In Wednesday trading on the FOREX roar brightened somewhat sluggish compared to the beginning of the week. Today will be published decisions on interest rates the ECB and the Bank of England. The growth of the single European currency is a problem for the euro area economy. Resolve this situation can only be through monetary easing policy.

Experts believe that the regulator will not do it soon, because it would prefer to start to get reliable signals that inflation risks are reduced. Traditional survey of economists by Bloomberg showed that 67 out of 70 respondents believe in maintaining interest rates at the same level. At the same time, such investment whales, as BofA and UBS expects a slight reduction of the base rate at today's meeting.

Some analysts tend to assume that the European Central Bank will go to the further easing of monetary stimulus only at the December meeting, having received confirmation that inflation risks remain stable. Conference by ECB President Mario Draghi also promises to be quite interesting. Draghi may make attempts to prepare the market for the December rate cut.

The data for the euro area suggest that inflation is on the long-term lows and continues to decline. In order to avoid a deflationary development process of the Japanese scenario the ECB will be forced sooner or later to resort to further enhance measures to maintain liquidity. Thus, any reference to it will cause a powerful wave of sell euros.

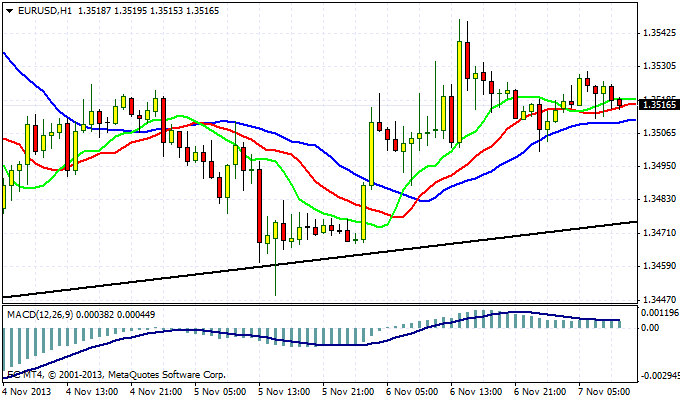

EUR/USD is now trading at 1.3515 . In the event that the application will please bear Mario Draghi, the euro quotes can very quickly turn out to be in the region of 1.3440 . This is a key milestone in the medium segment. To overcome the increased downside risks to create a pair of quotes in the 1.30 area. Open short position is just below 1.3440, and place a protective stop at 1.3350 .

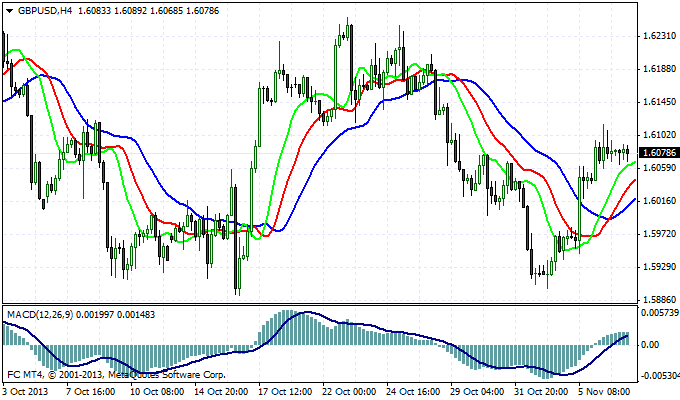

The current value of quotations GBP/USD - 1.6082 . The last two days of a consolidation of the pair. The Bank of England also publish today a decision on interest rates. Recently, data on the UK economy looks quite promising. If the representatives of the Bank will give market participants understand that they are ready to retreat a little from the current mild course of monetary policy in favor of a neutral strategy, the pound has all the chances to get closer to the important high at 1.6250 .

Good luck trading!