Beginning of the week did not bring with them any significant movements in the currency markets. Trading activity on the first day of the week was slightly above the average for this period. There has been some different trends among the major currency pairs. The fact that some couples who traditionally have a high degree of correlation, went in the opposite dealers attributed to the fact that the participants were guided by the local trend of the fundamental parameters. Good data on the business activity of the Eurozone could not keep the European currency at the highs on Friday. As a result, a pair quietly slipped into the close. News flow today will be mainly from the European region.

Having started trading with a mark of 1.3270, the euro commit attempts to get closer to the local level of resistance at 1.3, but this time to pass this barrier bulls failed. Closure of long positions in the area led quotes 1.3230 . The pair is currently trading near the 1.3260 level. Participants expect economic data for the euro area, among them - the consumer price index (05:00 - U.S.), preliminary data on changes in GDP (05:00 - U.S.), etc. Any weakness in the reports on the economy of the region can be used for speculative play on the dollar increase.

Long-term technical picture in EUR/USD has not changed for a long time. District 1.34 remains a key resistance. If the euro-bulls can not just go through it, but also firmly solidify the game to increase the dollar will have to wait until fall. But while the neutral-negative scenario in the pair remains in force. Level of 1.32 is local support, the passage down which can cause active open short positions on the euro. Protective stop loss orders to this case, optimally positioned just above the 1.33 level.

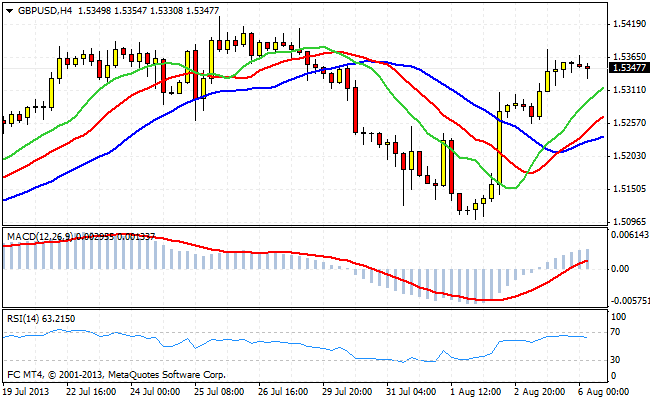

GBP/USD a bit stuck on the way to 1.54 and is in phase flat correction. Probability test zone 1.54 - 1.5430 in the next trading session high. Bears on the pound took a wait and wait for the right moment to resume the game at the slides. The reason for the short-term strengthening of the British pound, according to some analysts, are good indicators of the index of business activity in the services sector. The emergence of reversal patterns close to the level of 1.54 can open good opportunities to play on the drop pounds with an attractive risk-reward ratio.

Good luck trading!