During trading on Monday, the European currency was moving sideways. It was promoted by a small activity that often occurs at the beginning of the week. However, the pair EUR/USD fell to 1.3000, where the support, and then began to rise to the top of the zone range at 1.3080 . At present, the euro is just trading at the upper limit of what is - the possibility of the sale, more patient traders expect growth to the level of 1.3100, which will enter into a deal to sell at the lowest risk. During the opening of the European session border formed by the range is likely to be under pressure, traders should use the strategy of breakdown, because soon the market in the short term will move in the direction where the boundary will be broken. It should also be remembered that usually the breakdown of the price movement is quick and sharp, so it is wise to use pending orders to enter the position.

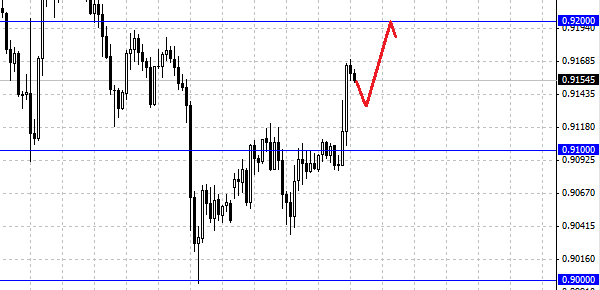

AUD/USD has broken through the 0.9100 level. The first attempt was unsuccessful, and the Australian dollar had to fall back to the level of 0.9035, after which recovery began with a bang. AUD/USD slightly hesitated near the 0.91 level, and eventually was able to overcome the resistance and raised in the area of 0.9160 . The pair is trading near strong resistance at 0.9200, from which we believe will begin actively selling Australian. Otherwise, a pair of faced with even greater resistance at 0.9300 . Analysts said the bank Morgan Stanley, the downtrend for the pair AUD/USD remains. The bank calculated the drop below 0.90 dollar, to a minimum in August 2010 - 0.8770 dollar. Dynamics of the Australian dollar last week was still the worst among the currencies of the Big Ten, and how much was a moderate recovery that was observed on the background of the general weakness of the U.S. dollar, indicating a high conviction investor in respect of the negative prospects for the Australian dollar.

Also today, Tuesday, is expected to yield economic data from the U.S. and Europe. Traders will be watching the news out of Europe, such as the index of sentiment in the business environment in Germany ZEW institute and throughout the euro area as a whole, as well as the consumer price index. According to the U.S. will also index of consumer prices and industrial production data.

Social button for Joomla