Bidding on Wednesday was centered around all of the expected event - the FED meeting. In summary minutes of the meeting, called the large-scale sale of the U.S. dollar. Virtually all of the major currencies against the dollar has lost its value in an average of 200 points, which is a little more somewhere a little less. The main effect of the markets had a statement by the committee to refrain from reducing the monthly volume of purchases of assets, its value remains at around 85 billion dollars. It was also decided to wait for a stronger strengthening of the U.S. economy, for starters change the policy of quantitative easing.

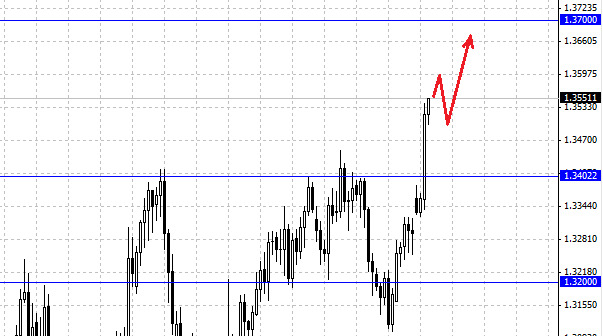

After the publication of minutes of the FED meeting pair EUR/USD was able to reach the level 1.3540, at the moment the market is a little consolidation. The immediate support for the euro now is the level of 1.35 . In perspective, the pair EUR/USD, likely will go to a maximum level of 1.37 this year. The decision not to reduce the asset purchase was a blow to the dollar, and to a greater extent on this now benefit riskier currencies, including the euro. Powerful momentum that we saw yesterday, will be the basis of the upward trend for the pair EUR/USD. But, nevertheless, we can not rule out the flesh of the corrective movement to the level of 1.34, followed by the European currency will continue to grow.

The growth of the British pound at a meeting of the Federal Reserve was 250 points. Although traders bulls GBP/USD is in an advantageous position, we are all concerned about the super-fast pace of growth. Upward trend in GBP/USD is almost vertical line growth (recently), such growth can not last long, so we advise caution when buying a pound. GBP/USD pair is sent to a mark of 1.62, then pound target the 1.63 level. Support for the pair is at 1.60 .

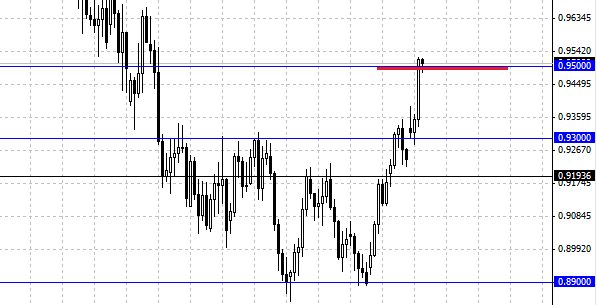

The Australian dollar reached a significant level of 0.95 . Bears clearly have no place in this situation. Although it's very important how the Aussie behaves near the level of 0.95, which is not only a technical resistance, but also psychological. If this level is formed near the base, it's likely the bulls will continue to advance, the more so because there are all conditions. The most important support is, of course, the level of 0.93, but the level of 0.94 may become a mainstay at lower AUD/USD.

Social button for Joomla