Expectations of an early onset of decline in the volume of quantitative easing, perhaps, cause the most heated discussion in recent times. The most popular expert positions that involve small decline in redemption in the coming months. In keeping with the current version of the policy as a lot of supporters. But here's the experts who believe that the FED should expand incentives, can be seen not so often.

The head of the Federal Reserve Bank of Minneapolis Narayana Kocherlakota in his last speech, said that the decline in asset purchases may have a negative impact on the pace of economic recovery. According to Kocherlakoty, the U.S. economy is now in a very vulnerable position, and any intervention can exacerbate the already precarious state. Inflation expectations are relegated to the background. The paramount importance of the level of employment gains.

Central banks around the world are trying to weaken their currencies. These challenging activities may ultimately lead to higher inflation. The main risk of this scenario is that here there is a substantial likelihood of deflation. People just stop buying valuing goods and postpone their purchases until better times. Following the company will cease to grow and create jobs. Current FED policy is aimed at preventing a deflationary scenario.

A side effect of prolonged stimulus is the formation of multiple bubbles in financial markets. All this can result in quite frustrating for investors in the capital markets. But while the soft policy of the Central Bank of the world's leading promotes growth in the stock markets.

Powered financiers have warned investors. Jim Rogers in a recent interview with Reuters, said that the actions of central banks to weaken their currencies are absolute madness. He also noted that now we are simply dealing with the sea of liquidity, which sooner or later will start to dry up. Thus, according to Rogers, the central banks make a catastrophic mistake.

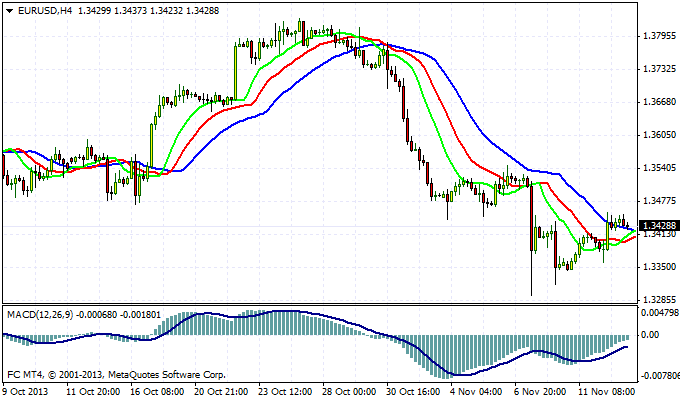

Quotes EUR/USD are currently at the level of 1.3420 . Designating a local maximum in the previous trading session, the couple can try again to get closer to the lows at 1.3290 . Now you can try to open short positions, placing a protective stop just above 1.3455 . Support levels - 1.3290, 1.3170 and 1.3000 . While all variations pair EUR/USD is in consolidation after part of last week's decline. Exit from the current trading ranges occur in the near future.

Good luck trading!

Social button for Joomla