Bidding on Wednesday took place on the territory of the U.S. dollar. The U.S. currency has shown a steady growth against major currencies. Analysts attributed the causes of increasing dollar Syrian conflict, we can not disagree with this, but nevertheless we believe that the rise in the dollar due to the economic condition of the United States, as well as reinforced by the growth of stock market indices.

So, at the end of the day on Wednesday, EUR/USD pair dropped to 1.33, which is support. After the euro managed to recover some of the losses. Now, on Thursday, EUR/USD continues to decline, and we believe that the bears should be enough force to break support and head to the level of 1.32 . Growth continues to be constrained by resistance at 1.34 . It's noteworthy that in the breakout 1.33, the European currency may fall to lower than 1.32, this area is a deterrent, and if the bears will take control of the euro, will begin a downward trend, which will focus on the level of 1.28 .

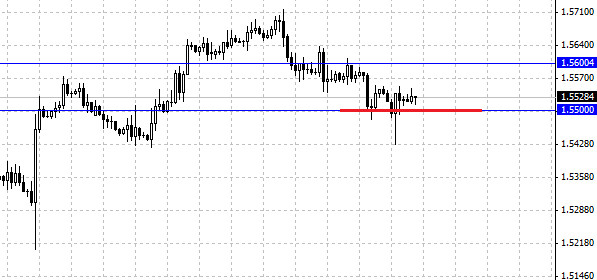

Market participants were able to observe an interesting dynamic movements the British pound. GBP/USD pair dropped to 1.5430 local support. This breakthrough would be a clear signal to sell the pound against the dollar, given the fact that we have seen a gradual decline in quotations for the pair GBP/USD. But amid the speeches Carney pair managed to recover and now it's trading below 1.55, which, according to many analysts, is a turning point. To continue the downward movement of the pair should be fixed below 1.55 .

Australian dollar does not want to fall. After the breakdown level of 0.90 AUD/USD pair seems to be aimed at reducing, but at the moment the market is experiencing growth in the Australian, most likely this is due to positive data, which were published today. We believe that they will not be able to provide long-term impact on the Australian dollar, and the pair will continue to decline. The value of 0.90 as the level of resistance are much higher, so traders can begin again to sell AUD/USD when approaching this level.

Also today, the important economic news expected. In particular, the change of unemployed in Germany, the value of GDP and the number of applications for unemployment benefits in the USA. This data will undoubtedly have an impact on the movement of currencies, so keep track of their value in the economic calendar.

Social button for Joomla