There’s one iron clad rule among traders, which everyone tries to learn at the very beginning of their Internet trading career. Yes, we all are well aware that “trend is your friend”. And we all know that opening in the direction of the main movement, or a trend, gives a greater chance of working out the correctness of the order. It’s a sin not to use this chance, because the likelihood of pullback at this point is lower than a development of the mainstream, or a trend. And chances of turning point are even less.

So, the main task of the trader is to determine the trend movement. In such cases many tools for technical analysis are used. One such tool is the Alligator indicator. This tool was invented by Bill Williams, and it can accurately and honestly show the direction of the trend. Its principle is simple: it consists of three moving averages with different parameters, with each MA having its own offset value. In such a way, Alligator indicator is formed from three averaged lines named “Alligator’s Jaw", "Alligator’s Lips" and "Alligator’s Teeth".

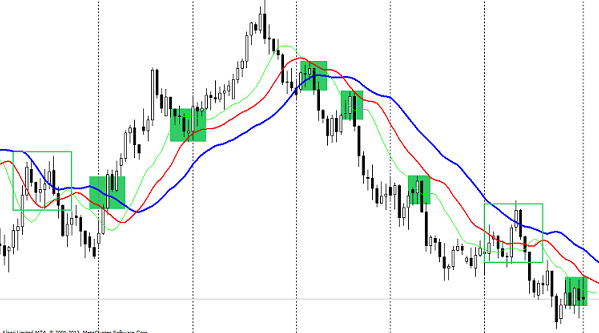

The blue line of the indicator is "Alligator’s Jaw”. This average has parameters of period at 13 and offset at 8.

The red line is “Alligator’s Lips". This average has parameters of period at 8 and offset at 5.

Finally, the green line is "Alligator’s Teeth", with parameters of period at 5 and offset at 3.

Thus, forming the overall trend movement by three averages, Alligator indicator is used in determining the trend. In order to trade using this indicator, you should consider the characteristics of its values. The image below shows signals which define high probability of trend or even the moment of order opening change.

The main signal of the indicator is all three lines crossing the price chart. This means that there was a turning point on the market and the movement changed. Then you should open orders in a new direction after price rebounds off "teeth" and “lips”. If both these lines are broken and it rebound off "jaws", there will be a significant continuation of the indicator movement. Lines crossing each other should also be considered as a signal, though the basic interpretation is to analyze three averages as an integral whole in relation to the price chart.

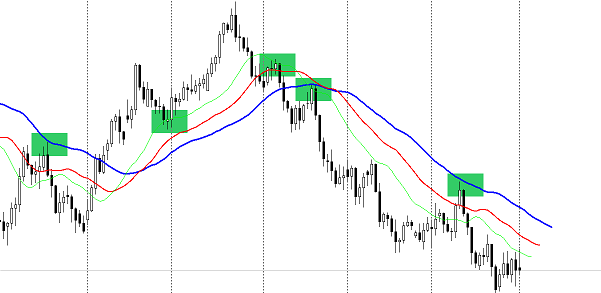

Another advantage of Alligator indicator is that it can be modified, using slightly different parameters. Thus, it can be tested manually to choose the "brightest" results. Here is an example:

In this case, the indicator is used with the parameters of 21, 13, 8. They are the same Fibonacci numbers plus one. As everyone knows, most of the indicators for large values have fewer signals, while better filtering false ones. For clarity, you can compare these two images. In the latter case, signals are "cleaner" than in the former one with standard parameters. In this respect, it should be noted that this technical instrument has a sufficient diversity of its use.

Of course, there is a drawback. This indicator only works with a clear trend movement. When there is sideway movement, it is impossible to work with Alligator’s averages. They say it is "asleep". And when the moving up or down starts, they say that Alligator “wakes up””.

Thus, we can safely conclude that the Alligator indicator, due to its averages, may behave as a trading system in its single version. Of course, you can make the analysis process more complementary using additional tools, but the fact that Alligator can be used just by itself is an undeniable fact.

Social button for Joomla