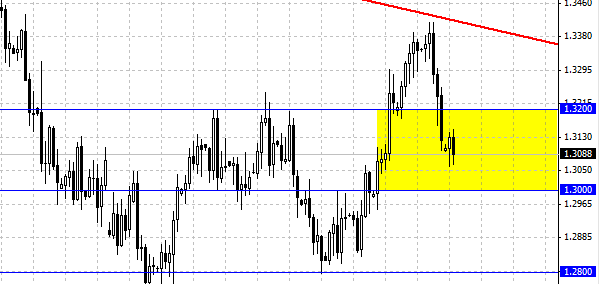

During the day EUR/USD pair lowered, but wasn’t able to leave the diapason of prices of previous day. This demonstrates that the market had taken a little break after an abrupt fall, and is now probably going to face consolidation. Nevertheless, in long-term perspective we assume that the descending tendency will continue for the EUR/USD pair. We should mention that the pair is again lower than the level of 1.32 and is heading towards the level of 1.30. We still think that the pair movement during the summer period will be carried out between the boundaries of 1.32-1.28. At the moment traders should watch the resistance levels, where they can open positions for lowering European currency, which is level of 1.32. More aggressive traders with low risk should sell from the level of 1.3150-30. The behavior of price near the level of 1.30 will show whether the dollar is potent enough to move further towards 1.28, or we will see again a market trapped in the area of 1.32-30.

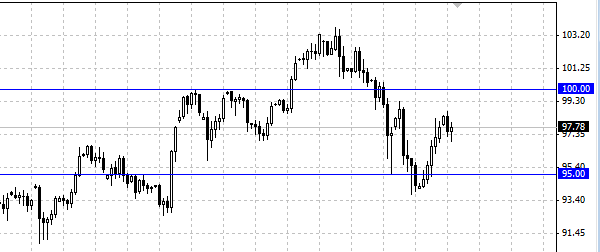

USD/JPY pair is lowering despite the strength of dollar relative to other currencies. But we are still in bull mood when it comes to this pair, because long-term graphs demonstrate it very well, and the recent growth signals the renewal of ascending trend. The fact that the USD/JPY pair returned into the channel of 95-100 as it was mentioned by Japanese Bank is very “comfortable” for Japanese currency adds plus to our opinion on the upcoming growth. Probably Japanese Bank will take action very soon, by weakening yen, the abrupt strengthening of dollar relative to Yen will become a signal to buy the pair and a sign that Japan bank joined the game. The closest aim for the pair is the level of 98, consolidation higher than 98. Consolidation higher than this level will open the way to the area of 100 yen for a dollar. The support is situated at the level of 95 the level of 96.20 can also be looked at for opening deals for purchase.