Every beginner heard about technical indicators, but not everyone knows that there are also economic Forex indicators out there. In fact they are nothing else but the economic statistics, which can be met everywhere today – from the brokers’ websites to the news on TV. In general, the economic Forex indicators are information about the condition of the national economy, published by corporations, banks, international organizations or the government.

All factors without exception affect the foreign exchange market in the long-term, so depending on the trading style, the interpretation of these indicators and the prioritization in the analysis will differ – for example, the scalpers only take into account the most important information that leads to strong bursts, namely:

-

Explanation of the monetary policy, such as the date of the next revision of the basic interest rate and the publication of the minutes of the central banks;

-

Inflation index;

-

Trade balance information – the dynamics of imports and exports has a significant effect on the exchange rate as a means of payment;

-

Preliminary and final estimate of GDP – after its publication, both traders and investors are starting to massively change the structure of their portfolios, so the demand for the currency "at the moment" will depend on the prospects of the economy;

-

The whole range of data on the labor market – normally, such information for a single country comes out at the same time in the form of the powerful cluster;

-

Production volume – impact varies by country if the industry takes a significant weight in the GDP, the actual deviations from the plan can change the trend direction in the mere minutes – not only for the national currency, but also for the currencies of suppliers and importers.

How to use economic Forex indicators in mid-term strategies

If intra-day trading is simple - you either don’t trade during the news release, or use the opportunity to catch the momentum, it is objectively harder to work in the mid-term, because, first of all, the list of the factors is not limited to the listed above, and a few more groups should be considered:

-

PMI indices for the manufacturing and service industries;

-

Consumer Comfort Index, retail sales volume;

-

Leading and lagging indicators, published by several organizations;

-

The yields on bonds and other information from the money market;

-

The entire list of indicators from the construction sector.

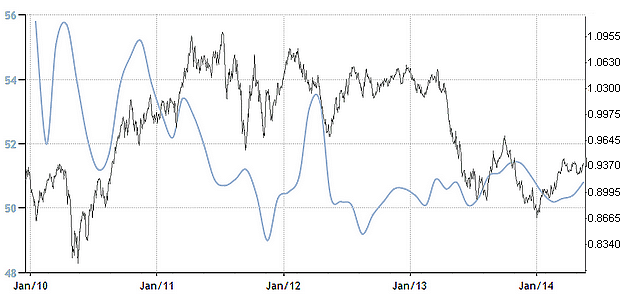

Secondly, it is necessary to consider not just the deviation for the reporting period (month, quarter), but rather the trend for the recent years, compare it with the direction and evaluate its weight for the currency using the correlation coefficient. As an example, the figure below compares dynamics of PMI index for manufacturing in China and the rate of Australian dollar:

Given the strong dependence of Australian exports on Chinese demand, it is not surprising that during the optimistic or negative periods, the correlation appears, albeit with a large error and deviation. The advantages of this approach are:

-

it is not necessary to track economic Forex indicators accurately to within a minute – if the index is strong, the market will be working it out for at least a few days, if not weeks;

-

trading strategy is less prone to occasional bursts and deviations;

-

if the trend is identified correctly, it is advisable to add the orders in the wake of floating profit rising.

Important nuances that should be considered when using economic Forex indicators

In conclusion, we would like to note that any person who is interested in economy (trading also being its integral part) may note that the emphasis in the world news is constantly shifting. Such a phenomenon is widespread and avalanche – separate editions start raising a topic, and then the television and news agencies pick up the torch. When this happens, you should consider the following:

-

From this moment, after the publication of fresh data relating to the sore topic, the market will behave nervously in the early hours, knocking many stop-losses and bringing the gambling traders to stop-out;

-

The chances are high that the mid-term trends will develop exactly in the opposite manner to popular theories and assumptions of the media. Of course, there is no conspiracy, but rather the majority of market participants overestimate the events under the influence of the news press.

Social button for Joomla