below:

- On Monday morning, open the calendar and mark the events that may lead to an increase in the volatility of currency pairs (you can customize the diary with the sound alert);

- 10 minutes before each event, open the chart of the corresponding pair (or currency index, such as the USD index) and assess the current dynamics of the rate;

- If there is a clear trend, it is better to ignore the deal, since the publication of news can likely form the "Saw";

- If the intraday market is flat, set two pending orders – buy-stop 10 points above the recent high and sell-stop 10 points below the recent low (valid for EUR/USD, for the remaining pairs the offset must be calculated taking into account the factor of average volatility of the necessary tool relative to the EUR/USD volatility);

- Stop-loss for each order is placed at the opening price of the opposite position, for example, stop for a buy-stop will be at the price of the sell-stop;

- Take profit on each "pending" is set as at least 50 points, but it is better to use as insurance against breakage of communication and it is reasonable to use a trailing stop as a basis. As an example, the transaction would be the situation on the EUR/USD pair after the publication of Nonfarm Payrolls:

Speaking of the risks, we should note that everyone decides for themselves on how to trade on news, but it is optimal to adhere to the minimum risk (1-2% of the funds in the account for the whole deal), because it is better to use more currency pairs and take from 8 to 15 signals a month than to conclude several deals on one pair with huge volumes.

Social button for Joomla