Stable successful trading is the dream of every trader. Williams’ fractal strategy offers mathematically accurate signals to the entry and increase of positions, and specific method of exiting the market, sensitive to price movements, allows to close in the last phases of the trend, capturing not less than 80% of the movement.

Criticism of Bill Williams has long subsided, after his method of structural analysis of the market has proved its profitability. Market phases were suggested to study in five dimensions:

- space (fractal);

- energy (market strength);

- velocity (momentum);

- area (overbought/oversold);

- balance lines.

Williams’ fractal strategy is based on working out of the two signals from this scheme of fractals and balance lines. After the first opening on the fractal signals, the volume can be added to the position after the appearance of an additional signal of the remaining three dimensions. This makes it possible to take the maximum profit from any trend movement.

The principle of operation of the strategy and basic requirements

Basic tool of the technique is fractals that show the beginning of the price pyramid and the entry signals. A combination of moving averages called Alligator by the author is used as an indicator of the direction and strength of the trend. Its task is to estimate the significance of fractals and determine the levels of StopLoss. Three Alligator lines are balance lines for a greater time period.

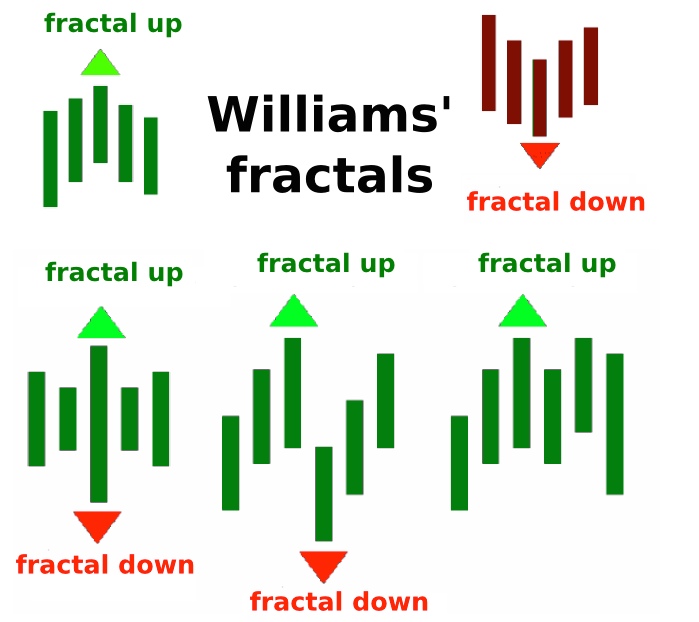

Candlestick combinations for the emergence of Williams’ fractals:

- up: set of 5 (at least) consecutive candles, where the average has the highest max;

- down: combination of 5 (at least) consecutive candles, the average of which has the lowest min.

The number of bars is not regulated, and it is not necessarily, for example, that the max of the following candles declined steadily for the up fractal, or min of the central bar was above the rest. That is, fractals can also be considered as non-standard combinations, such as:

If two (or more) bars in the construction have the highest max, only the last one is taken into account for trading. Situation is similar for down fractals.

Surge of the prices by at least 1 point outside the fractal limits upward is considered the breakthrough of the sellers. Similarly, the breakthrough of the price by at least 1 point outside the fractal limits downward is considered the breakthrough of the buyers:

Important: historically, the theory of fractals was created for the stock market, which has a different structure, driving factors and tactics of the players. Therefore, fractals in Forex strategy should be used only in conjunction with trend indicators.

Installing and configuring the indicators

The Williams’ fractal strategy uses standard indicators. A built-in indicator Fractals with default settings is used to find fractals. Arrows of the indicator define the found fractals and do not repaint. The Alligator indicator is usually used with default settings, but allows customization.

Use of the strategy in trading

Strategy can be used in two ways.

Option of the Williams fractal strategy without the Alligator is more risky

You can trade on any currency pair with an average volatility, desirably with a penchant for sustainable trends: EUR/USD, AUD/USD, GBP/USD. We perform analysis at the opening of the current day on the chart D1:

If the up fractal formed, we open a deal to sell at the opening of the day, if the lower one – to buy. You can open with the market or set pending orders:

- to buy – BuyStop is 2-4 points above the max of the second candle from the key fractal.

- to sell – SellStop is 2-4 points below the min of the second candle from the fractal.

Stops and take-profits in this case are generally not used; at the end of the day the deals are closed manually, but if a new fractal is not formed (the trend continues), it is possible to hold the deal or enter again. Stop is still recommended to set behind the level of the key fractal. Please keep in mind that 1-2 candles after the key bar shall not be taken into account, because at the time of appearance of the indicator arrow they have to be closed, i.e. the entry is performed on the 2nd-3rd candle after the fractal.

Important: a significant portion of the trend movement is lost in waiting for the "appropriate" fractal. This strategy needs a serious deposit.

Option: Williams fractal strategy + Alligator

Trading instrument: medium-volatile currency pairs: EUR/USD, GBP/USD, AUD/USD, USD/CAD, USD/CHF; futures – on the periods of D1 and above.

Timeframe: for analysis and search for the entry point – M15, for support of the transaction – from H1 and above.

Trading time: European/US sessions. Before/after/during the news release – no entry. Control of transactions before the night session is required.

So, the strategy gives a signal to open a position to buy if:

- price crosses the Alligator lines and the breakthrough candle closes above;

- fractal up is formed.

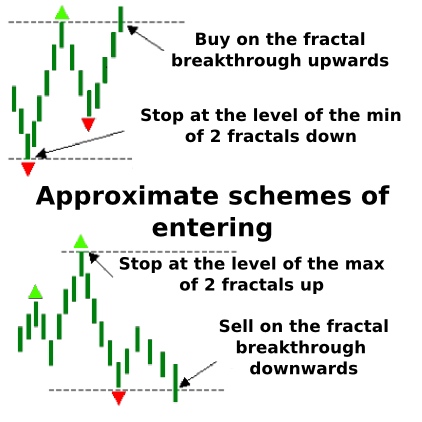

We place a BuyStop order 2-4 points above the closing price of the candle that formed the fractal. Close the deal at the reverse of the price (breakthrough of the Alligator red line downwards and closure of the candle below it), or by take-profit.

Conditions for opening a position to sell:

- price crosses the Alligator lines and the breakthrough candle closes below;

- fractal down is generated.

We place a SellStop order 2-4 points below the closing price of the candle that formed the lower fractal. Close the deal at the reverse of the price (breakthrough of the Alligator red line upwards and closure of the candle above it), or by take-profit.

Important: Williams’ fractal strategy implies that until the reserve fractal has formed, the trend continues and the transaction can be held. You can also close the deal at the formation of closed candle in the opposite direction.

Stop-loss by this procedure is set at the most remote extreme of the last two opposite fractals: to buy – at the lowest of the last 2 fractals, to sell – at the highest.

Important: to make a decision about the deal, the direction of the Alligator and the location of the fractal are equally important. The transaction at the breakthrough of the fractal upwards opens only if the fractal is above the Alligator's Teeth, the transaction to sell – if below the Alligator's Teeth.

If the Alligator lines are intertwined, i.e. there is no trend in the market (flat), then we ignore the appearing fractals and don’t open deals until the trend with a fractal manifests itself below/above the Alligator.

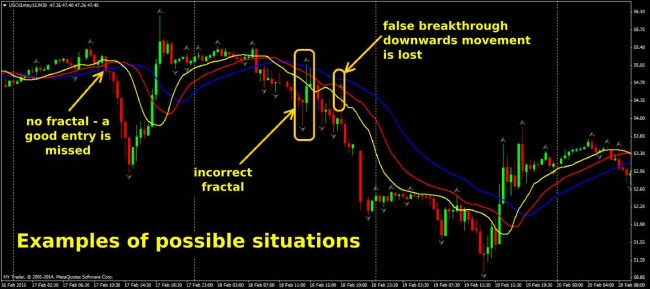

In market conditions, the formation of "false" fractals and "false" breakthroughs is possible – besides, the expectation of the "right" fractal under the Williams’ fractals strategy leads to the loss of good entry and a strong movement.

The longer the period of consolidation, the stronger the subsequent movement – you can set the pending orders on the breakthrough beyond the boundaries of small fractals.

So, as a conclusion...

First of all, a few tips from the author of procedure:

- never trade against the Alligator;

- when the Alligator exits the hibernation, the first signal will be the appearance of a fractal;

- at the open position, you can use the red line of the Alligator as a dynamic stop;

- after 5 green or 5 red bars in a row appear, you need to move the stop on the level of the previous extreme;

- when you close positions by stop, we reopen at the first appropriate signal in the same direction.

In general, the Williams’ fractal strategy is quite simple, but quite completed and profitable. You only need to familiarize yourself with the classification of fractals and not to violate the basic principles of money management and techniques in trading. Source: Dewinforex

Social button for Joomla