The next FED meeting, which took place on Wednesday 30 October, did not bring any new information. Participants expect any concrete actions and statements with respect to monetary policy, but FED officials still prefer to take a neutral position. According to the study, there has been quite moderate growth in economic activity. Despite the fact that the current unemployment rate is higher than the values of comfort, a number of labor market indicators show some improvement.

Inflation is still far from the target values. In the Committee believed that, while maintaining the policy, the likelihood of continued economic growth will be much higher. The range of the federal funds rate maintained in the range of 0 % to 0.25 %. The key parameter for the revaluation of the current strategy is the level of unemployment. Following the publication of the accompanying statements in the currency markets was a small wave of volatility that subsided after a couple of hours. Statistics on retail sales in Germany disappointed investors. Sales in September came out worse than analysts' expectations.

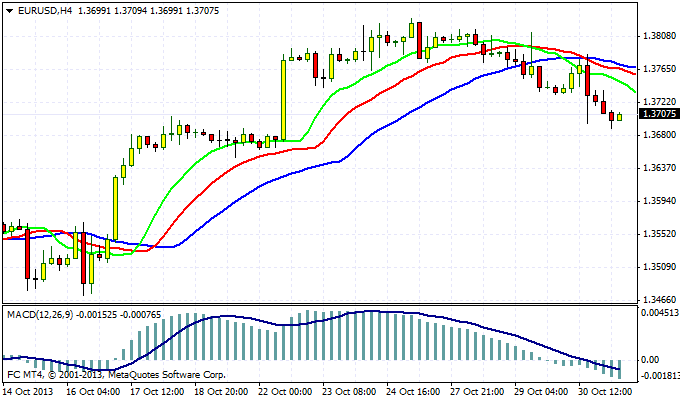

The pair EUR/USD is trading at 1.3711 . Here, there is demand for the European currency. Having reached during the current trading session low of 1.3688, the euro is trying to recover some of the lost ground. Trading activity remained low. Market participants do not have enough new information to the game in one direction or another. While the medium-term trend for the euro is not broken, chances are that in the next trading session, we see attempts to re-test the area of the October highs at 1.3820 . Treat game to slide in the pair can only be the case if received signals to replace the clear trend.

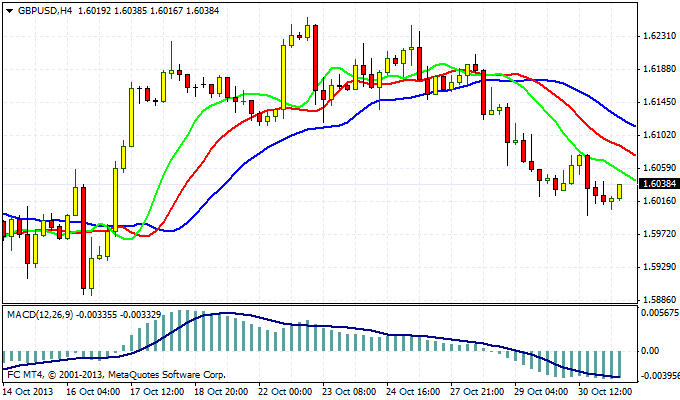

GBP/USD on the daily chart, a classical double top. If the figure is realized, quotes pounds can quickly move to the level of 1.56 . An important level of support in the current situation serves mark - 1.59 . But if selling pressure weakens, then the players to increase GBP/USD will take another try for the maximum in the 1.6260 .

Good luck trading!

Social button for Joomla