EUR/USD in expectation of FOMC

EUR/USD pair grew in price during the last week and it was able to consolidate higher than the level of 1.33. However, our graphs demonstrate the line of resistance which should implement the pressure on EUR/USD pair closer to the end of the week. There are several candle-hummers on a daily graph in succession, thus we assume that the next week will be a Euro week. Undoubtedly, the market is expecting the Federal Reserve system press conference, which will happen in the second half of the week. The results of the meeting will determine the destiny of US dollar, whether the chairman of the DRS announces a program of quantitative easing or no. But we consider that the traders will prefer waiting for the closure of the candle on the day of the press conference. However it is obvious that one should buy EURO higher than the line of tendency and sell it lower.

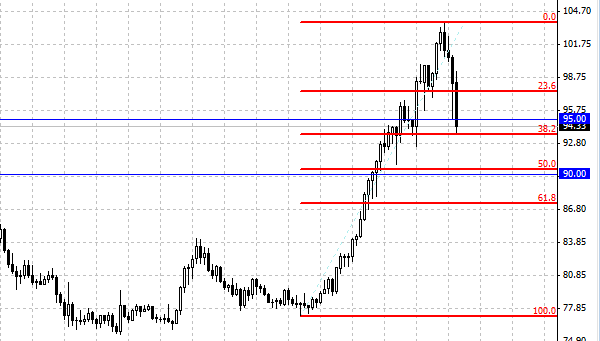

Fibonacci numbers and USD/JPY

This currency pair brought headaches to many people within past weeks. But if we look at its full movement even this extreme sale with the discount reached the Fibonacci level by 38.2%. Taking into account the fact that the level of 94 is till on and it impeded the following fall, we assume that there is a support forming at this level on the market. Unfortunately, there is no technical level to start buying, except for believing in the level of renewal of Fibonacci by 38.2%. Traders should watch this area on a daily graph and to look for opportunities to enter. The level of 90 coincides with the level of 50% rehabilitation Fibonacci, and we assume that this is the level at which the Japan Bank can start acting, if the pressure on the USD/JPY pair towards lowering continues.

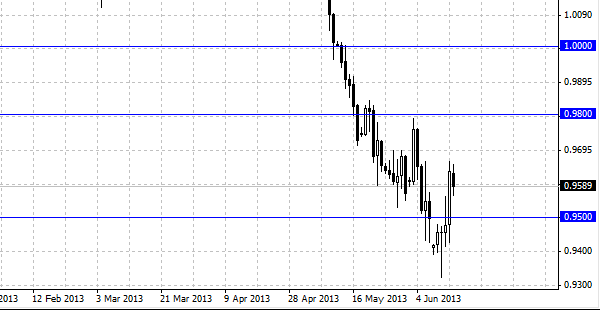

AUD/USD passes into a side movement?

AUD/USD pair has had a positive week, at the end of which the pair was capable of closing higher than the level of 0.95. Such rehabilitation of the pair looks like a beginning of the side movement, instead of major deployment. The upper level of the diapason can be represented by the level of 0.98 because the line of resistance is there, the lower border will be near the level of 0.94. We tend to assume that the overall tendency of the AUD/USD pair remains descending, and the movement of the pair lower than the level of 0.94 will open the way to the strong support level of 0.90, many analysts also think that this level is the closest aim for Australian dollar.