One of the most profitable methods of the online trading is trading in the middle of the channel. In fact it is the same trend, but it has more visible maximums and minimums. Of coarse, highs and lows always play one of the most important roles, especially when it comes to solid units. In this case we use a channel not only for finding a target. Our application of the channel includes the target for closing of the order and the opening of the new one, whether it is selling or purchasing. As a rule, the channel indicator is used for distinguishing the channel. But the range of indicators, which are used in the diapason trading, can be used for this purpose. This article explains the principle of analysis of some of such indicators.

One of the most profitable methods of the online trading is trading in the middle of the channel. In fact it is the same trend, but it has more visible maximums and minimums. Of coarse, highs and lows always play one of the most important roles, especially when it comes to solid units. In this case we use a channel not only for finding a target. Our application of the channel includes the target for closing of the order and the opening of the new one, whether it is selling or purchasing. As a rule, the channel indicator is used for distinguishing the channel. But the range of indicators, which are used in the diapason trading, can be used for this purpose. This article explains the principle of analysis of some of such indicators.

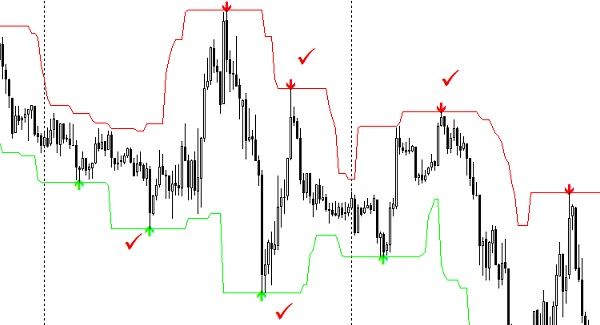

The Super-Signals-channel indicator is a graphic instrument, which counts levels, which form the channel and the moments for opening of orders. It is considered that this indicator works similarly with the ZigZag Indicator. But it is not correct, if you see more carefully, you will see two or three minimums or maximums in raw sometimes. It means that Super-Signals-Channel is able not only to show highs and lows, fixing waves in the middle of its channel. This channel indicator is something like the ZigZag Indicator and genuine fractals at the same time.

The image shows quite rare situation with two or tree signal, which can confuse the trader. But there are two factors, which can compensate these minuses. The firs one is a small number of this kind of situations. Usually these combinations occur rarely. The second factor is that this indicator works more accurately in the longer intervals.

The following image shows the principle of work of this indicator as well.

In this case the image also shows the derivative line of support and resistance. This indicator works much better together with additional indicators.

Bollinger lines are another channel indicator. Although there are many ways for interpretation of this graphic instrument, it is still very convenient for use. Moreover, you can easily choose the parameters, which you need just by testing it. The major feature, which distinguishes this indicator from the previous and the following ones id the fact that the channel of this indicator was not built directly. From the first sight, this kind of indicator is not convenient. But is not true. The experienced trader would note that the Bollinger lines can build the channel, irrespective to the price movements. The graph, indeed, is a row of maximums and minimums.

The Standard Deviation Index is the indicator for diapason trading as well. But, unlike the Super-Signals-Channel indicator and Bollinger lines, this indicator shows only direct lines. It happens, because the upper and the lover lines are built in relation with maximums, minimums and the middle line. In fact, these lines are equidistant from the middle line.

The channel indicator works differently in this case. While the channel is built according to the price movements in the cases, which are described above, in this case the price is located between two lines, which were already built.

Of course, the implication of channel indicators seems to be simple. However you should not forget to analyse the market by yourself as well. The indicators, which are described above should be used as additional tools. Even if you see the lucky moment on the price graph, which is formed in the channel, you should not enter the market immediately in contradiction with your trading system rules. But, the use of the indicators can be quite beneficial, and can help the beginner to learn how to define sideway trends.