Many traders in the beginning of their career immediately begin to study complex trading strategies, facing the flow of information they simply cannot grasp. Experience has proved that it is much more effective to move from simple to complex.

It should immediately be taken into account that Forex strategies for beginning traders won’t allow you to earn a lot of money, their main task is to teach a beginner to manage capital, understand the logic of price movement, as well as filter out unpromising methods, i.e. create the necessary conditions to avoid losing the first real account in the first transaction.

Grid Forex strategies for beginning traders

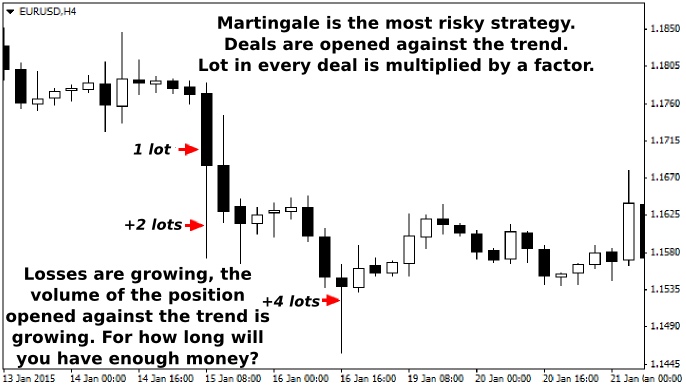

At the beginning of the study of materials on the market, a strategy called "Martingale" can catch your eye, which involves multiplying the volume of each new deal by a certain factor. Quite often the newcomers come to such methods on their own, successfully hitting a multi-year "sideways", but we’ll hasten to disappoint you – it's a straight road to losses.

Even if you remove the factor and leave only a grid of equal-sized limit orders, the result is always the same, only the time of the siphon-off will extend. This is due to the fact that the currency pairs simply have no limits to price changes, they are not stocks or raw materials, where you can find strong support levels and trade from them without any leverage.

Another "generator of instability" in the currency market is central banks that break down all the technical picture with their intervention and unexpected decisions. An example of such a situation would be the story with the Swiss franc on the January 15, 2015, when after the decision of the SNB, the franc strengthened against the dollar by 2,910 points (on a 4-digit), or 28.5%, over a half hour.

Therefore, Forex strategies for beginning traders should be built in such a way as not to increase the risks of such pulses, but convert them into advantage, and the "stop" grids may be mentioned here, which are based on three simple rules:

- All transactions are opened only by the trend with buy-stop and sell-stop pending orders;

- Trading is conducted at a minimal volume with leverage 1:10;

- Orders are opened from each other at a distance of at least 120 points (for the EUR/USD pair).

Take-profit for each order is set at the level of the new period opening, after achieving which we place a new stop order instead of the triggered one, but in the opposite direction. For example, if the price starts to grow in the above example, after working out the first buy-stop by take-profit, the grid will change as follows:

After one of the orders got "frozen" at a loss, we don’t do anything with it and wait until it’s triggered. We should remind you that conservative money management rules in this case allow to withstand any drawdowns, and the result of all transactions will be positive in the distance. If the total profit accumulated on the account is impressive, you can close all unprofitable orders and start building a new grid from scratch.

As a result, the mathematical Forex strategies for beginning traders serve three important functions: first, they teach how to manage capital and risk, secondly, they allow to obtain experience of making transactions on real accounts, which removes a lot of psychological barriers, and, thirdly, the stop grid brings a small but steady income – what else is required in the teaching process?

Trend Forex strategies for beginning traders

After mastering the stop grid that clearly shows that you can only make money on the market by the trend, it makes sense to explore strategies aimed at finding medium-term trends. At the time, Alexander Elder devoted several books to such procedures, where he describes the basic approaches of work in the direction of the current trend in detail.

For example, the famous "Three Screens" work perfectly on any market including Forex, but Elder’s method is not suitable for those who has just knew about the market, as it requires basic knowledge of technical analysis, which is better to get in practice. And here an elementary strategy called “EMA 8/18" can help.

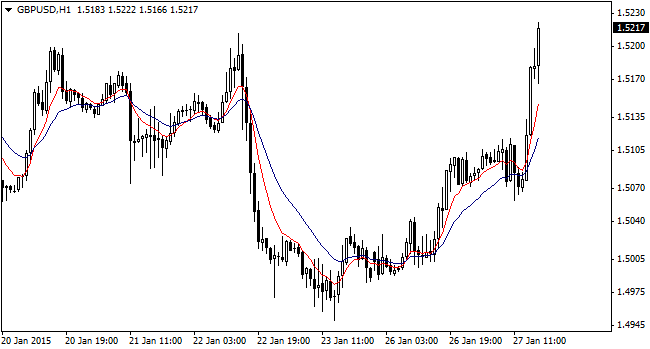

It is based on two exponential moving averages (calculation formula and the description of the indicator can be found in the menu of the MT4 terminal: FAQ – Technical Analysis), built on the 8 (hereinafter EMA(8)) and 18 (the EMA(18)) candles respectively.

As with all Forex strategies for beginning traders, EMA8/18 was designed for the most popular currency pairs (the so-called "majors") and the author recommended using H1 as a working timeframe. Let us remind you that H1 is the best timeframe, on which the amount of noise is much lower as compared to smaller periods. Of course, the signals on this timeframe are received not often, but the probability of working out is quite high.

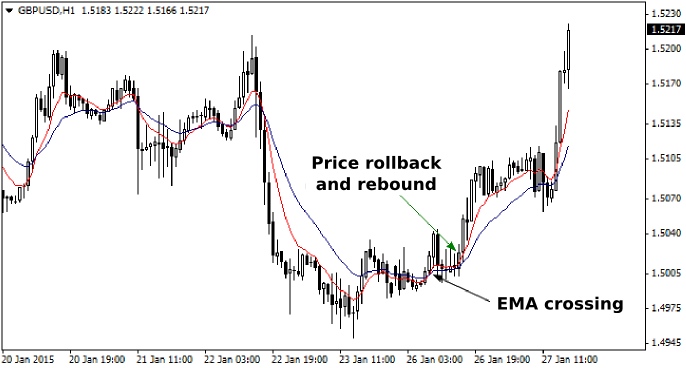

The figure above shows a classical system signal. It is not hard to guess that the deal to buy is made after EMA(8) crossed the EMA(18) upwards, then returned (rolled back) to the EMA(18) and rebounded from it again. The rules for the deals to sell are completely opposite.

Originally, the author recommends trading on the rebound not from the EMA(18), but from the EMA(8), however after a series of tests on several pairs it became evident that the number of false signals that lead to the triggering of stop-loss is greatly increased in such tactics.

Speaking of the stops, the author sets the fixed stop orders of 35 points, but we do not share this approach, since if the volatility changes (for which there may be infinitely many reasons, ranging from central banks’ decisions to geopolitics), the strategy will start to slowly and surely siphon-off the account. On the other hand, the stop may be unnecessarily large.

Alternatively, you can use the ATR indicator built in the standard package of any terminal. Its full name is "Average True Range", and it is designed to objectively assess the volatility on the market, so it’s enough to specify the period of calculation in the settings and obtain the recommended stop level.

What else you should consider when choosing Forex strategies for beginning traders

Very often novice speculators begin to study Price Action immediately, having read the materials telling about the dangers of indicators. In fact, you should not rush, as even during the study of indicator systems, the memory will accumulate experience and different price situation from the past.

Also, the experience shows that the Price Action is rarely used in its pure form: as a rule, experienced traders combine the classic trend tools (moving averages, channels and tangents) and patterns, so Forex strategies for beginning traders are no exception.

If you still want to learn how to "read the net chart," you can complement the EMA8/18 strategy with such patterns as Pinocchio, Doji, Hammer, Star and Three Soldiers. Detailed description of some patterns can be found on our website in the "Forex basics" and "Trading strategies" sections (by the way, you can also find other simple strategies for beginners there). Source: Dewinforex