Tuesday on the FOREX market was relatively quiet. In the major pairs was some different direction. Quotes of the single European currency have attempted to test the 1.3 area, but the dynamics of the pair GBP/USD had a bearish trend. Drivers to start more or less strong move today will be enough.

Macroeconomic data will reveal different sides of the current situation in the Eurozone and the U.S. economy. In the European session, extend the data on the labor market in the Eurozone. Later, during the American session, participants will assess leading indicators of the labor market, to win back the GDP data for the second quarter (8:30), and at the end of the session to interpret the statements of representatives of the Federal Reserve (14:00).

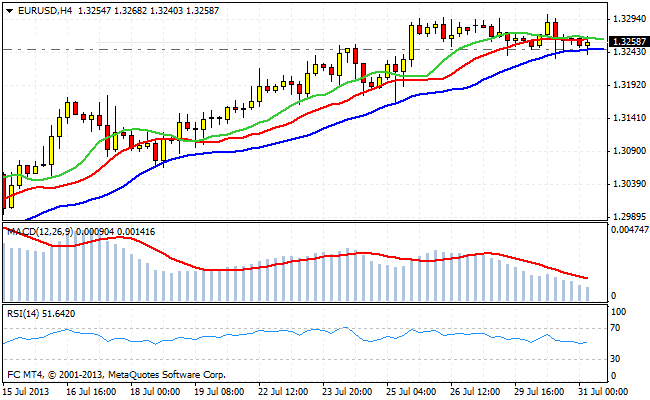

After testing the high of 1.3301 to the euro players chose to take profits. This caused a wave of short sales as a pair, and finally quotes attempted to break below short-term resistance of 1.3233 . At the moment EUR/USD slipping a bit before exiting the block of macroeconomic statistics in the Eurozone. Technically, the pair is overbought, so today's session could be the beginning of a new wave of growth in the dollar.

Market participants will closely monitor the output data as well as quantitative characteristics of the labor market and economic growth - is the FED's main landmarks. The basic idea is speculative now - is the outcome of the FED's September meeting. While economic data suggests that it is not so smooth. This fact forces the monetary authorities do not take the time to reduced incentives. But, nevertheless, there is still time and coming to market statistics can be strong, which will cause investors to reconsider their attitude to the FED's willingness to act.

Local support is at 1.3223 and 1.3170 . The passage of these levels down will be a signal to open short positions in the pair. Top quotes limits the level of 1.33 euros. According to dealers, there is a decent noted accumulation of pending orders to sell. Accordingly, if the euro bulls manage to break through the dam, we will see new highs around 1.34 - 1.36 .

The dynamics of the pound in recent days shows a clear downward movement. Once the support level at 1.5262 was reached, reducing Intraday several accelerated. Participants take a short position, you can place a trailing stop. Target levels may be lower mark - 1.5040 and 1.48 . Bullish on the dollar can buy it through and against the euro and against the pound, as traditionally GBP/USD pair is trading more dynamically.

Good luck trading!

Social button for Joomla