The dynamics of trading on the foreign exchange market shows the mood of the market, the major currencies traded in a small range, which indicates the position of the majority of expectant players. The sharp weakening of the U.S. dollar on Monday, not continued, the U.S., as well as other currencies, traded kept no signs of purposeful movement. Market, we can say waited protocols FED meeting, which will take place this week, on Wednesday.

The European currency declined on Monday. Although the EUR/USD pair opened strong and up, proceed in a northerly direction the pair failed. On the contrary, EUR/USD started to close the gap, but it bounced off the 1.3324 level and is now trading slightly higher. It's worth noting that there was a rebound from recent highs, which was located just at the level of 1.3324, this price action indicates that this level is seen by market participants as a significant support level. Today affect the movement of the pair EUR/USD will be able to index data sentiment in the business environment in Germany and the euro area as a whole. Resistance for the pair is at around 1.3385.

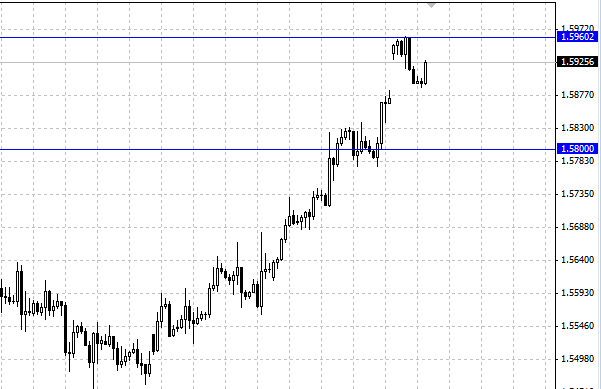

The British pound broke divergence soaring upwards. Prospects are lower now in question. Quotes GBP/USD moving in rhythm with his fellow European currency. Support has formed at the level of 1.5890, a barrier to the further growth of the pair likely to be the level of 1.60, with an increase above that GBP/USD has his sights on the levels of previous peaks 1.62 - 1.63 . Today will block economic statistics for the UK, which could have an impact on the couple in the short term. Basically pound and the euro are now awaiting the FED meeting, which will shed light on the fate of the dollar, and accordingly for other currencies.

AUD/USD holds above the 0.93 level. The bank Westpac said that the Australian dollar is predisposed to growth in the region of 0.95 . Analysts also believe that the growth of the Chinese economy will support the pair AUD/USD. If, after the publication of minutes of the FED's dollar is under pressure, the Australian dollar it will be on hand. The only fear factor is the weakness of the economy as Australia, which could cause further interest rate cuts by the Reserve Bank of Australia. Support for the AUD/USD is the level of 0.93, the resistance is in the range 0.94 .

Social button for Joomla