Many intraday trading strategies work properly only on a specific market segment, with a fixed time corridor. Such approach is logical and correct, because the volatility will depend on market liquidity and concentration of important news for a pair, and hence the profit targets and stop-loss value will as well. This is why the intraday trader needs to know which trading site is currently active. Clock Forex indicator was designed for this purpose and intends to simplify the work of the trader.

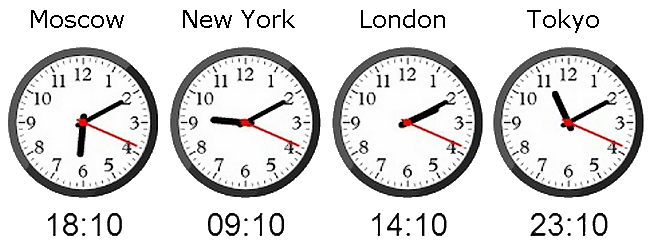

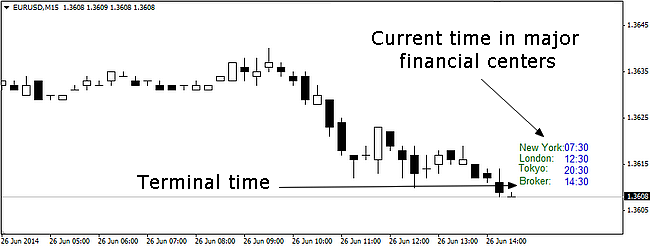

The “Clock” Forex indicator is the most simple and convenient solution, its main advantages include, first of all, conciseness – it doesn’t clutter the chart, and secondly, the flexibility to set up – you can opt out of any region and leave only the most important one. The figure below shows an example of the working window, with the adjusted indicator:

There are also disadvantages in the work, the most important of which is problems with the automatic detection of GMT time. During testing on multiple terminals with different DCs, the experiments were conducted, and the result was the same – GMT time was defined incorrectly. Probably the developers customized the code for a certain broker, whose terminal time coincided with GMT, so you'll have to manually edit the parameter «gmt_shift» in the code, which defaults to 0, via MetaEditor. Please note that the value is specified in minutes and represents the offset from the current time.

Minor drawback is that there are few regions and cities built in – for example, Sydney, Chicago, and others are missing. Of course, it is much more important to know the session time in general, because the excessive strategy optimization for the only region does more harm than good. So, the Clock Forex indicator in the form of session duration markups will be more interesting.

I-sessions Clock Forex Indicator

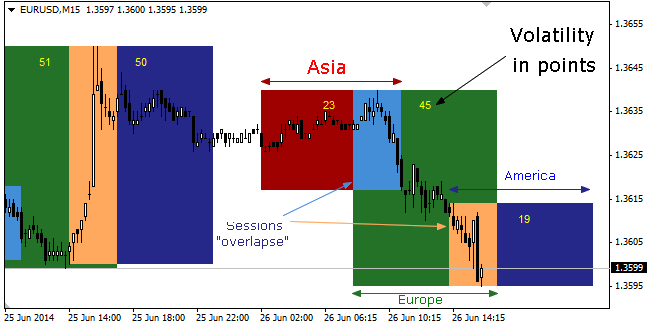

Unlike Clock, the user himself sets the hours of the start and the end of the trading session in this algorithm. Such an approach is much more efficient, since the very term “session” in the foreign exchange market is quite vague, because Forex operates round the clock and has no single site with a strict schedule regulation. The chart below shows an example of the default indicator settings:

Given the peculiarities of building, a number of important points should be noted. First of all, work time of the major stock exchanges can be used as time limits, because a fair assumption is that the currency is in the greatest demand during the work time of the major sites.

Secondly, it is also permissible to select options based on your own reasons – for example, if you previously estimated the time of greatest average volatility, it would be reasonable to use these periods in each session, thus abandoning the areas where it is difficult to earn.

Thirdly, the Clock Forex indicator can be successfully used in the strategies built on the logic of “flat breakthrough”, the most common of which is called “London explosion”. Settings of this indicator are intuitive and contain blocks of time settings and graphical representation. In the latter, FillBack is fundamentally important – to turn on the areas filling: if “false”, the sessions will be marked up by lines only. Filling is very useful when working simultaneously on multiple instruments, as the situation is easier to perceive visually.

Social button for Joomla