Wednesday market was waiting for news on the U.S. economy and, of course the same, the publication of minutes FOMC. Economic data provided strong support for the dollar, resulting in other currencies fell markedly against the U.S. dollar.

The EUR/USD reached a low of 1.3213, and the pair began to recover. Strengthening of the dollar stopped after the publication of minutes of FOMC, EUR/USD surged above 1.33 level to the level of 1.3344 . Minutes of FOMC had some pressure on the dollar, but as we expected, the pair above this area did not take place, the pressure on the euro has had a downtrend line that passes through the 1.3350 level. In the euro there is no advantage at the moment, so we believe that the pair EUR/USD is in a stage of decline from the mid to 1.30 .

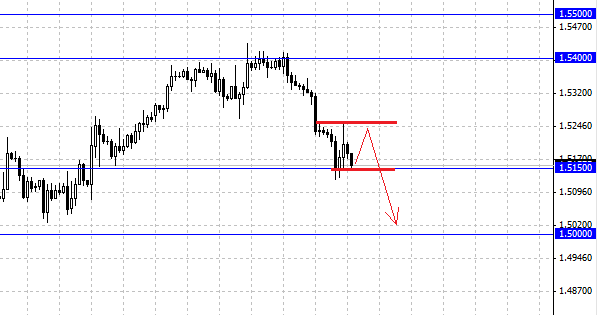

The British pound as opposed to the euro shows a negative trend, the pair GBP/USD is moving in a southerly direction. Reverse this trend can today's data on the UK. We believe that the downtrend begins to form on the pound, and the immediate goal is the level of 1.50 then 1.48 . For the last day GBP/USD pair dropped to 1.5120 . After the publication of minutes of FOMC reached 1.5250 and once again began to decline.

Another interesting development in the market was the consolidation of the Australian dollar below 0.90 dollars, which, in our opinion, was not only a lot of resistance, but also an important psychological level. Currently AUD/USD is trading at 0.8950, and we believe that the pair will continue to decline, the pair will be capped at 0.90, which now plays the role of resistance. In the short-term target for the pair will be the level of 0.8750 .

Today, the markets are also waiting for an important event - the ECB press conference. After a controversial and rather sluggish response to the statement of FOMC (essentially a pair of EUR/USD remains trading in a range), we should expect that the ECB conference will give an impetus to the strong purposeful movement. The number of applications for unemployment benefits can also add a dynamic market. In general, the best solution for traders will be waiting for important news, they will shed light on the future prospects of the currency market.

Social button for Joomla