Forex Cleaner expert advisor was written in 2011 and is still popular, because it combines a simple algorithm and an acceptable percentage of profits. The Forex Cleaner EA immediately stands out of other robots because it doesn’t use Martingale and averaging in trading, but fixes losses by the stop-loss or by catching the signal to close the position.

Initially, like all other robots, the Cleaner was paid, but today it can be freely obtained online, plus you can find many new and free modifications. Despite this fact, for reasons of clarity, we’ll review only the very first version, as it has monitoring on real accounts.

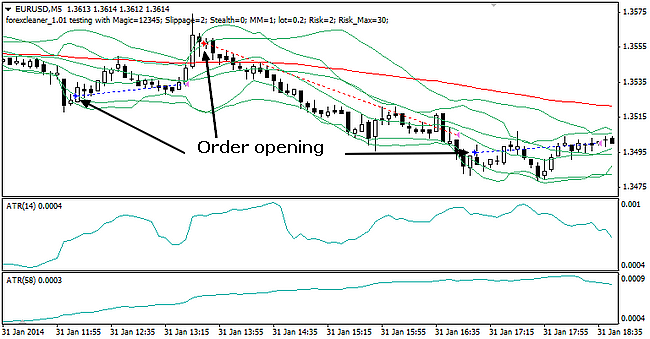

So, the code uses only standard indicators in combination with candlestick analysis, so no additional files and libraries need to be installed, which is already an advantage. The basis of the strategy is built on the Bollinger Bands and ATR. The latter is used as an additional filter to open the order on really strong deviations, not a narrow flat. The example of the transactions is represented below:

As you can see, the Forex Cleaner EA uses two ATRs with periods of 14 and 58, and the same number of Bollinger Bands with periods of 11 and 23. The entry points are identified using indicators with fast settings: for example, the following conditions are necessary for the deals to buy:

-

the price touched Bollinger bands calculated over 11 bars;

-

the touching candle or the one of the following has closed within the channel, i.e. prices should stop sliding along the border.

Positions are closed in a similar way, but in this case a period of 23 is used, which is reasoned, because this approach allows to squeeze out the maximum from the trend caught. To be fair, we should note that the ATR in this case does not bring significant benefit, because it uses the ratio of fast and slow true ranges, instead of the normal values, so most of the new versions don’t have this filter.

Forex Cleaner EA in the strategy tester and on real accounts

Before turning to analyzing the monitoring, you must deal with the settings and capabilities. The developers recommend using the robot on the EUR/USD pair on M30 timeframe. There is minimum number of parameters available for customization:

-

Slippage – the acceptable slippage. If trading is not conducted on M1 and M5, this value is not critical;

-

Stealth – use a regular stop-loss (value false) or virtual one (true), where the dealing center won’t see them, but the EA will close positions as usual. It is useful when trading with a disreputable DC;

-

MM – automatic money management;

-

Risk – allowable percentage of the loss of the deposit per deal, only relevant when MM = true;

-

Lot – the fixed lot, if you disable the two previous parameters.

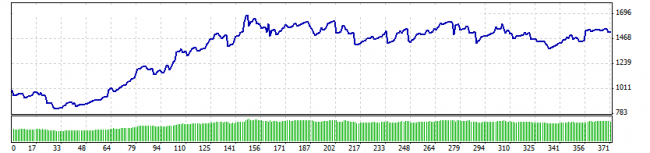

Further, in due order, tests were conducted on the recommendations of the authors, but the results for the period from January 2013 to July 2014 has been unsatisfactory. Despite the fact that the robot didn’t siphon (moreover, over the entire period it only saw a drawdown by 1% relative to the initial deposit at the very beginning), the net profit for the year and a half amounted to just over 11%. Therefore, there was an additional series of experiments on the European currency, the results of which came the following:

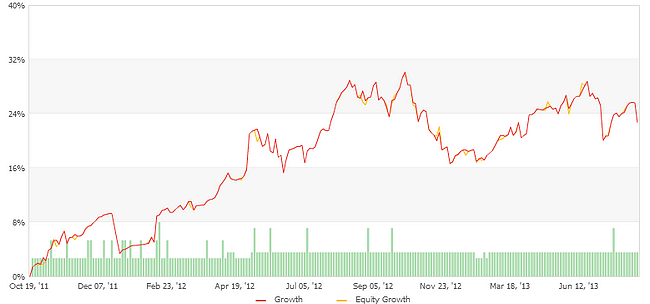

Maximum drawdown was 21.11% versus 53.5% in net profit for a year and a half – this is a strong relationship for the EA not using averaging. It should be noted that this instance is one of the few which in actual accounts shows the results not worse than in the tester – for example, the test on the following account was eventually completed in February 2014, but it does not matter, since the beginning of the work corresponds to the date of release to the public:

The remarkable fact is that monitoring is designed for the pairs containing AUD, i.e. the Forex Cleaner EA has a full right to be called multicurrency. For this account, the profit factor over three years was 1.29 and is acceptable for "mid-term". In addition, according to the same monitoring, the probability of loss of 40% of the deposit is only 0.01% and will require 42 losing trades in a row, which means that we can increase the risks.

In general, the strengths of the robot have already been listed, but you can’t ignore the major drawback – namely, the inability to change the indicators parameters in the original version at your discretion. In later versions with open source it can be done by means of MetaEditor.

Social button for Joomla