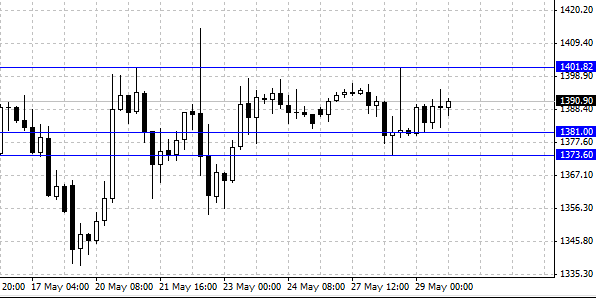

XAU/USD pair is in the side movement, upper bound is at the level of 1400 and is restraining growth of gold. Yesterday trade was not different from the previous 9 days. The pair reached 1401.81 level, but afterwards it retreated to the level of 1381 – which is currently a local minimum. American data demonstrated that consumer confidence index has grown to 76.2 from 69, as shown in report from S&P's, real estate price index grew by 10.9%. On the one hand we see bull pressure from stock market that has grown in power, low expectations of inflation all over the world and great economic data from the USA, and on the other hand precious metals find support due to increasing demand, which is formed by Asia and Central Banks, after lowering of the price of assets by ¼. That is why traders should wait a little bit while the market gives signal for closure of this hard market. The key levels in near-time outlook are 1400 and 1373.60. The breakdown of the level of 1400 and keeping it higher on a 4- hour graph will be a good signal for bulls.

If that happens, we think that the pair will grow to the level of 1442. On the way to this goal one should expect resistance near the mark of 1411 and 1430. However if the bulls increase the pressure and the price drops lower than support at the level of 1373.60, then the most important aim will become a level of 1360. If the support at the level of 160 breaks, then bulls playing against gold growth will face a problem at the level of 1354.50, the base of recent consolidation.

Social button for Joomla