Among traders using advisors for trading on the FOREX market is very popular as a counselor ILAN, of him will be discussed. You should start with the fact that the adviser ILAN not automatic and mechanical, that is necessary to control the part of the trader. Advisor ILAN designed for short-term trade based on the exchange rate fluctuations in the market FOREX. Open transaction advisor closes itself when a certain level of profit (profit target). Stop-loss in this strategy are not provided. What does the advisor to the side of the trade? To display the losing trades into profit mechanism applies adaptive averaging the total position.

The main feature is the adviser ILAN direct relationship between profit and risk. When working with low-risk income of 10 - 20 % per month, if you are willing to go to greater risks of profit may reach several thousand percent per annum.

The principles of the EA ILAN.

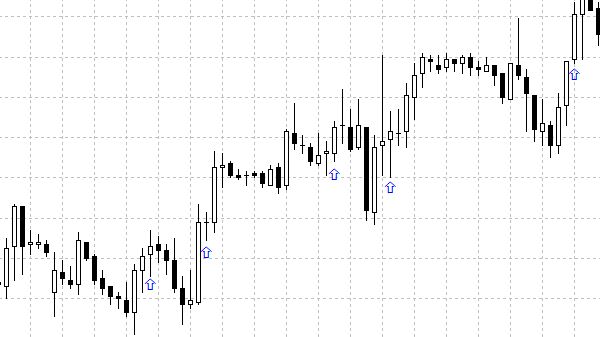

Standard version adviser trades on the charts with the timeframe H1 (1:00). EA opens the transaction at the beginning of each new hour, and the condition should be observed that there are no other transactions open to the advisor.

The deal for the BUY: Opens if the closing price of the previous hour is higher than the closing one hour back.

The deal for SELL: Opens when the closing price of the previous hour is lower than the closing one hour back.

As you can see, the principle of open trades is simple, and who said that the strategy to be difficult? This approach ensures the uniformity of the EA, except for periods of waiting for the signal to the input. The main task of the adviser does not determine the best entry point, and the management has open positions.

In version adviser ILAN 1.6 entry conditions have become more complex, instead of this change and the timeframe in which trade is conducted.

After opening a position, set take-profit and stop-loss level, defined in the settings advisor. And the level of stop-loss is always higher than the initial take profit. Such a move has been made in order to give the market room for small price hikes and possible noise. If the price reaches the level of take profit before the stop-loss level, the transaction is closed and fixed income.

If the opening price of the transaction reaches the stop-loss at this level will open another transaction in the same direction. Since forming the aggregate position for which is determined by the weighted average opening price, which by definition is much better than the opening price of the first transaction. What if we are faced with change in the overall trend and when it will unfold is unknown? - You may ask. ILAN Advisor feature is that for profit does not have to wait for a turn! Enough to wait for the formation of any significant correction of a new trend to take profits on the total position - because its average price is much closer to the current market.

This strategy is known as well as the average position, it can often be used only by banks, large investment funds and large investors, as needs a large enough capital to wait for correction or reversal.

Advisor ILAN allows investors to use this strategy even with small capital. First of all, thanks to the use of exponential change in volume for the second and subsequent transactions aggregate position (that is, with each new deal increases the amount of the transaction), and secondly the use of leverage the investor makes a deposit more capital, which is also one of the requirements of the strategy.

As a result, an advantage the strategy include:

- The ability to adjust gain, depending on the level of risk.

- Permanent work, every hour a new deal.

- The strategy is simple and straightforward.

On the downside:

- There is no limit losses.

- You must have substantial capital.

- Self-closing of the transaction - need to constantly monitor the market.