After a long decline, the European currency on Thursday showed growth. Economic data from the U.S. were better than analysts' forecasts, but even that could not keep the euro from rising. Today is full of statistics and their market will not be able to ignore. The Bank of England, the discount rate in the euro area and the UK, the ECB press conference, the data on the U.S. labor market. All market participants are waiting for these data, because by their results will be judged on the short term, the major currencies - the euro, the dollar and the pound.

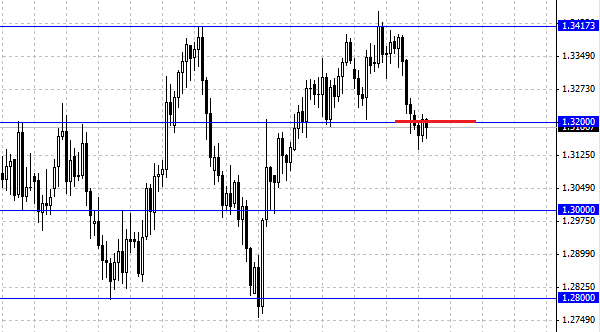

The EUR/USD after rising on Wednesday, has lost all its positions and is now trading lower. Such dynamics are easily explained by the fact that the market expects the ECB meeting, the results of which will shed light on the fate of the euro. At this point you should refrain from opening trades, and better close already exists, and if the press conference after the ECB's EUR/USD pair fixed above 1.32, most likely, the market will enter a stage of the range and the euro will operate between 1.34 and 1.32 . If the euro negatively react to the ECB, the bears will be the level to 1.30 and 1.28 . Currency strategists at CitiFX, believe that the discussion of the ECB additional stimulus measures will be taken negatively by the market participants. From a technical point of view, EUR/USD is experiencing downward pressure, which plays into the hands of the bears are likely to euro moves 1.28 dollars - analysts CitiFX.

Meanwhile, the British Pound has shown strong growth, managing to consolidate above 1.56 . Currently the pair GBP/USD down, let's see whether to stand as a support level of 1.56 . Traders trading this currency pair also are awaiting economic data from the United Kingdom, which will undoubtedly be the driver of further movement. In general, the pound is the growth stage, which is nearest to the level of 1.57, the support is 1.56 and below 1.55 .

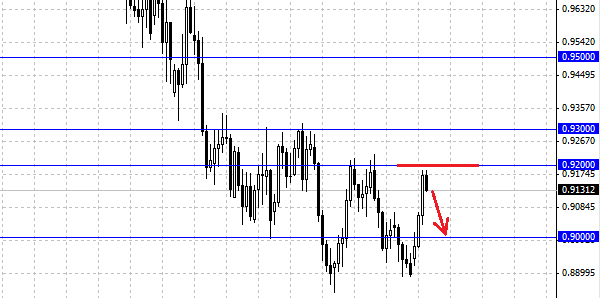

The Australian dollar, slightly below the level of 0.92 began to decline. Now all of the major currencies are losing its positions under the pressure of the U.S. dollar. Traders close their positions ahead of key economic data that will have an impact on a pair AUD/USD. In our opinion, the higher Australian dollar was trading at, the more it becomes vulnerable. Investors, putting on lowering AUD/USD, at any time can start selling a pair that weak both from a fundamental and from a technical point of view.

Social button for Joomla