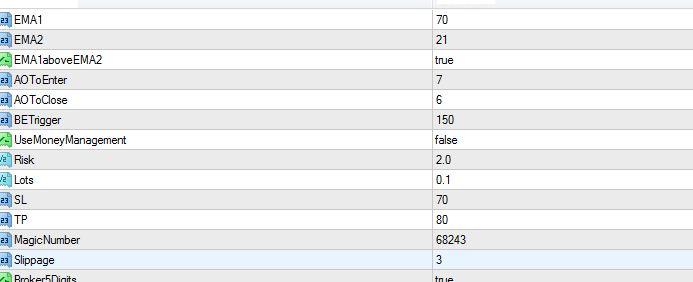

Forex Enforcer EA enters the market in the trend direction (working timeframe is h1), based solely on the indicators values. The algorithm doesn’t use Martingale principle, as the team of developers opted for stable trading and security of the deposit. The EA uses the values of two moving averages with periods of 21 and 70 accordingly and the Awesome Oscillator indicator with default settings.

However, the most interesting part is how the EA carries out risk management and trading itself. The algorithm is bases on MM, allowing it to resize the working lot depending on the market situation. The main drawback of most trend advisors is that they allow you to take only a part of the emerging trend movement. In some cases, a new trend may be quite strong and the trader won’t receive part of the profits.

After the price passed a certain distance in the right direction (adjustable in the settings), the Forex Enforcer only fixes 50% of profits, and the SL level is moved to a breakeven. This allows receiving the maximum profit from the trend movement.

How to install and configure Forex Enforcer EA

To install the EA, you just need to copy a file with .mq4 extension to the Experts folder, after which the robot will appear in the list of EAs in the trading terminal. Originally, the Forex Enforcer EA was created for trading on a EUR/USD pair, and for this currency pair the default settings are recommended by the developers.

The EA identifies the trend by the location of moving averages relative to each other. If the fast MA is below the slow one, the downward trend is identified, if above – the trend is ascendant. Besides, the distance between the moving averages is taken into account, and readings of the AO indicator are used to determine the exact point of entry into the market. The authors have provided 2 versions of the EA:

- With a fixed lot – in this case, the volume of the deal will not increase/decrease.

- Lot size is expressed as a percentage of the deposit (maximum 5%).

If the value of one pip is $1 and SL is set at 80 pips distance, in the worst case the trader will receive a loss of $80. At the deposit, say, $1800, the loss will be only 4.44%. But if SL triggered 3 times in a row, the losses will total to $240. In this case, the risk for the next deal will be 5.13%. If, in this example, the lot size is expressed as a percentage of the deposit, the potential loss would not exceed 5%.

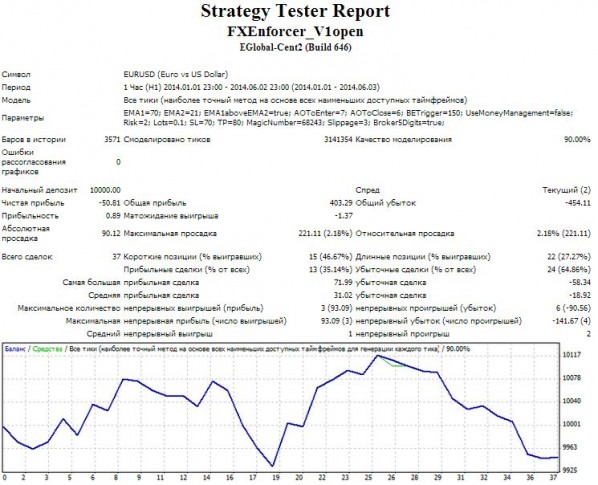

Forex Enforcer EA: test results

Test results showed that the settings recommended by the authors don’t bring profit. The test was conducted on the EUR/USD currency pair since the beginning of 2014, resulting in the loss of $454.44 at the initial deposit of $10,000. Our EA made 37 deals within 5 months in total.

The EA needs to be modified for further use in trading. First of all, you should focus at such parameters as periods of moving averages and Awesome Oscillator readings, which are used to enter the market (the AOToClose and AOToOpen parameters in the Preferences window of the EA).

Traders generally speak positively about the work of the EA, pointing at the only disadvantage of relatively low frequency of deals (10 per month in average). But open source code, implementation of MM, partial profit fixing and user-friendliness are worth trying to optimize the Enforcer EA.

Social button for Joomla