Breakout EA is an automated variant of the strategies built on volatility breakout. In fact, there are lots of names of such manual algorithms – like “morning flat breakout” and “London explosion”, but their disadvantage lies in the need to spend time on positioning of similar pending orders.

Breakout EA is an automated variant of the strategies built on volatility breakout. In fact, there are lots of names of such manual algorithms – like “morning flat breakout” and “London explosion”, but their disadvantage lies in the need to spend time on positioning of similar pending orders.

Breakout EA was created to address this disadvantage, and it became the progenitor of a series of robots. Of course, we won't review all the modifications – instead, we'll take a look at the basic, simplest model which everyone can add modules to, based on their own understanding of the market.

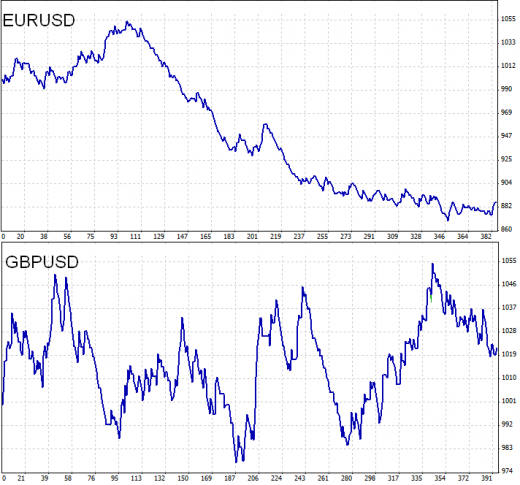

The authors recommend using this robot only with two pairs: EUR/USD and GBP/USD. This recommendation is due to the simple fact: the volatility in the given pairs is growing rapidly during the very first minutes of the European session, causing breakouts of flat formed during Asian trading.

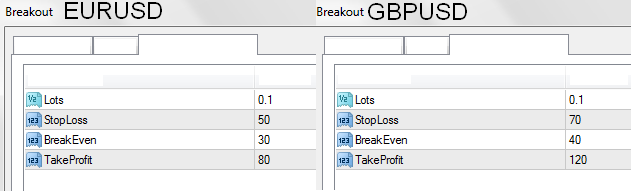

Breakout EA with the default settings

Before proceeding to describe the robot configuration, we shall say a little about the logic of its work. At 8 pm GMT (before many European traders and banks enter the market) the EA puts two pending orders beyond the boundaries of the morning flat – buy stop and sell stop with the set parameters of stop-loss and take-profit. During the operation within a day, one or both of them are worked out, and at 11:59 pm GMT the remaining pending orders are deleted, while those that weren’t closed by the stop or take in the process are forcibly closed.

The next business day the Breakout EA repeats all the steps. As we noted in one of the previous publications, a significant disadvantage of this type of advisors is their age – in particular, the Breakout EA was written before 2007, i.e. before the global financial crisis, which has changed the movement nature of currency pairs. The figure below shows the recommended settings from the authors:

BreakEven parameter is the profit margin in points by a triggered order, and when it is reached, the stop loss is moved to breakeven. All settings with the pound have larger values, as its amplitude of the oscillations is traditionally wider than with the euro. Recommended operating timeframe is H4, although it does not matter much. Now let’s run the tester for 2013 with the developer's settings:

Blamestorming and attempt to optimize Breakout EA

The test results showed the following:

- euro default settings are no longer relevant, which resulted in the rapid Equity decrease;

- pound account status was stable, without any significant drawdown, but the profit (subject to the rules of money management) was about 2% per year – that will never do, even though the EA met the immediate goal – it didn’t siphon the money.

The attempts to improve euro results failed, though all the basic options have been tried – from balancing between the stop and profit to disabling the stop and trying to save a deposit only by controlling the amount of profit.

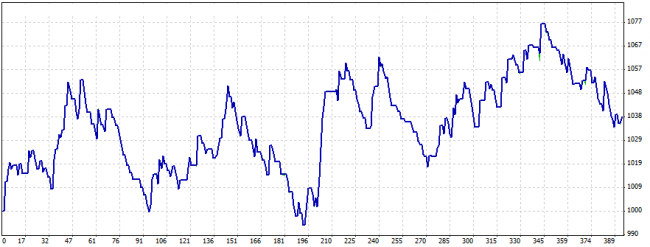

Reason for the failure is simple and was mentioned above: the market has changed its nature after the crisis, the EUR/USD pair now sees more false breakouts at the opening of the European session, often resulting in triggering both pending orders, and, as a consequence, in disrupting both stop-losses on them. Now there are fewer one-way powerful movements. The result of pound optimization is presented below:

In this case, we managed to reduce drawdowns to a minimum by reducing the breakeven threshold to 20 points, and the EA was able to generate profit. You could even try to increase the risk by 3-5 times.

Let’s summarize the pros and cons of Breakout EA.

The following properties can be singled out as the advantages:

- easy to use, no complicated settings and algorithms;

- no need to keep your computer on overnight, it’s enough to turn the terminal on before the working session;

- many modifications are freely available.

The main disadvantages are:

- the strategy itself is unfounded, there are no filters, whereby you have to operate only with the expectation when selecting parameters;

- low general income and lack of opportunities to trade aggressively (of course, not every trader considers this circumstance as a disadvantage).