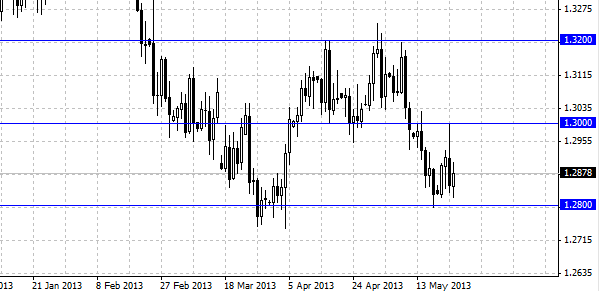

EUR/USD pair was working on its technics on Wednesday. You can see that the pair was moving towards the level of 1.30 and it meta strong resistance there. In a weekly review we assumed that the market would experience difficulties when moving higher than this area, but we have to acknowledge that we are surprised how precise was our assumption. 1.30 level is a strong resistance, but Be Bernarke’s remarks helped to keep the pair from following growth, he did not exclude the possibility to begin removing the politics of quantitative softening during the following several months. It is not important because the following movement of the EUR/USD pair is uncertain.

The summer months are coming and the financial activity is lowering, most likely will move the European currency in a side movement, if there are no important changes. By analyzing the graphics it is possible to say that yesterday’s candle is very bear like and this pair is characteristic for its lowering pressure. The area of support of 1.2800-1.2750 is still the strongest obstacle for the following lowering of the pair. However, we see EUR/USD pair at lower levels, than now. By taking into account the above mentioned information traders should follow this pair. But they need making the deals on EUR/USD is not the best idea, currently this market does not look friendly.

The trading of US dollar looks optimistic and that is why we advise to buy it against other currencies. Great opportunities are opened at the moment by USD/yen pair, yesterday it made a fake breakdown of 103.00 level, after which it lowered quickly up to 300 points. This behavior is like a correction after considerable growth, USD against yen is a great investment. One should look at local minimum and technical levels, reaching of which gives a great price to enter the deals, first of all it is a level of 99.95, provided the aggressive style of trading the traders can consider entering the longs at the level of 101.26.