In addition to the indicators and graphical approaches, candlestick combination can also tell a lot about the situation on the market. You can identify candlestick patterns without the help of indicators, on your own, but in this case a novice trader can face difficulties.

Forex candle indicator can greatly facilitate this task, because there are many dozens of candlestick combinations, while there is an element of subjectivity inherent to the beginners when they identify patterns. All candle combinations can be divided into two groups:

-

reversal patterns (at the "bottom" and at the top);

-

trend continuation pattern.

The most popular reversal models include bullish and bearish engulfing, doji, hammer, piercing line, dark-cloud cover and a number of other patterns. The key combinations of the trend continuation include three white soldiers, separation, 3 methods, windows.

When visually identifying the candle combinations on the chart, the trader can miss some of them. In addition, for certain patterns only approximate ratio between the length of the shadow and the body of the candle exist, which can lead to some confusion in the identification of a pattern.

How is Forex candle indicator useful?

The main advantage of this kind of indicators is that they are impartial and act strictly according to their inherent algorithm. This is to ensure strict compliance of candle combinations with the parameters set in the code of the indicator.

Forex candle indicator can identify virtually unlimited number of candle combinations. It all depends on how many criteria are laid down in its algorithm in the establishment phase. This eliminates the need to keep all the combinations in memory.

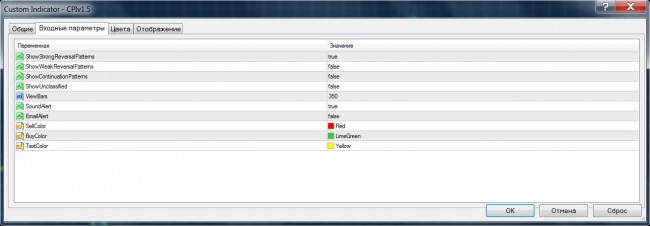

As for the settings, the majority of candle indicators allow you to enable/disable the display of weak models on the chart or models of continuation/reversal trend. Furthermore, notification alert after completion of the combination is provided.

In general, functional of different candle indicators is similar – an arrow on the chart points to the candle, which completed the formation of candlestick pattern, besides the inscription says what kind of candle combination was formed.

Forex candle indicator in live trading

Typically, traders use 5-7 most common candlestick combinations. Forex candle indicator allows to bring the number of combinations used to several dozen. In general, it can improve the efficiency of trading.

When using candle indicators, you should remember that the probability of working out of the received signal increases with the timeframe. Also, sometimes the indicator gives ambiguous signals. For example, after a long flat, the indicator marks the shooting star on the chart, although the strength of this signal is low.

In general, candle indicators can be used as a useful addition to the trading system. Such an indicator may be a kind of filter in the analysis of the market situation. Due to the large number of candlestick combinations embedded in its algorithm, the candle indicator will be particularly useful for the beginner in the currency market.

Social button for Joomla