Today's publication will review an interesting advisor Forex Warrior, whose peculiarity is not even in its algorithm, but rather in the approach of the author, who doesn’t sell a “pig in a poke”, but is a manager and created monitoring for all his accounts. This fact and the availability of free information allow to make objective conclusions about the performance of the algorithm on the live market, not just on history.

As usual, we’ll start with the basic settings and the mechanism of the deal making. First of all, it should be noted that it uses Martingale combined with the grid strategy on limit orders, so it is reasonable to apply the Forex Warrior EA on the cent account in order to reduce the risks due to smaller lots. Orders are opened in both directions, but the algorithm has an embedded module that is starting building a position with the trend under the pronounced movement, i.e. it builds a pyramid. Most of the settings are similar to other robots, but there are some features, which we will analyze in groups.

The block of settings for manual intervention in the process of work, in particular:

-

Flag_Stop_Buy (Sell): correct stop of the work completely or in one direction only, which eliminates a lot of failures in comparison with a stop via a normal shutdown;

-

CloseAll_Buy (Sell): immediately close a series of orders to buy (sell) by setting the “true” value;

-

CloseBE_Buy (Sell): the series will be closed at the following level: breakeven plus the BEpips value, if it is positive, and minus if negative.

The Forex Warrior EA can manage risk and capital on its own with the following options:

-

AutoMM and AutoMMEquity: when enabled, the lot will be dynamic and depend on the size of the deposit – thus, when the balance increases, the initial serial lot will increase proportionally;

-

MaxDD and MaxDDPerCent: maximum drawdown in absolute terms (in the currency of the account) and in the percentage of the deposit, respectively, above which all orders are closed and the robot stops;

-

CheckEquity: a sort of artificial intelligence, which in fact is a regular calculation of sufficient funds to open an order in one step.

Other settings are intuitive and are designed to determine the values of stop-loss, take-profit and grid spacing. The only peculiarity is that there are several thresholds for parameters upon reaching which the multiplier factor changes, all such blocks have a Dynamical prefix to the name.

Analyzing the results shown by the Forex Warrior EA

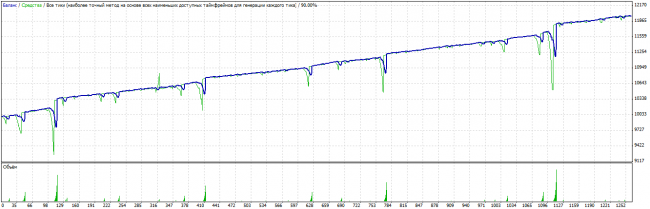

For a more objective assessment, we will first of all carry out experiments in the tester, and only then turn our attention to monitoring. This approach derives from the assumption that the author knows his EA best, while we need to answer the question of how much the robot is configurable for a lucrative job for novice traders, without customizing to author’s parameters. So, after a brief optimization on the 5-minute chart of EUR/USD pair, we got the following result:

Drawdowns immediately attract attention: unfortunately, we didn’t manage to get rid of them, but their effects were minimized, and if you remember other similar advisors previously discussed, the Forex Warrior EA looks better that many of them. Talking about statistics indicators, we can comment the following:

-

profit-factor 1.55 is not bad for the algorithm with Martingale;

-

net profit of 19.7% with a maximum drawdown of 15.98%, which in absolute terms didn’t exceed the amount of profit, means that the immediate goal is met and the robot can be called efficient, though the performance can be improved;

-

average profit trade of 6.93, against the average loss of 7.63, is also an acceptable value which depends on the nature of limit grids with averaging.

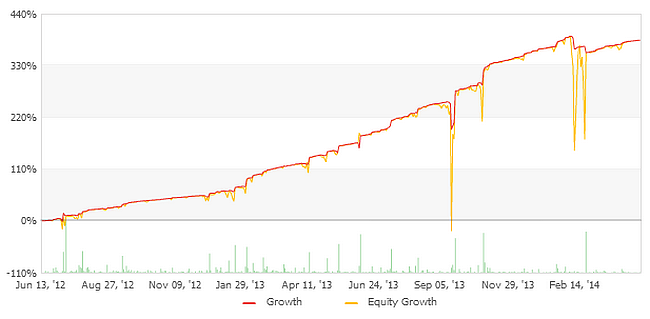

A monitoring of the author’s account is presented below, where trade is conducted with currency basket of EUR/USD, GBP/USD and EUR/GBP pairs:

Without going into detailed statistics, the funds dynamic allows to argue that if the EA had been launched in September 2013, but not earlier, then the deposit would have already vanished. Probably, this result was a consequence of the September FRS decision, but if the developer had used less aggressive parameters, such an outcome could have been avoided. In all other respects, the results replicate our testing with a small imprecision, so we can make a conclusion about the EA efficiency, but with one condition: the conservative money management must be adhered to.

Social button for Joomla