Any beginning trader is looking for the most profitable Forex indicators. After all, textbooks on the currency market contain descriptions of dozens of indicators or combinations of indicators that bring good profits and provide virtually 100% accurate entry and exit points. The beginners focus heavily on technology – because it is fairly easy to learn, in the first place, and because books, webinars and educational videos all contain the perfect execution of all signals from indicators on history. In fact, the authors of these lessons do more harm than good.

This article will review real benefits of Forex indicators and define the truly profitable ones. We want at once to dispel the notion that the indicators can effortlessly make a trader rich. After all, we're talking about indicators, not the trading systems or automated robots. The outcome of the trade using indicators directly relates to trader’s skills and understanding of the indicator. It is the trader who decides whether to open a deal or not, while the indicator just gives a signal or draws some prospects.

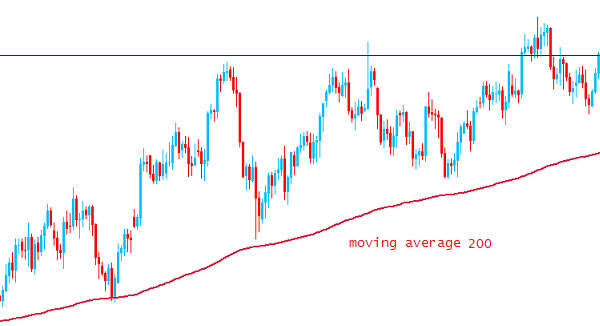

When traders see the words “profitable” and “Forex indicators” together, they imagine timely signals which are worked out in most cases. Focusing on the indicator data is a huge mistake, if trends and news are omitted and not taken into account. Of course, history remembers everything – remembers, but doesn’t consider – while the price does consider very much if not everything: not only the past, but also the present. We emphasize this because the traders should pay attention to profitable Forex indicators which interact with the price. For example, let’s take the Moving Average. There is a fairly banal strategy: to buy when the price crosses the MA upwards, and to sell when the price crosses the moving average downwards. This strategy will outperform any other one built only on indicators for one simple reason: all indicators are lagging. It's not a secret. This is why it is worth looking for indicators that the most tightly interact with the current price.

Profitable Forex indicators can be found for free, and we have repeatedly mentioned that paid indicator is not a guarantee of future returns. Even standard indicators can bring profit to experienced trader, if he uses them properly. Understanding of the market and the prevailing trends is part of the moneymaking when using the indicator. Profitable indicators usually are not universal, but only do well in certain phases of the market. Moving averages help only if there is a trend, while oscillators help with the formation of a trading range. However, their combined use with a price may help find the top or the bottom and be ready for a reversal.

This is why the approach to the Forex market should be integrated. You cannot concentrate on one thing and disparage another. There is no easy money in the market. Selecting the appropriate and profitable combination of indicators can be a difficult task which many traders can’t cope with for years. The quotes are constantly changing and flowing from the growth phase to recession and back, while often consolidating on the move. Economic news and crises shake markets every now and then, changing the market situation in seconds. It is impossible to predict the market and be sure 100%, so the traders just need to switch along with the market and use tools appropriate to its current state.

Social button for Joomla