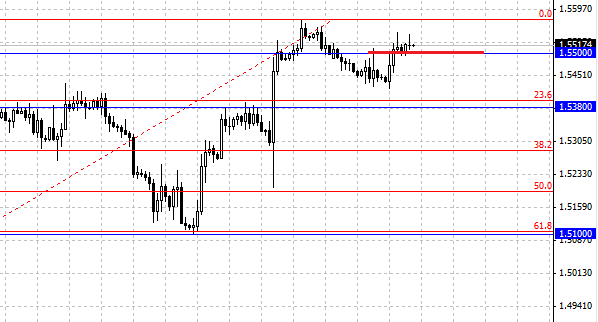

The British pound rose above the level of 1.55 . The main drivers of growth were the MPC protocol and data on the labor market. After yesterday's publication of the UK economic data, opinions, currency analysts leading banks on the future of the pound was divided. We present some of them:

Standard Bank: investors underestimate the potential improvement in the UK labor market. We expect to reduce the level of ILO unemployment rate to 7.6 % by the end of the year and further strengthening of the pound.

Morgan Stanley: strong data and a tough stance MPC should support the pound/dollar in the short term, but the decline below 1.5435 dollars can cause a rapid drop to 1.5240 dollars. We recommend selling the pound on the rise, and do not expect a sustainable up-trend on it.

Scotiabank: Short-term indicators suggest further growth of the pound/dollar, but as long as the pair fails to break above the 200-day MA (1.5527 USD). In general, we expect the bearish end of the year to 1.45 dollars to outpace the recovery in the U.S. economy.

Societe Generale: strong data and a tough stance MPC should support the pound/dollar in the short term, so we recommend buying the pound/franc and the pound/yen. The data on the labor market have a much greater weight than the protocols MPC.

BTMU: strengthening the capacity of the pound is limited, as the Bank of England may take measures to prevent the further growth of short-term rates in the United Kingdom, which will reduce the attractiveness of the British currency.

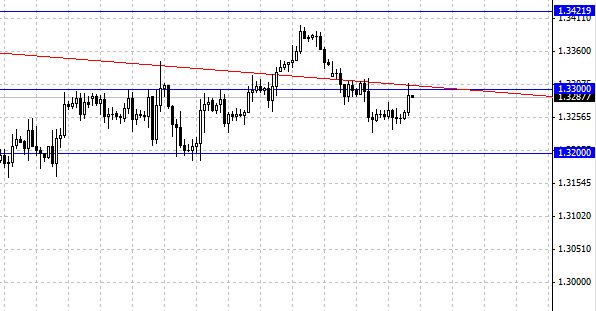

On Wednesday, the EUR/USD pair dropped, coming strong economic data on GDP were unable to stop the fall. As it became known, eurozone GDP in the second quarter increased by 0.3 % compared with the previous quarter. Compared to the same period last year, GDP Monetary Union fell by 0.7 %. The results were better than expected by experts who predicted the growth of the first indicator by 0.2 % and the fall of the second - by 0,8 %. The most significant increase in GDP was recorded in Germany and France, which are the largest in the eurozone. The German economy grew by 0.7 %, while experts predicted growth of 0.6 %. The pair EUR/USD rose to 1.33 resistance area. Maybe it's a delayed reaction of market participants on positive data from the eurozone. Level of 1.33 will curb euro, and most likely we will see a rebound and the further decline of the European currency.