Continuing the series of reviews on popular trading advisors we will consider the following robot. The Wall Street Robot Forex advisor is one of the most advanced algorithms. This EA is able to learn new things by itself and has a system of flexible adaptation to a constantly changing market. In first versions the advisor worked on four major currency pairs: EUR/ USD, GBP/ USD, USD/CHF, USD/JPY. Recent versions of the expert work with a slightly different set of tools. Particularly, the 3.9 versions are not available to work with the USD/CHF pair due to the low efficiency of trading on this instrument.

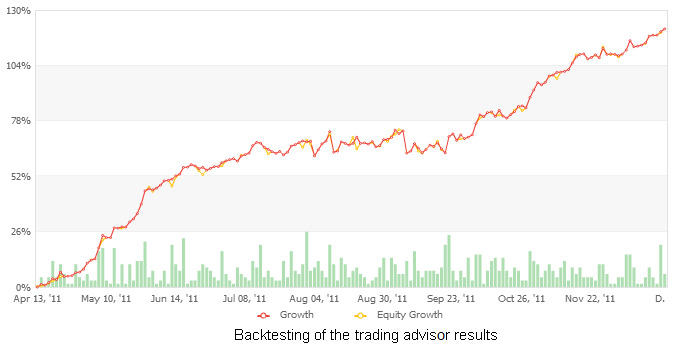

The Wall Street Robot Forex advisor appeared in 2011 first time and immediately became known as the stable and profitable expert. This EA is the 24-hour scalping robot, which works on the 15-minute interval. Some last versions of the expert work with numerous pairs: EUR/USD, GBP/USD, USD/JPY, NZD/USD, AUD/USD. This set of working tools was chosen in the results of multiple backtesting and optimizing. Producers also tried to reduce the risks and set a standard level of stop loss at 30 points. In earlier versions, more aggressive trading with broad protective orders was conducted. Bektesting results are shown on the following picture. As can be seen from the graph, the Wall Street Robot Forex advisor is the strong tool for making profit.

Main parameters of the advisor description

Now let’s go through the description of the basic advisor’s settings and then sum up.

MaxSPREAD is the parameter, which determines the maximum value of the spread, which will allow the advisor to perform the operation. If this parameter is equal to 4 then when the spread is 5 points or more the transaction will not be conducted. This is the very important parameter since the magnitude of the spread reflects the degree of volatility and, the overall risk level consequently.

StealthMode is the option, which is included in many trading advisor and advisor Wall Street RF is not an exception. This is a unique toggle switch, which shows orders-limiters. If the toggle switch is turned on and is in the «true» position the dealer (broker) may lack information about the location of advisor’s orders. Many producers of software for automated trading had to use this trick in order to avoid manipulation on quotes and orders.

AutoMM is the parameter, which manages the size of the position in the EA. If this parameter level is greater than zero then the fixed and fractional money management system will be activated. For example, if the AutoMM is 1, then for every $ 1,000 0.01 lots will be opened. AutoMM_Max adjacent parameter sets a limit on the maximum level of opened lots. There is also a possibility for setting a fixed lot size for all operations regardless of the size of your fund. There is the parameter FixedLots for this option.

MaxAccountTrades is the parameter, which sets the maximum amount of positions in the account, which can be opened simultaneously.

This list of parameters is not complete, nevertheless, I believe that these parameters are the most basic ones. If you set the values of key parameters correctly in accordance with the general strategy, the risk management algorithm will maximize the effectiveness of trade with the balanced risks. The Wall Street advisor is a professional tool for trading, which allows provides traders with an excellent opportunity to increase the fund.

Social button for Joomla