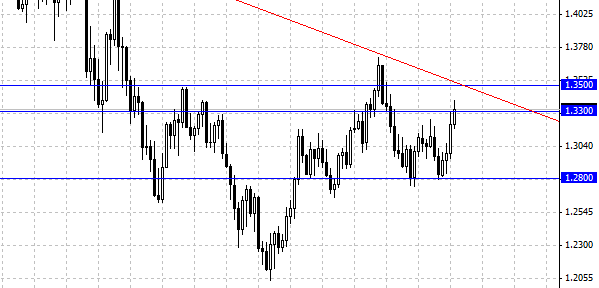

EUR/USD pair dropped at first lower than the level of 1.33 during the session on Thursday, but as you can see it grew significantly to form hummer-shaped candle again. This is the second hummer in succession, and in most cases it means an optimal action. Now the level of 1.33 looks as a quite strong support on the market, and as a result we think that the tendency for growth for Euro will remain. However, there is a line of fall of European currency on a weekly graph, which can demonstrate a significant resistance. Besides, it should be noted that distinct European indexes look absolutely terrible. It is especially true in terms of such peripheral countries as Spain, Italy, Greece. News and economic data from Europe will most likely shoe negative development which will keep a strong growth.

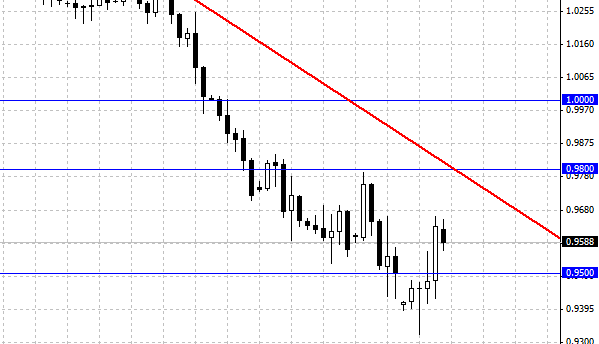

Similar behavior could be seen on Australian Dollar which after fall to the area of support of 0.9425 rehabilitated and increased significantly after breaking down the level of 0.95. In fact, the market reached such maximums of the session as 0.9650. Such movement only supports the idea of upcoming potential for growth. Though, it is risky to purchase AUD/USD pair, since the pair is trading within this area. This resistance is represented by the level of 0.98, and in order to start buying it is better to wait for closure of the day higher than that area, that will be a secure signal. On the other hand, the candle that has a resistance near that level would be too tempting for the position for sales, because we expect future weakening of the Australian instead of long-term growth. With its all changeability and anxiety the asset will still be the center of attention of traders and investors.

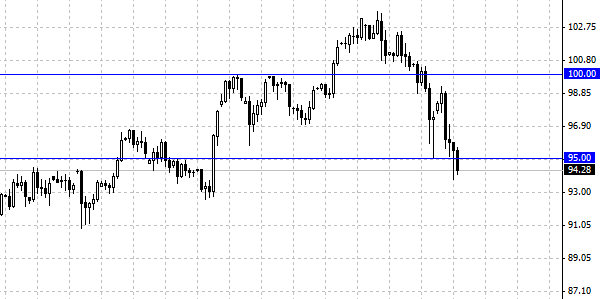

Japanese currency has consolidated quite quickly and its growth has been active for two weeks already. However, the buyers of the UDS/JPY pair entered the game approximately at the level of 94, in order to put this market back. The candle obtained on Thursday was a massive hummer, which was concentrated at the level of 95. Though the fall of the USD/JPY pair has been continuing, one should not disregard the level of 95, because the Japan Bank said that the diapason of 95-100 is very comfortable for Japanese currency. A significant fall lower than that level will be a very tempting possibility for Japan Bank, it is hard to assume that it will stand aside in that case. If the market closes higher than the candle that was formed on Thursday that will be a classic signal to buy up to the level of 99. But at the moment it is not true and most likely the growth of the USD/JPY pair might be expected only the next week. We think that the level of 100 finally will be reached, the real question here is the following: how long will it take?