Any experienced trader knows that there are no perfect trading systems and robots out there – sooner or later, the volatility of the instrument changes and a series of losses appears, which means that you always have to work, collect statistics, and edit codes of algorithms.

But many newcomers, due to lack of experience, are obsessed with the idea to find a trading method that would consistently generate profits,preferably without their involvement. The sellers of different strategies and robots take advantage of this naivety by assigning sounding names to their creations, so this publication will review one of them, known as Grail EA.

Finding out how exactly Grail EA works

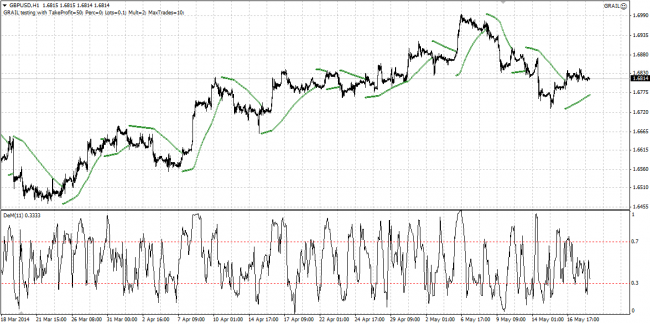

Grail EA is old enough and was written back in 2009 for the GBP/USD pair, using Parabolic SAR indicator at a period of 0.0029 and a maximum of 0.2 in combination with DeMarker oscillator, whose period can be found below in the example of the working window:

To open and maintain positions, the robot uses several types of signals – in particular, it opens a deal to sell at the moment when Parabolic changes direction or DeM touches the upper boundary. The mechanism to buy is reverse.

Code of the robot, despite its age, is still closed, so you won’t be able to change the parameters of signal indicators. We should note that the authors didn’t even bother to create a manual for customizing, probably hoping for consultations after purchase – well, let it lie heavy on their conscience, because what we need is a result. Let’s go back to the main thing: the algorithm contains minimum of parameters, such as:

-

TakeProfit – size of take-profit on a series of orders;

-

Lot and mult – size of the first order and a multiplication factor of each subsequent series of orders;

-

Max Trades – maximum number of deals in a series;

-

Perc – absolutely useless function: in result of experiments, it was found that it doesn’t affect the period between orders, but at a value of 0.01 the initial lot increases arithmetically.

Testing Grail EA and making conclusions

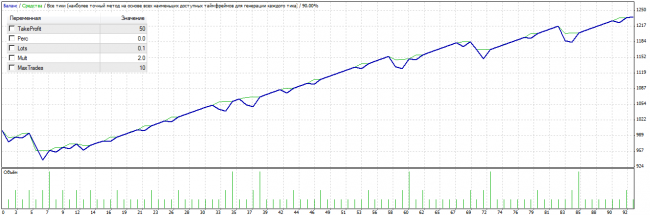

Despite the fact that the robot was originally created for the British pound only, all tests were made on EUR/USD pair in order to find the limit of possibilities, because if the algorithm was “overoptimized” by the developers, the deposit would certainly be lost even on a recommended pair, it is only a matter of time. So, the optimization result for 2013 and corresponding settings are shown in the figure below:

Reviewing the detailed report of the strategy tester, it should be noted that the results for this controversial year are quite good – for example, the maximum drawdown of 10.47% versus net profits of 23.7% and profit factor of 1.93 both indicate fairly accurate entry points that provide an advantage at a distance. In conclusion to the above, we will briefly list the advantages of the Grail EA:

-

easy setup, few parameters;

-

algorithm uses fairly reliable indicators;

-

you can disable multiplication of the lot and work only with averaging;

-

signals are rare, but of relatively high quality.

Of course, there are also disadvantages, main of them being inability to change parameters of indicators and accompany positions with trailing stops built-in to the code. The minor ones are irresponsible developers and non-stop trading, which is expressed in using either Martingale or averaging.

Social button for Joomla