Unexpected event on Monday was the weakening of the U.S. dollar. Analysts point to several reasons influenced the dynamics of the U.S. currency. The first of these was the revision of the GDP of France. The Central Bank of France has increased its forecast to 0.2 % growth in the coming quarters. The other, also the fundamental reason is the fear of investors about the program of quantitative easing, which many expected in September.

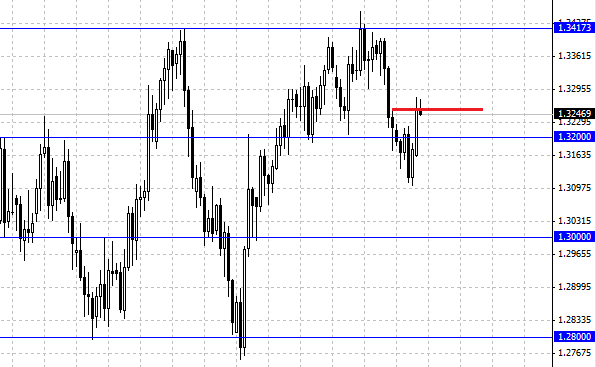

On the pair EUR/USD market sentiment reflected particularly noticeable. The European currency under the influence of a positive forecast of GDP in France rose above the 1.32 resistance, now the pair is trading at 1.3250 . In view of recent events, the resistance in EUR/USD moved to the level of 1.33 . Further dynamics will be determined by the behavior of the euro outside the designated level. Today's economic calendar is missing important events, but it's worth noting that the level of industrial production in France fell by 0.6 %. 1.32 level now acts as a support, the very same pair is in our opinion in limbo. General economic conditions in favor of the dollar, but the market has yet another opinion.

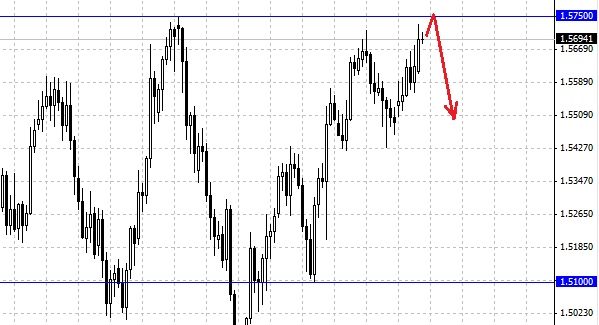

The currency pair GBP/USD has demonstrated significant growth. The pound rose to its previous high - resistance 1.57 . Fixed above him failed, but still ahead. GBP/USD pair is aimed at achieving a level of 1.5750 - a maximum of June. If the pound will not be able to break through the level of 1.57 it's likely to start a new wave of devaluation. We believe that the GBP/USD will fall from current levels, or at a slight increase, in the worst case scenario, quotes, reach a level of 1.58 lbs. This week will be as important economic data on the British pound as the number of applications for unemployment benefits and the statements of members of the Bank of England.

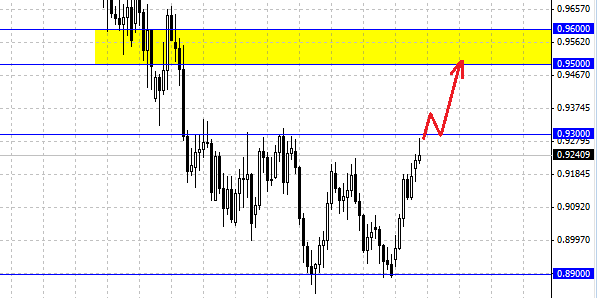

The Australian dollar, breaking the 0.92 mark, to strive for the level of 0.93 . Level of 0.93 is the upper limit of the range formed by the pair AUD/USD. The absence of downward pressure on the pair gives the bulls a chance to prove themselves. Currency strategists at CitiFX believe that even an increase above 0.92 can be the basis for continued growth. The aim for the bulls in this case will be the region 0.95 - 0.96 .

Social button for Joomla