During the last session with the U.S. dollar fell against major currencies against the data on the reduction of the trade deficit. As shown by recent data that has been provided by the Ministry of Commerce, by the end of June the volume of U.S. exports increased significantly, showing with the highest rate in nearly a year, a sign of strong demand from the world economy. The news put pressure on the dollar was a statement by the President of Federal Reserve Bank of Atlanta, D. Lockhart, who noted that the application for decommissioning program of bond purchases may be made at any of the meetings of the Federal Reserve System, planned for 2013, including those at the meeting on the results of which are not scheduled press conference. Support for EUR/USD pair had submitted a report on Germany, which was much better than expected. As a result, the pair managed to grow in the 1.33 resistance area, and even a little higher, the euro has stalled there and at the moment EUR/USD is trading around the level of 1.33 .

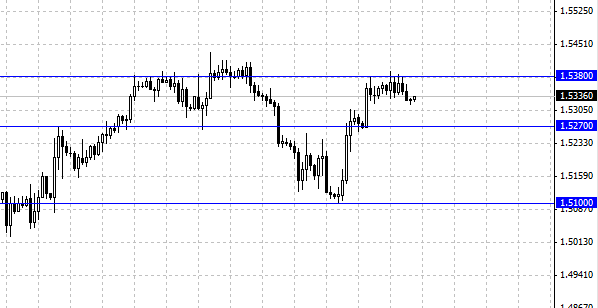

The pound fluctuates against the dollar after failing to keep growing, despite the optimistic reports, which were presented yesterday. The Office for National Statistics reported by the end of June, industrial output increased significantly, thereby exceeded the experts' forecasts, helped by the recovery in the sector of mining production. GBP/USD continue to buy on dips to 1.5330/20 dollars, but attempts to develop an upward movement of bulls still meet active resistance, in particular a good interest in the sale marked the vicinity of U.S. 1.5365 and about 1.5380 dollars. Currency strategists at Morgan Stanley doubt that the Bulls will decide on an active attack on the eve of the publication of the report of the Bank of England's inflation. Improve the dynamics of the British currency contributed to recent stronger economic data, overall economic situation remains unfavorable. At Morgan Stanley noted that the UK needs a short-term capital inflows, and amid increasing expectations on growth rates in the U.S., it faces its deficit, which is supporting the national currency. Meanwhile, lending falls, which can be a cause for concern the Bank of England, and MS is believed that after the inflation report pound waiting for a new period of weakness and a return to levels near 1.5030/00 dollars in the light of which the current levels look attractive to sales with a stop - at 1.5440 .