As you might guess from the name, a Three Candles strategy is based on the eponymous pattern from the Price Action method, so it perfectly combines simplicity, efficiency and versatility, since such models work in any market.

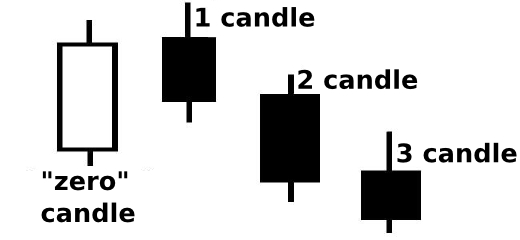

Textbooks and thematic publications mention the “Third Candle” pattern under different names, since the freedom of expression has not been canceled, and there is no single course on Price Action, the copyrights to which are owned by just one person, in any case – the essence does not change with the name and this model visually represents the following sequence of candles:

Similar patterns are “Three Black Crows” and “Three White Soldiers”, but if in these patterns a lot of attention is paid to the opening prices of each bar, the pattern “Third Candle” provides more freedom of action and imposes fewer restrictions.

Three Candles strategy and basic rules

So, the starting point for all further actions will be the formation of two candles, namely, if an upward trend was observed before the key point, the bullish candle should be replaced by the bearish, with a higher high, and if there was a downward trend for some time, the bearish candle should replace the bullish, updating its low.

Thus, the considered candles pattern is a classic reversal pattern, which is aimed at finding a new trend, but in this case we are interested mainly in the last candle, rather that the whole trend, which can be formed after the model has appeared.

The logic of such a solution is simple: it is better to take a short pulse with high probability, than to constantly be in tension, which is especially important on the timeframes smaller than H4. On the other hand, if the Three Candles strategy is used on "dailies", you can try to use a trailing stop with a filter by H4.

But this is a special case, so today the emphasis is on the hourly charts, as, in our opinion, it is the best timeframe where signals regularly appear, with their quality, i.e. resistance to random fluctuations, remaining at an acceptable level. Once all organizational issues are taken into account, the orders are opened by the following instructions:

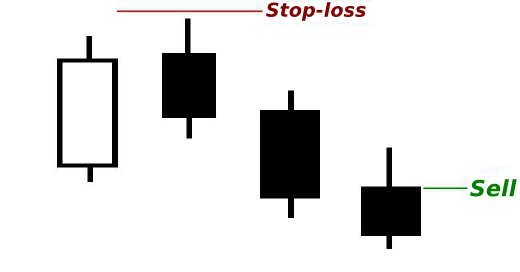

- The deal is opened at the opening price of the third candle;

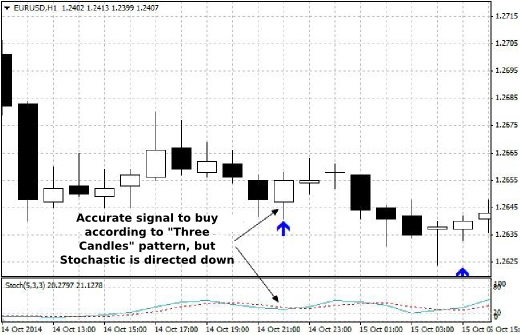

- We set a Stochastic oscillator with settings (5;3;3) as an additional filter on the chart, and if the Stochastic lines are directed upwards, any signals to sell, even the most reliable ones, are ignored. If the Stochastic lines are directed downwards, the buy is banned;

- The second candle should be of medium size, i.e. not too big but not too short. Of course, these estimates are relative and depend on the experience of the trader, so the beginners can simply calculate the average range of the candle for the period and use it as a base. We won’t focus at the calculations in this publication, as there is nothing complicated here, especially since there are many specific indicators for these calculations.

Three Candles strategy and support of the positions

One of the advantages of the system considered today is strict rules for the installation of stop-loss, which is always placed behind the high of the first candle. Thus, whatever happens, no matter how market volatility is varied, a trader at any time knows their risk.

Speaking of stops, if the potential loss exceeds the average range of candles twice or more, then the transaction by the system should be abandoned. One may argue that a Doji can form there, which is a crime not to use. Well, yes, this situation is not uncommon, but in this case the trader must trade Doji, i.e. a completely different pattern with its own rules of construction and identification.

As for the profit taking, the Three Candles strategy provides several options ¬– in particular, the authors advise to set take-profit either at your own discretion, or exit the market at the close of the last candle of the pattern. If the second option is more or less adequate and logically justified, the first recommendation again requires experience and knowledge of the instrument, so it can be fatal for beginners.

In addition, it is necessary to take into account two other reservations: firstly, if within five candles after the opening of the order the price has not determined the direction, it is recommended to close the deal; and secondly, before the release of important news, such as the Nonfarm Payrolls, GDP, the volume of production, consumer price indices, the signals should be reasonably ignored. The authors of the strategy recommend to wait 30 minutes before and after the release of statistics, but it's best to wait at least 2 hours.

Three Candles strategy in examples

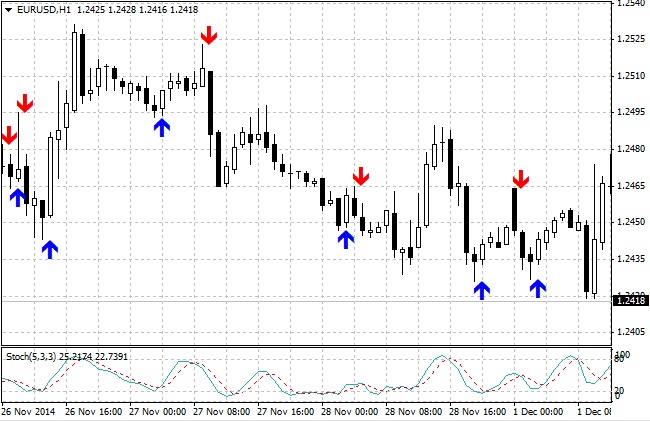

In order to simplify the process of search for signals, we recommend to find an indicator called 3rdCandle. Although it works not entirely correctly, as it also displays patterns which high (low) of the first candle has not updated high (low) of the zero candle, thus focusing only at the "color" of the bars, it is still much easier to analyze the ready-made sample rather than search for all the signals on a clean chart. The figure below shows an example of how the working window should look like:

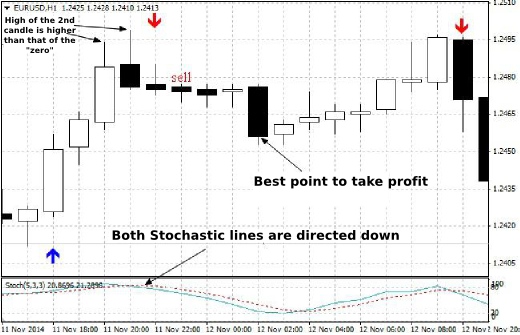

We’ll traditionally start with the quality signal, which the Three Candles strategy is able to generate. The following figure shows a classic situation – a high of the first candle was formed above the high of the previous bullish one, the Stochastic lines are directed downwards and the potential stop-loss does not exceed reasonable limits:

It can be seen on the following chart that the Stochastic has filtered out the losing trade. In this example, the pattern "Three Candles" was formed as expected, the low of the first candle was below the low of the zero bar, but the Stochastic lines were directed downwards, indicating that the market is not over the bearish wave yet.

And the last image shows a situation we specifically chose, where the strategy has generated a false alarm. It would seem that all the conditions have been met, but since the losslless Grail does not exist in nature, sooner or later the trader will have to manually close a position, or a stop-loss will trigger.

The main strengths of the considered strategy

Nevertheless, the Three Candles strategy appeared surprisingly robust, because it was hard to find an example of a losing trade at backtesting for educational purposes. This circumstance is a major benefit of the algorithm – accurate signals on the timeframes from "hour" and bigger are rare, but are processed with high probability.

In addition, it is easy to write the EA under this algorithm, which is a rarity for a class of strategies based on the Price Action patterns. This is due to the fact that unlike other methods that require subjective judgments from the trader and synthesis of several patterns, the system considered today is fully formalized and uses candlestick patterns only when opening orders. Source: Dewinforex

Social button for Joomla