Even the beginners in the Forex market know that Forex indicators can bring a lot of benefits. But not every trader is able to efficiently use them in daily trading; creating the working indicator strategy is also too much for many traders.

Some the traders believe that Forex strategy on indicators is a waste of time, because sooner or later indicators settings cease to bring profit, and you will have to spend a lot of time on choosing new parameters. The skeptics say that the indicators should be considered only as a supplement to technical analysis, for example. However, there are many working indicator strategies that are consistently profitable.

To make a trading system based on indicators profitable, you should follow a few rules when you create it:

-

use only indicators with clear operation algorithm and easy readings apprehension;

-

it should be remembered that different categories of indicators should be used for different parts of the market. So, oscillators work well during a flat market, while trend indicators are good in areas with a pronounced movement of the price chart;

-

you should not complicate the trading system with excessive number of indicators. Meaningless jumble of indicators will only complicate the analysis of the market situation.

Choosing instruments for Forex strategy on indicators

Of the three categories of indicators (trend, oscillators and indicators of volume) in a trading strategy, it is recommended to use only the instruments of the first two groups. Volume indicators (or psychological indicators) don’t give a clear idea of the point of entry into the market and are used more for a general understanding of the processes in the foreign exchange market.

When trading, it is important to be able to identify the state of the market (trend or flat). To identify the state of the market, a set of moving averages is often used. Despite the simplicity of this indicator, it allows you to accurately identify the state of the market. 2-3 moving averages with different periods are used in trading systems, their mutual arrangement allows to judge on the direction of the price movement. MA parameters are chosen empirically.

Moving averages provide only an indication of the direction of the trend. To refine your search of the entry points, you can use the Stochastic oscillator. First of all, it is important to consider the behavior of the fast and slow Stochastic lines in oversold/overbought area. Its parameters, as in any other Forex strategy on indicators, are chosen empirically.

Development of the indicator strategy

In the field of currency speculation, it is always recommended to opt for more reliable strategies, even if it slightly reduces profitability. That is why in the considered example of Forex strategy on indicators, the behavior of the currency pair will be analyzed in 3 timeframes: D1, H4 and H1.

Two SMAs with periods of 200 and 72 should be set in the D1 time interval, as well as Stochastic with the parameters of 8,3,3. The trader identifies the trend and finds correction after which the possible entry into the market is possible at this time interval. Deals are not made at D1.

H4 timeframe will need only Stochastic oscillator with the same parameters. This time interval is not used for making a deal either. The trader should wait for a signal confirming the near completion of correction - the divergence in the Stochastic Oscillator on H4. After its formation, you can continue on H1. The entry into the market will be done at H1 time interval. To identify the completion of the correction, you will need 2 moving averages with periods of 72 and 24.

Example of the transaction with the indicator strategy

The analysis begins with the daily chart. If the price after daily candle closure is below the SMA72 or just touched it, and at the same time Stochastic is in oversold/overbought area, it can be considered as the first signal of the end of correction.

After that you need to wait for the divergence to form at H4. This suggests that the correction is nearing completion. After that, you have to wait for SMA24 and SMA72 crossing at the H1 timeframe and enter the market.

SL can be placed under the closest minimum, but it should not be less than 45-50 points (depending on the chosen currency pair). And TP can be placed at the high of the previous day. However, the best option will be to transfer the deal to breakeven after the Stochastic reaches overbought area (for deals to buy) or oversold area (for short positions).

The considered Forex strategy on indicators has only one substantial drawback – the extremely low number of deals. But it can be compensated with the constant monitoring of several currency pairs. The benefits should include high reliability of the strategy.

Common rules for the development of indicator strategies

Forex strategy on the indicators is quite a promising kind of the trading systems. Summarizing the above example, we can form a set of rules following which you can independently set up a working indicator strategy. To do this, you need to:

-

decide on the style of trading, select timeframes to analyze the market;

-

choose 2-3 indicators with the algorithm familiar enough to the trader;

-

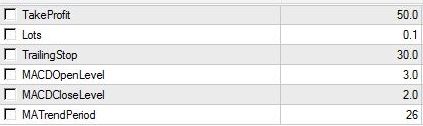

then you need to develop the rules of the strategy and experimentally choose the parameters of the indicators. This part is the most difficult and responsible: if a trader is familiar to MQL4 programming, the process of finding the optimal parameters can be automated;

-

the final step in creating the strategy can be considered an indicator backtesting. It can be performed either manually or automatically (of course, if the trader was able to create an expert advisor based on the strategy). To do this, you can set the optimization criterion and the range of changes in the parameters of indicators in the “EA properties” tab of the strategy tester.

When using the indicator strategies, you don’t have to abandon other methods of market analysis. You can combine the indicators readings and, for example, elements of technical or wave analysis. With the right approach, it will only increase the profitability of the trading system.

Social button for Joomla