Description of Forex indicators is the first thing a novice trader faces in the search for methods of trading and development as a professional. On the other hand, a well-written description is equally important to programmers and sellers of the ready algorithms, because if a potential buyer doesn’t understand it, they won’t buy the product.

Why the description of Forex indicators is so important to a trader? The main reason lies in the lack of knowledge of a programming language, and, as a consequence, the inability to read a code and to draw conclusions about the performance of the indicator. And this is perfectly normal, since not every experienced trader would climb into the wilds of programming if they are satisfied with the system.

Compulsory description of Forex indicators

So, first of all, description should provide information on the main purpose of the algorithm – whether it is for identifying a trend, or it is an element of a particular signal to open an order. Special case of the latter option may be exclusively for filtering false entries. Absence of such a clause leads to a colossal waste of time during the testing process.

If the indicator is custom, or with the arrows without auxiliary lines, its principle must be described – as a rule, the “cornerstone” of the code is one or more of the following: tick volumes, moving averages, mathematical and regression calculations, as well as a variety of graphic patterns. As you can see, there are a lot of options, and these are only the main ones, so if the seller is hiding algorithm in general terms under various pretexts, it is expressly not recommended to buy such a product.

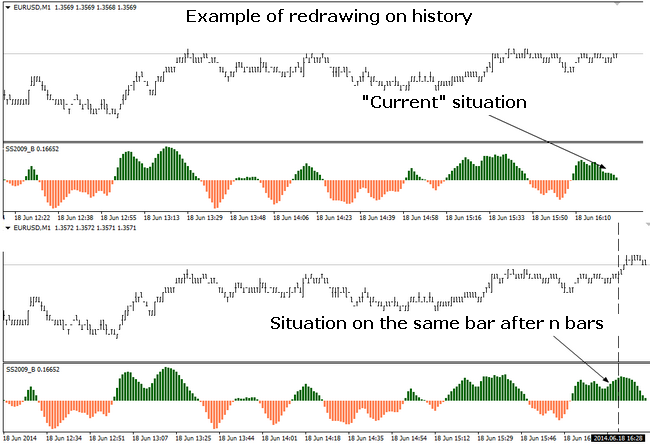

In addition, strengths and weaknesses of each formula must be listed – for example, many seemingly “grail” indicators redraw their history. Aside from the beginners’ frustration, such "dummies" can lead to real and substantial losses, since not all beginners know about this phenomenon, an example of which is shown in the figure below:

No less useful but not compulsory description of Forex indicators

We have examined the points without which you should not even look at the paid indicator. But there are other issues from the perspective of the buyer that the seller must mention in the description in order to draw attention to their development:

-

recommendations on settings for each tool or algorithm for calculating the optimal parameters given the volatility;

-

signals treatment options – you can normally find some hidden features in any formula, such observations are often made by the traders already in the process, but it won’t be superfluous if the developer assesses and describes non-standard signals on their own;

-

it is advisable to record and share video with the example of real-time trading by the generated signals. Note that developers often abuse video lessons in an attempt to explain all aspects in 10-20 minutes in a sound track of dubious quality – this only repels and compels to further outline the material. Much more efficient and less time-consuming is to share the tutorial in the text format, and comment only the examples of the trading day in the video.

In conclusion, let us remind that parameters description and options of trading in some algorithms are available directly from the code. To read it, you need to open the file in MetaEditor and see a text pattern:

Novice speculators should pay attention to the fact that if the Forex indicators description satisfies all points listed in the article, you can safely say that you have found a responsible contractor and vendor, the cooperation with whom should not create difficulties, and in the case of a free indicator won’t result in the waste of time.

Social button for Joomla