Monday was an important day for the market, largely due to the fact that the attention of traders focused on European currency and it's rival the dollar. Despite the decline in the euro against currencies such as the British pound and Australian dollar U.S. dollar showed a decline. This is likely to affect positive economic data from Australia and the UK.

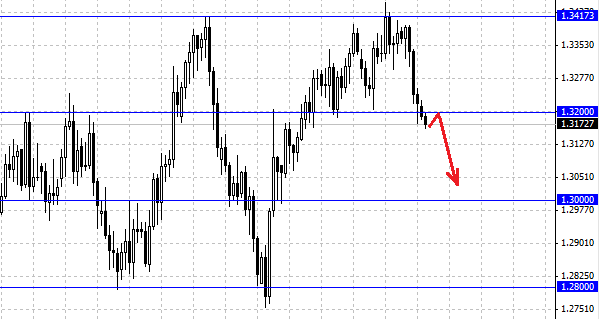

The EUR/USD opened near an essential and important support 1.32 . A break of support would mean a further fall in the euro, and the most likely to repeat the scenario with a reduction to 1.28 . At the end of the day the pair EUR/USD managed to close below support, which of course caused a new wave of sales of European currencies. Now the pair EUR/USD is trading at 1.3170 and has great potential to decrease. Commerzbank analysts believe that the pair does not have enough power and the desire to consolidate above. The last movement of the euro give reason to believe that the way out of the range that existed in the market will develop in the scenario bears. The bank noted that a break below 1.3180 will signal the development of a downward movement, the purpose of which will be the levels of 1.30 and 1.29 . We agree with Commerzbank on the development of the negative dynamics of the pair, the pair EUR/USD is at the mercy of bears. Support for the euro is at 1.30 and resistance at 1.32 .

Pound was unable to consolidate below 1.55, an unsuccessful attempt to break the bear market has failed and now the pair GBP/USD, is likely to continue it's upward movement. We have already considered such a scenario in the end it turned out that the reduction is to roll back and gaining new strength, the pound tends to around 1.56 - 1.57, a buy signal also was the fact that the pair opened with a big up. Support of the British pound on Monday had economic data, Manufacturing PMI was better than analysts' expectations, it's importance has left 57.2 . The mood of a pair of positive support is at 1.55, and only a move below will signal a change in trend.

The Australian dollar has returned to a value of 0.90 and is trading higher. Recently, the dynamics of the pair AUD/USD was volatile, have not seen a clear reduction as before, it makes you wonder. We recommend traders to refrain from buying or selling AUD/USD, and wait for a clear signal for the start of operations. Contribute to the growth of a pair of positive data, which come from Australia.

Social button for Joomla