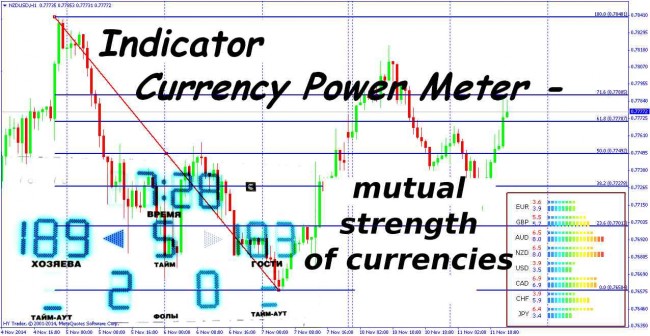

The strength of the financial instrument should be properly assessed in the current market situation for successful trading. Member of the family of the dashboards to assess the relative strength of currencies, the Currency Power Meter indicator will help traders who trade several instruments simultaneously.

The financial market is a dynamic structure with active mutual influence of all components. To find the interesting currency pair from the point of view of the position opening, it is useful to determine its status in relation to other currencies, both in tandem with the dollar and in the crosses.

The relative market strength of a financial instrument at each moment is determined by its fundamentals, the current preferences of market participants and the arrangement of interests of major players. The Currency Power Meter indicator allows you to objectively assess the strength/weakness of the potential market movement based on the current dynamics of the remaining components.

Important: Do not confuse the relative strength of currencies with the concept of cross-correlation!

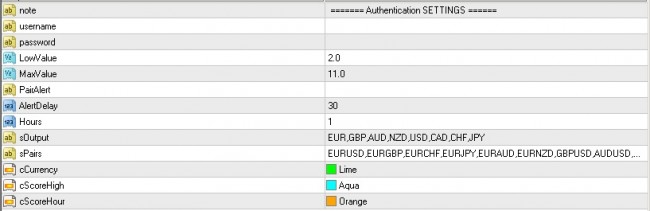

Installing and configuring the indicator

The indicator works in the trading terminal MetaTrader 4(5) and is installed in the standard way: put two source files in the “Indicators” folder and then follow the scheme: "Insert" - "Indicators" - "User” – “Currency Power Meter”.

General view of the indicator setup window:

Set the following parameters:

- Hours – required value of the low period (from M5 to H1);

- sOutput – list of all financial instruments displayed: the default value is a list of major currencies, but the list can be corrected;

- sPairs – list of the currency pairs (the major – with the dollar and crosses), from which we obtain data for analysis;

- the last three parameters are setting colors.

Information panel of the Currency Power Meter indicator usually appears at the bottom right of the main window and consists of a list of the instruments listed in the SOutput setting. The color indicators are located to the right from the name in the form of two bands: the thin one shows the strength of the tool on the low period (default is 1 hour), the broader one – on the daily period (this option cannot be changed). Period of the thin band can be changed in the settings – Hours setting. Panel indicator does not disappear from the chart screen when you change the current trading tool.

Important: the maximum period of data processing by the indicator is 1 day and it is not used on longer periods!

The number before the band is the value of the strength of the currency pair in the shares of the scale from 1 to 10: the higher the value, the stronger the dynamics of the instrument.

How to use the Currency Power Meter indicator

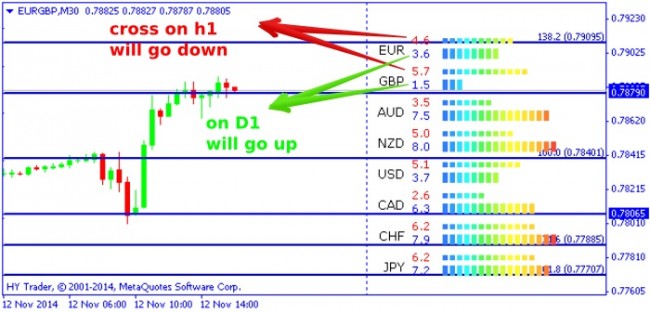

In order to assess the direction of the movement, simply compare the indicator readings near the selected currencies, given the basic direction of quotations (forward or backward). In principle, the number near the band is already colored by default in the standard direction of the trend.

If, for example, for the EUR/USD pair the value of the indicator for the euro is 4.7 and for euro is 5.1, then the next price level below the current price is more likely to be broken down (the strength of the "bears" for the euro is stronger). So it is possible to estimate the market potential to breakdown or rollback from the price levels. Good effect is obtained by using the indicator in combination with clearly tuned oscillator – in this case, it should show oversold.

The length of the band and its colors from a colder to a warmer color also shows the potential of the currency.

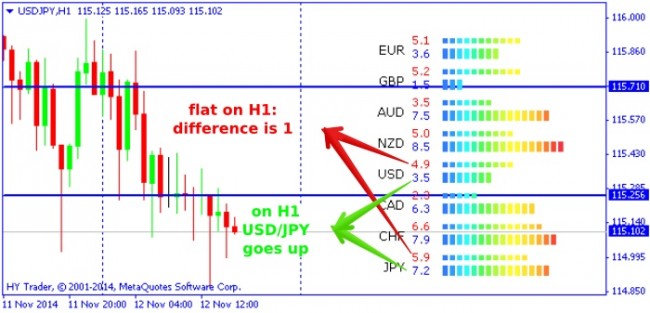

Compare the readings of the same period – the large (D1) or small (in this case – H1).

The critical values of the indicator are 2 and 8, as well as the absolute difference between the readings of the pair – the larger it is, the higher the probability of a chosen direction. If the figure is close to 2, the trend is weak, if it is approaching or more than 8, the current trend has exhausted and you should wait for a reversal.

Important: the Currency Power Meter indicator is for informational purposes only and does not give trading signals to enter the market!

An example of the practical application of the indicator in trading

The use of the indicator helps catch moments of activity after a long flat market (the absolute value of the indicator is rising sharply) or analyze unusual market conditions.

Assessment of the mutual influence of the currencies is especially important if you prefer to trade crosses. Factors affecting the movement of major pairs in the cross can "spoil" you the open cross position, and before you make a full analysis of the situation, you can get into a serious loss.

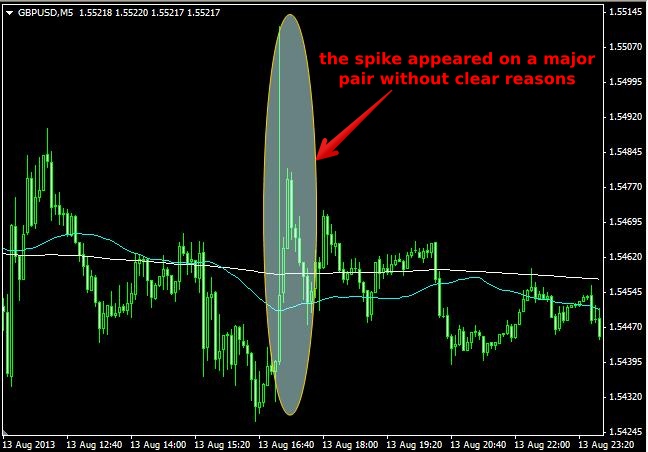

Sometimes the cross pair moves contrary to the logic of technical analysis because one of the components is experiencing a short-term pressure from technical or fundamental factors. As an example, we can bring the situation when a price "spike" appears on the GBP/USD chart, for which there was no apparent reason – news, speeches, or any technical signals.

At the same time, a major pair EUR/USD showed a complete peace of mind.

Imagine the panic of the trader who is trading the pound and their question: why did this price spike appear and what to expect next?

The answer must be sought in the EUR/GBP chart. Obviously, after breaking the lower price level after a long consolidation, the stops of so large amount were taken that cross took around 45-50 points – this is a lot for it. All price momentum "swallowed" the pound, which took almost 70 points in both directions in a couple of minutes.

Using the Currency Power Meter indicator can alert the trader about such situations: at this moment the relative strength indicator of the major pair GBP/USD shows a sharp jump, the euro/dollar pair will remain at the previous level, and the rate of the cross pair will also show a strong trend. Then the trader would understand that this temporary spike was provoked by the cross and it must be "caught" on the GBP/USD pair, or just waited over on euro/pound cross. And you don’t need to switch from the current tool chart to an additional one – all information will be visible in the main window.

Analyzing the information in the window of the Currency Power Meter indicator, you can much faster evaluate which of the currency pairs at the moment is worthy of your attention, and only then switch to the price chart of the right tool.

The mechanism for calculating these indicators does not use the calculation of the average (or any of averages), which means that its data is not delayed and reflects the actual situation.

And as a conclusion...

The Currency Power Meter indicator can be used as an addition to your usual pattern of technical analysis. It facilitates a common understanding of the short-term market situation and its direction, the possibility of a reversal or continuation, provides additional information for the closing or holding of the transaction.

The disadvantage is "relativity" of calculating the currency strength, which consists of the evaluation of the tool movement in a variety of versions. The attempt to thus consider the influence of a variety of factors does not always produce acceptable results. Especially inaccurate data is obtained by comparing the financial instruments that belong to different regions (such as the Euro and Aussie), with large differences in average daily volatility (franc and pound) or with different periods of trading large volumes (EUR – during the day, the yen – at night).

But for options of the pairs with the typical dynamics, about the same fundamental factors and activity in the same trading session, as in this example (the euro and pound), the results of the indicator are quite reliable and suitable for use in the short-term trading on breakdown or touch of the support price levels.

Social button for Joomla