Many traders, especially the beginners, get tired of manual trading and start using robots. Of course, advertising plays a significant role in choosing the algorithm. Often, system and EA vendors hide information about their product until the customer buys it. Profit Hunter EA is no exception, so in our review we will try to find out whether this robot is efficient or you should better search for its counterparts.

The developers call it “a smart Martin”, which should alert a user per se. Do such "Martins" even exist? In order to understand how it works, let’s look at its story and then at the EA itself.

Profit Hunter EA and its built-in trading mechanism

A variation of the "martingale" technique used in the EA is actually not unique, but rather one of the modifications of the old strategy of "Avalanche", with the only difference: instead of aggressive opening orders in both directions, all losing positions gained in the course of work are locked in the entire volume after the last series of orders. Thus, the risk of siphoning the deposit because of a false signal is reduced.

For immediate decision on the opening of the first order in a series, the Profit Hunter EA uses the fractal technology in its basic version. Other modifications use moving averages with different periods.

When configuring, you should pay attention to the following parameters in the main window:

-

Level - level used to set the stop-loss, take-profit and to determine the points for the series of orders;

-

Lock - number of orders, after which a counter position will be opened for the entire volume.

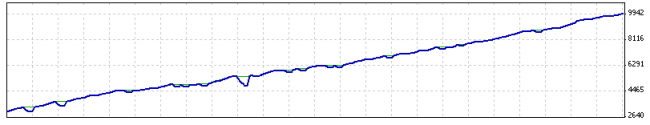

The Profit Hunter EA is recommended for use on GBP/USD pair on the 1-hour timeframe. Among other parameters, we should underline money management rules, which suggest there is a minimum deposit of $3,000 to start trading with recommended 0.1 lot. The result of testing on the author parameters is presented in the figure below:

Summary: Profit Hunter EA and its pros and cons

According to the results of the work done, it can be argued that the algorithm has the following advantages:

-

maximum number of series of orders and their values are determined by the user;

-

initial entry points are correctly defined with high probability;

-

notification of new orders received on email.

The disadvantage of the algorithm is, in our opinion, a totally useless stop-loss, which is set at the opening of the first order, and then just pulls back with opening the new countertrend deals. Under this option, it would have been logical to use a trailing stop, but the developers didn’t feel the need to use such an important tool for managing the positions. This creates an extra load on the data channel, which under conditions of high volatility during important news can lead to malfunction.

Social button for Joomla