At the end of Monday, the dollar could strengthen against the euro. However, against most other currencies, the U.S. dollar showed a decline. Drivers movements became economic data for the euro area, also on the bidding influenced Draghi speech, Lockhart and Dudley. Negative for the U.S. currency were negative performance index of business activity in the industry, it's possible to gain a foothold in such currencies as the British pound and the Australian dollar.

Of the pair EUR/USD most of the time flowed in the channel with the boundaries of 1.3550 - 1.3500 . In the afternoon, the European currency fell below support at 1.3500, reaching 1.3480 but began to recover. The pair EUR/USD is trading above 1.3500 . Publication of the index values IFO business climate can give an impetus to the movement of the euro, analysts expect a rise in the index to 108.4 against 107.5 in the previous month. If the forecasts are correct, then the single currency will be supported, and you can expect a rise in share price within the range set.

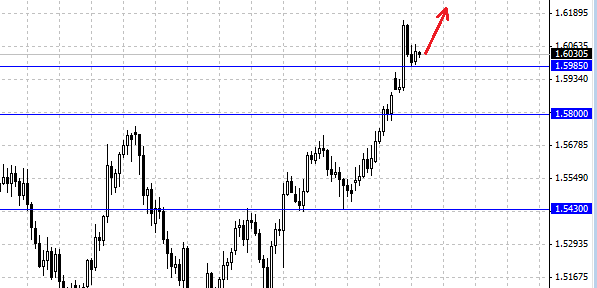

The British pound after two-day fall showed an increase against the U.S. dollar. Dynamics of the pair GBP/USD is still pointing to further growth. Now market participants can observe the correction, which after strong recent gains against the dollar is inherent in many currencies. The level of support for the pound formed at the level of 1.5985 . The behavior of the pair GBP/USD today can affect speech, members of the Committee of the Bank of England. We believe that the following statements by the Fed's dollar will gradually lose their positions and currency such as the euro and the British pound will take advantage of it.

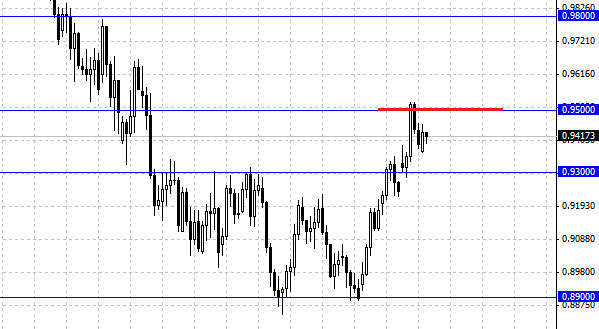

AUD/USD has just completed Monday rising prices. Australian dollar managed to reach Friday's high of 0.9457 and then stepped back a bit. The weakness of the dollar is playing into the hands of Australians who, apparently, plans to continue its growth. Resistance 0.95 once already withstood the onslaught of the bulls, but whether it can repeat its success? From a technical point of view, we are seeing a double bottom, which is a signal of the end of the old trend and the transition to the new. The purpose of the bulls will undoubtedly be a level of 0.98, this is where lies considerably resistance that previously hindered any attempt to break the fall of the Aussie.

Social button for Joomla