Prices in the Forex market are formed by the actual supply and demand. Efficient Lucky 5 strategy on a grid of pending orders uses the strength of "00" price levels, based on the logic and psychology of crowd behavior.

Naturally, men want to simplify everything, and the financial market is no exception. Mass thinking of the players always rounds prices and reaches for the key time points. This allowed to create a whole family of psychological trading techniques, and the Lucky 5 strategy is one of them.

Levels of elevated price activity (danger)

00 price levels refer to levels that are multiples of 100. This means the price of the *.**00 kind (1.3500, 1.6100, 0.9200) – the price with two zeros on the end in the case of 4-digit quotes, or ***.00 (138.00, 140.00) for the 2-digit quotes of the yen pairs, or in case of the 5-digit quotation – (*.**000) and 3-digit (***.000) in pairs with the yen.

Such basic price levels are the most attractive from the point of view of human psychology. They become the battleground for bulls and bears, regrouping and reallocation of resources often occurs there.

The fact that the market is almost always fighting off the "00" price level means that it is at this price the buyers/sellers establish a temporary balance. Round figure price levels are also an obstacle to rapid news movements and often act as strong support/resistance.

As a rule, prices at which the large foreign exchange or options are set are "00" levels. By the time of expiry (closing), the optional price of the instrument tends to catch up with the price of the spot market, so the presence of large options causes speculative price jumps in the area of basic prices.

Large marketmakers also take this information into account and when prices approach the "00" level, the volumes and number of transactions from their side increase sharply. They create artificial protection at 00 levels, and to enable a financial instrument to overcome such a price, you need not only strong fundamentals, but also the psychological desire of market participants to move to other trading levels.

Lucky 5 strategy: characteristics of the trading system

This technique is based on working out the actual trading impulses on the basic price levels with simultaneous filtering them on higher timeframes, using small trailing stop to transfer transactions to breakeven with a minimum profit.

Frequent loss is the main reason for the beginner’s panic. Triggering 2-3 stop-losses in a row is enough for a novice trader to get disappointed in their strategy and go in search of a new “grail”. The Lucky 5 strategy allows if not eliminate then at least minimize the stops triggering in trading and gives you up to 70% of profitable deals.

Basic conditions of Lucky 5 strategy

-

Trading terminal: Metatrader 4 (was also tested on cTrader).

-

Currency pairs: any pairs with high ADR (AverageDailyRange or the average daily price range): EUR/JPY, GBP/JPY, GBR/USD.

-

Timeframe: any (optimal for pairs with GBP and the Yen pairs is M15)

-

Trading period: Frankfurt, London and the beginning of the American session (no more than two hours after the New York opening).

-

Broker with fast execution of orders and the possibility of trailing from 1 point.

The method of the trading system operation

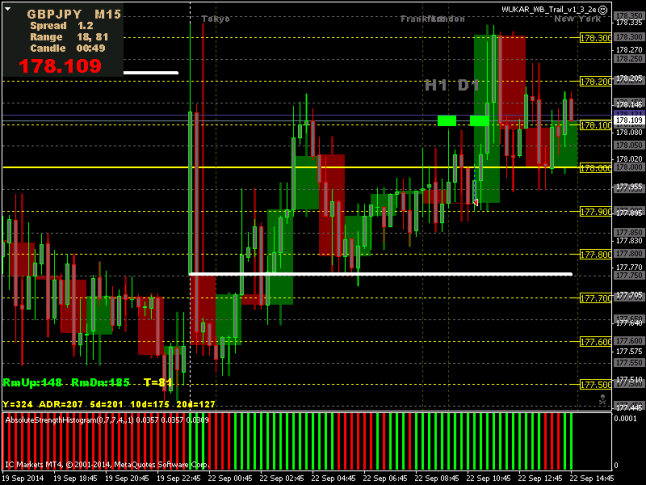

Every hour we set pending orders on price levels: *.00, *.10, *.20, *.30, *.40,*.50, *.60, *.70, *.80, *.90. We get approximately the following picture:

We trade only if the direction of the last hourly candle (H1) coincides with the direction of the daily candle (D1). Open orders strictly in the direction of the candle.

Setting: take-profit – 5 points, stop-loss – 10 points. When the first order is triggered, we manually transfer the order to breakeven after 3.5 - 4 points of profit. Only trailing stop works further. No additional indicators are commonly used.

The author of the strategy recommends to stop trading at getting 10 points of profit, but this is up to the trader.

Important recommendations when trading under Lucky 5 strategy

-

At the time of Frankfurt opening, set only *.40 *.50 *.60 levels.

-

Never sell at *.10 and never buy at *.90.

-

When trading, monitor ADR: there should be a distance of more than 10 points to the borders of the price range.

-

No trading 1 hour before and half an hour after the release of important news!

-

If the price has already passed the boundary of the average daily range, no more deals are opened that day.

-

We trade only on the first intersection of the level.

Sometimes, the template of the Lucky 5 strategy comes with an additional "basement" indicator ASH (AbsoluteStrengthHistogram), which acts as an additional filter. Trading orders should be set if the color of the indicator bar chart is the same as that of the daily and hourly candle. ASH readings help ride out the possible temporary rollbacks of the price if the order was triggered before the deal was transferred to breakeven.

Indicator bar chart allows to accurately identify the prevailing direction.

How to work at price levels of elevated danger

It should be understood that the levels of activity and accumulation of mass are visible to market makers, so often the price a little, only by 1-2 points, fails to reach the "00" level and reverses. In addition, requotes at the levels with lots of orders often lead to serious losses.

Therefore, it is recommended to put pending orders at the price 1-2 points above / below the "00" level.

Levels *.20,*.50,*.80 are also considered the levels of elevated activity (and danger) for intraday trading. Psychologically, a person perceives *.50 level as half way between adjacent baselines. Accordingly, the levels of *.20 and *.80 are perceived as marginal values for fracture toward a certain level, so-called "two steps to a new target."

Advantages of the trading system

-

Simple trading logic, comprehensible even to a beginner.

-

Lack of delayed signals and a plurality of additional indicators.

-

No need of constant monitoring: market analysis takes a few minutes per hour.

-

More than 70% of the deals opened under this strategy are closed with profit.

-

Work of open orders is controlled automatically.

-

Low chance to trigger stop-losses in full.

Disadvantages of Lucky 5 strategy

-

High level of stops compared to take-profit.

-

High requirements to trigger orders and trailing process.

-

You can’t trade during the periods of speculative volatility.

The Lucky 5 strategy is an interesting option of trading low-volatile pairs within the day, relying solely on mathematical logic and psychology of market behavior. TS does not require constant monitoring of the market and is recommended for both beginners and experienced traders with an average level of risk. Source: Dewinforex

Social button for Joomla