Novice traders often ask whether there are efficient indicators that can generate reliable signals to open orders. Of course, such algorithms exist, and today's publication will be dedicated to indicators like these.

First of all, let’s answer the following question: what are efficient indicators? Often this term is referred to a lossless “Grail”, which causes a lot of myths and rumors about the futility of the indicator analysis, since the formula that can reliably predict even the near future is not yet invented. In practice, a useful algorithm meets only three characteristics:

- Based on simple and well-known formulas (can be easily optimized for any trading platform);

- Virtually no lagging;

- No repainting of values on history.

Many textbooks also note that efficient indicators should be universal, i.e. they could both define the dominant force in the market and identify specific entry points depending on the settings. Of course, if the expert is able to perform both tasks, it is a powerful argument, but not a mandatory criterion of efficiency, because there are specialized trend and alarm indicators.

Efficient indicators from a standard set

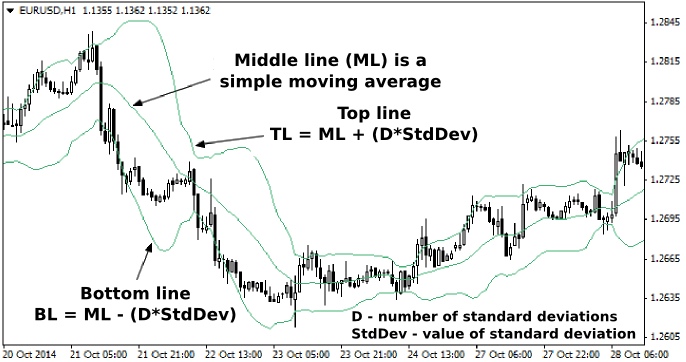

Speaking of universal methods, Bollinger lines can be a good example (they are also called "bands"), which are included in the installation package of any terminal. They are shown on the chart as three lines – one middle and two borders:

The main line is nothing more than a simple moving average (hereinafter SMA) calculated for a given period, and the moving is known to determine the direction of the trend. To build the top line, the algorithm adds the standard deviation value to SMA multiplied by a factor given by the user. To build the lower limit, the standard deviation is subtracted from the SMA.

It is not hard to guess that the bands are named after their developer, John Bollinger, who proved the efficiency of his research in practice, because not every teacher and author of methods runs his own investment and consulting company, as John have been doing over recent decades.

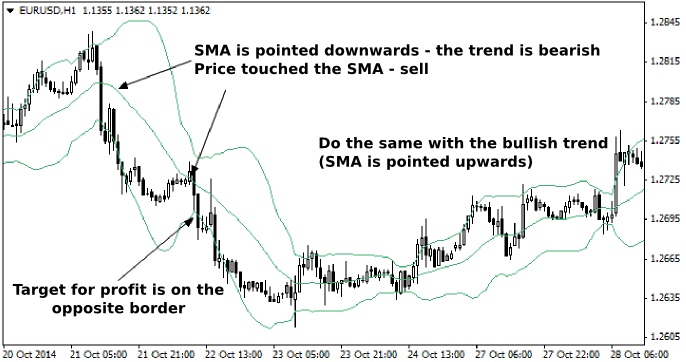

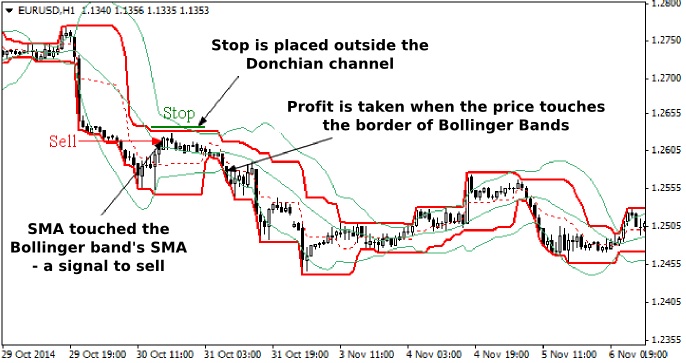

One of the strategies on the Bollinger lines implies following a few simple rules – firstly, trading only along the trend (in the direction of SMA), and secondly, the deals should be opened from the middle of the envelope, and the last rule – profit is fixed when the price touches the border of the envelope.

Many professionals include Bollinger bands in efficient indicators, as they help understand trends, generate signals, don’t repaint, and are based on simple formulas used in many industries and areas of life. All the other algorithms should be evaluated through a similar prism.

As for setting the stop-losses and converting the discussed strategy into a system, it's a separate topic that requires extensive research, but if we develop this theme of efficiency, we can review the Donchian channel.

Efficient indicators to build the channels

This tool is named after its creator, Richard Donchian, who saw in the 30 years of the 20th century something that many of today's traders either do not see on the chart or refuse to recognize because such signals are elementary. We are talking about the breakthrough of the trend extremes.

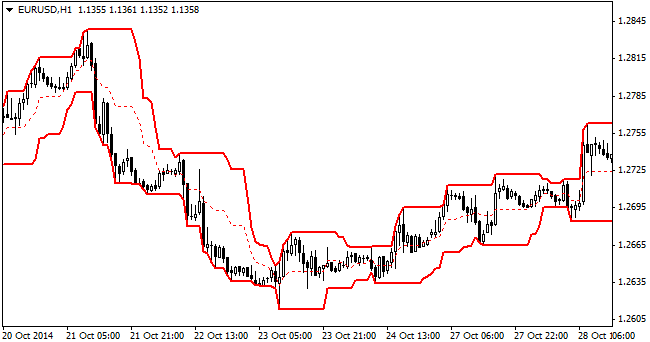

Donchian channel works very simply – it marks the price low and high on the chart with two lines, for the period that is specified by the trader in the settings. In particular, to mark Donchian channel, you will need to configure only two parameters:

- Period – the depth of history that the indicator will explore in identifying price highs and lows;

- Shift – shift of the chart for a specified number of bars. Option is useful when creating breakthrough strategies, but loses all meaning when the channel is used to set the stops (since it distorts the picture).

Accordingly, as the price moves, old vertices will lose relevance, and new ones will gain the most weight. We mentioned efficient indicators to build the channels, since in addition to the trends they perfectly determine the optimal levels to set stop losses, which you may lack when using Bollinger Bands.

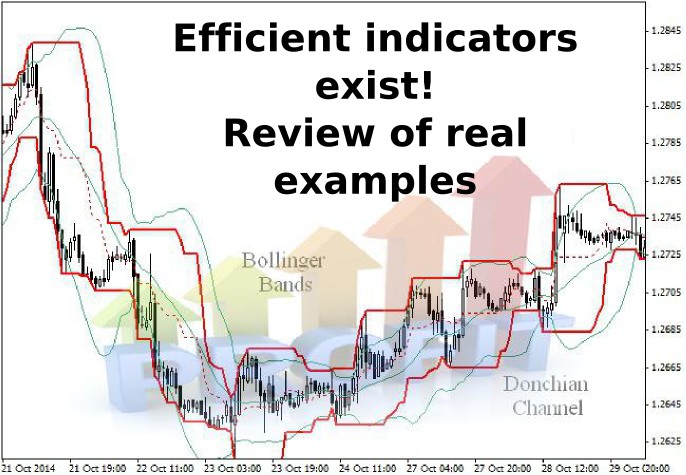

Let’s consider an example: on the hourly chart of EUR/USD pair we’ll set Bollinger Bands with standard settings and Donchian channel calculated for 12 hours without markup shift, and then combine the rules of work with each indicator into a single trading system:

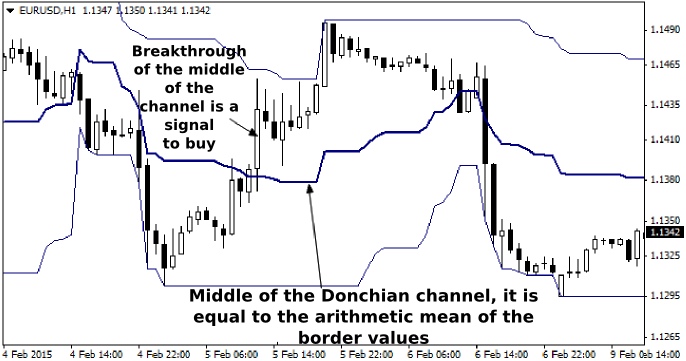

Like all efficient indicators, the Donchian channel can perform more complex tasks – for example, some speculators trade on the breakthrough of the middle of the channel. Unfortunately, this approach is linked with one problem: the identification of true and false breakthroughs requires experience, including in the volumes analysis.

Summing up: where and how to find efficient Forex indicators

Let’s formulate the main conclusions on today's topic from the reverse, i.e. consider the pitfalls a novice trader may encounter when searching for a “frame” for their system. And the first thing we can advise here is to selectively choose the paid algorithms: in particular, you should not buy indicator, if the author:

- Guarantees profitability – it is an attempt to mislead, because the market does not guarantee anything to anyone, if one pattern worked in the past, it does not mean that it will continue to work after the change in volatility, especially indicators that calculate stop loss;

- Does not disclose the method (at least in general terms), which the expert is based on – the desire of some developers to protect their research is clear and logical, but most often it is due to the fact that they sell the old indicator under the new name after exhuming it from long-forgotten forums;

- Offers very sophisticated techniques that take into account the intersection of many lines – perhaps, the method is indeed justified from a logical point of view, but any paid effective indicator should be as automated as possible in order to not end up in jokes about traders, where they do not see the chart for the indicators.

In fact, all reliable algorithms underlying the most profitable trading strategies were developed a long ago and are included in the standard package of almost all terminals. The main thing is to stick to simple rules – efficient indicators allow to achieve a positive mathematical expectation of a series of transactions, and if the separately taken signals are false, which later triggers stop-loss, it's not a reason to write off the formula from the accounts.

By the way, such flatness often leads to an enormous waste of time and effort, forcing traders to test a lot of completely different trading approaches over years, although the way out of the vicious circle is literally in the working window – in the navigator of the trading platform.

Social button for Joomla