Today and tomorrow in the evening Ben Bernanke will speak to Congress. According to experts, the chairman of the FED once again remind the members of Congress and the markets that in the beginning of the collapse of stimulus measures will not follow the growth of the interest rate. Such updates often are taking place in recent years, as markets tend to overestimate the FED's intentions with regard to monetary policy. Rather, Ben Bernanke will continue to keep making controversial statements. The main guidelines in the Federal Reserve's monetary policy remains - economic growth and labor market situation.

Despite the fact that the increase in the base rate seems improbable to many politicians, investors, however, believe that the tightening could happen in 2014. Typically, markets tend to take into account in advance in the prices of certain significant events and trends. Therefore, it is possible that before the start of the cycle of rising interest rates, we will see a major strengthening of the dollar.

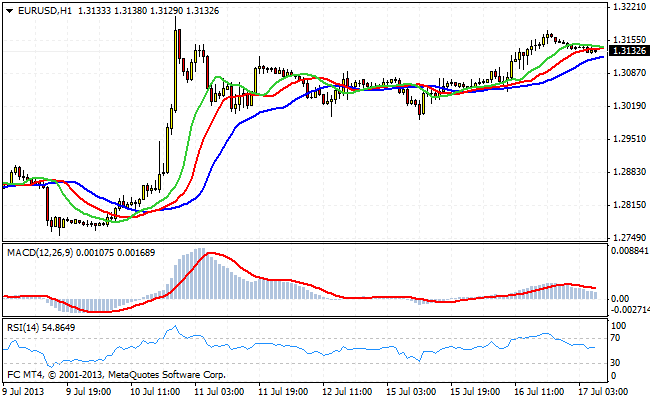

The situation in the pair EUR/USD remains the same. Low trading activity, moderate volatility - all these are signs that the markets are waiting for further statements from the chairman of the Federal Reserve. Already most of the participants it is clear that aggressive intentions - will not be made public. Short covering, apparently, continues to have a good chance to move into the euro zone 1.32 - 1.33 . This area provides a comfortable opportunity to open short positions in the calculation of the assault on a local minimum of 1,2750. While the most likely seen a scenario where increasing volatility and a couple on the statements of the district Bernanke reaches 1.32 - 1.33 . After that takes place, and the bears come into play on the euro.

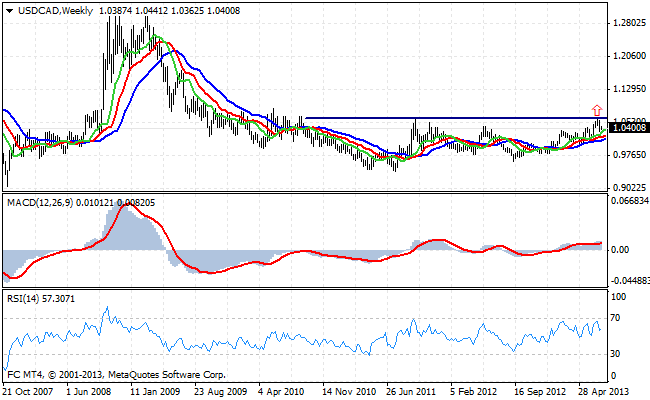

The graph above shows the long-term dynamics of the Canadian dollar. The technical picture looks so that the pair USD/CAD is trading near important resistance level, breaking which, most likely, she will get a good momentum for growth. This is the level - 1.0575 . Long-term goals of upward movement - 1.1700 and 1.2600 . Despite the fact that such goals are pretty ambitious, we should not lose sight of the fact that the Canadian dollar is in a long corridor. And, as a rule, out of range leads to the birth of the medium-and long-term trends.

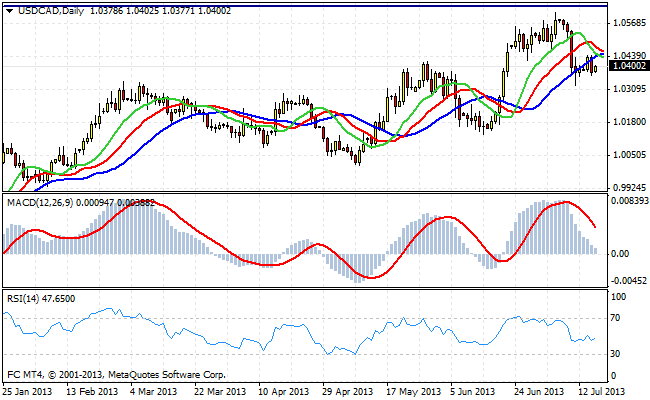

The daily chart shows the Canadian dollar medium-term bullish trend. Support levels now - 1.0310, 1.0170 and 1.0040 . The pair is in a corrective phase. Given the current trend, all attempts to reduce the USD/CAD may be used for building long positions.

Good luck trading!

Social button for Joomla